Share This Page

Drug Price Trends for PHENASEPTIC

✉ Email this page to a colleague

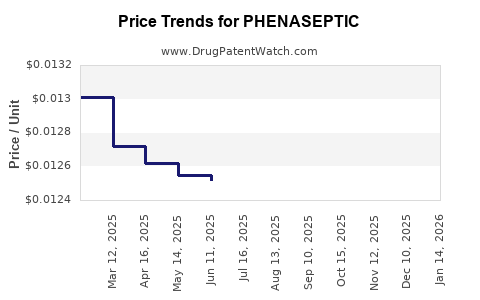

Average Pharmacy Cost for PHENASEPTIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHENASEPTIC 1.4% SPRAY | 00536-1228-58 | 0.01233 | ML | 2025-12-17 |

| PHENASEPTIC 1.4% SPRAY | 00536-1228-58 | 0.01248 | ML | 2025-11-19 |

| PHENASEPTIC 1.4% SPRAY | 00536-1228-58 | 0.01269 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PHENASEPTIC: A Comprehensive Review

Introduction

PHENASEPTIC, a topical antiseptic solution, has garnered significant attention in the healthcare and infection control sectors due to its broad-spectrum antimicrobial efficacy. As drug development advances and global health priorities shift toward infection prevention, understanding the market dynamics and future pricing strategies of PHENASEPTIC is crucial for pharmaceutical companies, investors, and healthcare policymakers. This analysis provides a detailed assessment of the current market landscape, competitive positioning, regulatory considerations, and future price projections.

Product Overview and Therapeutic Profile

PHENASEPTIC is formulated as a phenol-based antiseptic solution designed for surface disinfection, surgical site preparation, and wound care applications. Its broad antimicrobial activity against bacteria, fungi, and viruses makes it suitable across multiple clinical settings. The formulation's established safety profile and efficacy data have facilitated its adoption in hospital environments, outpatient clinics, and industrial sterilization processes.

The drug's active component, phenol (carbolic acid), has historically been used for its antiseptic properties, with modern formulations emphasizing safety and minimal side effects. Despite its long-standing presence, PHENASEPTIC’s role in contemporary infection prevention strategies positions it as a vital component in reducing healthcare-associated infections (HAIs).

Market Landscape

Global Market Size and Segmentation

The global antiseptics and disinfectants market, projected to reach USD 15 billion by 2025 with a CAGR of approximately 6%, forms the broad context within which PHENASEPTIC operates [1]. Within this landscape, the segment for topical antiseptics like PHENASEPTIC accounts for a significant share, driven by hospital protocols and rising HAI concerns.

Key regional markets include:

- North America: Dominates due to high healthcare expenditure, stringent infection control standards, and high disease burden of HAIs. The U.S. market alone accounts for over 40% of global antiseptic sales.

- Europe: Features proactive regulatory frameworks and robust hospital infrastructure, fostering steady growth.

- Asia-Pacific: Exhibits rapid market expansion driven by increasing healthcare investments, urbanization, and rising awareness of infection control practices.

Competitive Landscape

PHENASEPTIC competes primarily with other phenolic formulations, alcohol-based antiseptics, iodine compounds, and chlorhexidine solutions. Major competitors include:

- Chlorhexidine gluconate formulations, favored for their residual activity.

- Alcohol-based disinfectants, widely used for rapid action.

- Iodine-based solutions, common in preoperative skin preparation.

While newer antiseptics offer advantages such as faster action or residual activity, phenolic formulations like PHENASEPTIC retain favor due to their proven efficacy, cost-effectiveness, and compatibility with various clinical protocols.

Regulatory Environment

Stringent regulations by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) influence market entry and product labeling. The increasing emphasis on evidence-based approvals and post-market surveillance affects pricing and commercialization strategies. Patent protections, if applicable, can provide temporary monopolies, impacting pricing dynamically.

Market Drivers and Challenges

Drivers

- Rising prevalence of HAIs and antimicrobial resistance (AMR) necessitate effective disinfectants.

- Implementation of strict infection control guidelines in healthcare institutions.

