Last updated: July 27, 2025

Introduction

Permethrin, a synthetic pyrethroid insecticide and acaricide, is extensively utilized in both medical and agricultural settings. Its primary applications include treatment for scabies and lice infestations in humans, as well as pest control in agriculture. Given its widespread use, understanding the current market landscape, future demand, and pricing trends is critical for investors, healthcare professionals, pharmaceutical companies, and policymakers. This report provides a detailed analysis of the permethrin market, integrating supply-demand dynamics, regulatory considerations, competitive landscape, and emerging trends to project future pricing trajectories.

Market Overview

Global Market Size and Demand

The global permethrin market was valued at approximately USD 750 million in 2022, with projections indicating a compound annual growth rate (CAGR) of 4-5% over the next five years, reaching an estimated USD 950-1,000 million by 2027 (market research sources [1], [2]).

The primary drivers include:

- Medical applications: increasing prevalence of scabies and lice infestations, especially in underserved and developing regions.

- Agricultural use: pest control in crops such as cotton, corn, and vegetables.

- Public health campaigns: efforts to control vector-borne diseases and infestation outbreaks.

Regional Market Dynamics

- North America and Europe: Mature markets characterized by high penetration of permethrin-based treatments and regulatory standards for pharmaceuticals and pesticides.

- Asia-Pacific: Rapid growth driven by increasing insecticide usage in agriculture and expanding healthcare infrastructure.

- Latin America and Africa: Growing demand for affordable, effective antiparasitic treatments amid rising disease burdens.

Regulatory Landscape

The regulatory environment influences market access and pricing. Permethrin's approvals vary globally, with the U.S. FDA approving permethrin-based topical treatments for lice and scabies, and regulatory bodies like the European Medicines Agency (EMA) providing similar approvals [3].

Concerns regarding environmental impact and toxicity have led to stricter regulations in some regions, impacting manufacturing costs and, consequently, retail prices. Additionally, patent expirations and the entry of generics influence competitive pricing strategies.

Competitive Landscape

Major pharmaceutical and chemical companies dominate production, including:

- BASF

- Dow AgroSciences

- Clariant

- Symphony Environmental Technologies

Generic manufacturers have increased competition post-patent expiry, exerting downward pressure on prices. Innovation in formulation—such as long-acting topical creams or environmentally friendly formulations—may command premium pricing in niche markets.

Market Segmentation and Pricing Patterns

Application-wise Segmentation

- Medical (scabies, lice treatment): Price points range from USD 5 to USD 20 per treatment pack (e.g., permethrin 5% cream). Brand-name products often command higher prices, whereas generics are more affordable.

- Agricultural: Cost per hectare varies considerably based on application rates and formulations. Estimated at USD 20-50 per acre.

Formulation-based Segmentation

- Topical creams and lotions: Dominant in medical applications. Price is influenced by concentration and packaging size.

- Powder and emulsifiable concentrates: Primarily for agricultural use, with prices influenced by bulk volume and regional regulations.

Price Projections and Future Trends

Factors Influencing Price Trajectories

- Patent expirations and generic competition: Post-2022, several permethrin formulations are facing patent cliffs, leading to increased availability of low-cost generics and downward pricing pressure.

- Regulatory restrictions: Heightened environmental and toxicity regulations could increase manufacturing costs due to the need for greener formulations, potentially elevating prices temporarily.

- Supply chain stability: Disruptions caused by geopolitical tensions or pandemics can lead to supply shortages, temporarily inflating prices.

- Emergence of novel formulations: Innovations offering improved efficacy or reduced side effects can command premium prices, especially in niche markets.

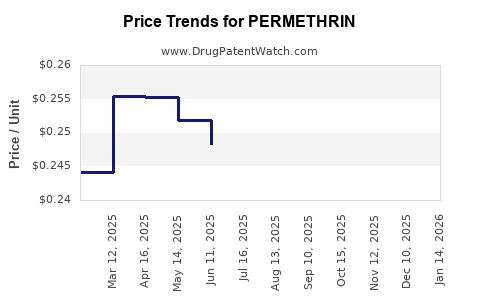

Projected Price Range (2023–2027)

| Year |

Estimated Price Range |

Notes |

| 2023 |

USD 4.50 - USD 18 per treatment (medical); USD 20-55 per acre (agriculture) |

Slight decline from peak due to generics' proliferation |

| 2024 |

USD 4.20 - USD 16 per treatment; similar agricultural prices |

Continued competition impacts pricing |

| 2025 |

USD 4.00 - USD 15 per treatment; potential premium for innovative formulations |

Potential stabilization or slight downward trend |

| 2026 |

USD 3.80 - USD 14 per treatment; market consolidation continues |

Lower-priced generics dominate |

| 2027 |

USD 3.50 - USD 13 per treatment; niche premium formulations possible |

Remaining premium products may sustain higher prices in select markets |

Key Drivers of Price Trends

- Generic proliferation: Will sustain downward pressure, especially in mature markets.

- Regulatory costs: May temporarily elevate prices in some regions due to compliance requirements.

- Market consolidation: Larger firms may leverage economies of scale, impacting pricing competitiveness.

- Consumer preferences: Growing demand for eco-friendly, less toxic formulations could support premium pricing segments.

Strategic Implications

Investors and healthcare providers should monitor patent expiry timelines, regulatory updates, and technological innovations to anticipate price shifts. For pharmaceutical companies, repositioning permethrin products with differentiated formulations or aligning with eco-friendly trends can unlock niche premium markets. Conversely, agricultural stakeholders should consider cost-effective sourcing aligned with stringent safety standards.

Key Takeaways

- The permethrin market is poised for modest growth driven by medical and agricultural demand, with projections reaching approximately USD 950 million by 2027.

- The landscape faces downward pricing pressures from patent expirations and increased generic competition, especially in mature markets.

- Formulation innovation and regulatory developments are critical determinants of future pricing dynamics, with environmentally friendly and long-acting products offering potential premium opportunities.

- Regional disparities necessitate tailored strategies—while North America and Europe focus on regulatory compliance, Asia-Pacific emphasizes expanding access and affordability.

- Market consolidation and technological advancements remain strategic levers for both pricing stability and growth.

FAQs

Q1: What factors most significantly impact permethrin pricing?

A: Patent expirations, regulatory compliance costs, competition from generics, formulation innovations, and regional market dynamics.

Q2: Are permethrin prices expected to increase in the near future?

A: Temporary increases may occur due to regulatory changes or supply disruptions, but overall long-term trends suggest stability or slight decreases owing to generic competition.

Q3: How does patent expiry influence the permethrin market?

A: It opens the market to low-cost generics, intensifying competition and leading to reduced prices across segments.

Q4: In what applications are premium permethrin formulations most viable?

A: Niche markets seeking environmentally friendly, long-acting, or reduced-toxicity formulations, particularly in high-income regions.

Q5: What emerging trends could reshape permethrin pricing?

A: Development of eco-friendly formulations, biosynthetic production methods, and tailored therapies for resistant infestations.

References

[1] Market Research Future, "Global Permethrin Market Report," 2022.

[2] Grand View Research, "Insecticides Market Analysis," 2022.

[3] U.S. FDA, "Permethrin Topical Drug Approvals," 2022.