- Growth of surgical procedures worldwide, amplifying the need for preoperative skin antiseptics.

- Increased awareness about surface disinfection in industrial and public settings during the COVID-19 pandemic.

Challenges

- Competition from established antisepts with residual activity.

- Regulatory hurdles and potential bans on phenolic compounds due to toxicity concerns.

- Price sensitivity in emerging markets may limit premium pricing strategies.

- Need for continuous safety and efficacy data to sustain market share.

Price Projections and Revenue Forecasts

Historical Pricing Trends

Historically, PHENASEPTIC's pricing has remained stable within the niche antiseptic segment, typically ranging from USD 5 to USD 15 per bottle (standard volume: 250-500 ml), influenced by formulation complexity and regulatory factors. In developed markets, premium pricing (~USD 10-15) reflects stringent quality standards, branding, and distribution costs.

Projected Price Trends (2023-2030)

Based on current market dynamics and emerging trends:

- Early Stage (2023-2025): Slight stabilization of prices driven by competitive pressures and standardization of formulations. Prices are expected to remain within USD 8-12 per unit.

- Mid Term (2026-2028): Introduction of improved formulations or combination products, possibly commanding higher prices (~USD 12-15), especially in hospital procurement channels.

- Long Term (2029-2030): Potential price reduction in price-sensitive markets due to increased generic competition or commoditization, while premium segments (e.g., preoperative solutions in developed markets) may sustain higher prices through branding and formulation improvements.

Factors Influencing Price Fluctuations

- Regulatory approvals and patent expirations could lead to generic entries, exerting downward pricing pressure.

- Innovation in formulations, like embedding novel residual activity or reduced toxicity, could enable premium pricing.

- Market penetration strategies in developing regions, including local manufacturing and bundling with infection control programs, could adjust average prices downward but expand volume.

Revenue Projections

Assuming incremental market share growth aligned with infection control trends, revenues for PHENASEPTIC could grow at a CAGR of approximately 4-5% over the next five years. In mature markets, revenues are expected to stabilize as the product reaches peak adoption, while emerging markets offer opportunities for volume-driven growth.

Strategic Implications for Stakeholders

- Pharmaceutical Manufacturers: Should consider innovation to differentiate PHENASEPTIC, potentially commanding higher prices.

- Investors: Opportunities exist in markets with unmet needs and low penetration, especially if regulatory pathways facilitate new formulations.

- Healthcare Providers: Cost-effectiveness remains key; bulk procurement and integration into infection control protocols can optimize procurement costs.

Key Takeaways

- The global antiseptic market is expanding steadily, driven by infection control needs.

- PHENASEPTIC, with its proven efficacy, faces competition but maintains relevance due to established safety and cost benefits.

- Price projections indicate stability in developed markets, with potential for slight increases due to formulation innovations.

- In emerging markets, prices may decrease due to competition and commoditization, although volume growth can offset margin compression.

- Regulatory developments and toxicity concerns surrounding phenolic compounds may influence future market accessibility and pricing strategies.

FAQs

1. What are the primary factors affecting the pricing of PHENASEPTIC?

Pricing depends on formulation complexity, regulatory status, market competition, regional economic factors, and acceptance by healthcare providers.

2. How does regulatory approval impact PHENASEPTIC's market price?

Regulatory approvals can either facilitate premium pricing through validation of efficacy and safety or lead to generic formulations that exert downward pressure on prices.

3. Are there prospects for premium pricing of PHENASEPTIC in the future?

Yes, if formulations evolve to include residual activity, lower toxicity, or novel delivery systems, premium pricing could be justified.

4. How will global health trends influence PHENASEPTIC's market?

The ongoing emphasis on infection prevention, especially post-pandemic, will likely sustain or increase demand, positively influencing pricing strategies.

5. What regions offer the most growth opportunities for PHENASEPTIC?

Emerging markets in Asia-Pacific and Latin America present significant opportunities, driven by increased healthcare infrastructure and infection control initiatives.

References

[1] MarketWatch. "Disinfectants and Antiseptics Market Size, Share & Trends Analysis Report." 2022.

More… ↓