Last updated: July 27, 2025

Introduction

PERFOROMIST (formoterol fumarate inhalation solution) is a long-acting beta-2 adrenergic agonist (LABA) approved for maintenance treatment of airflow obstruction in patients with chronic obstructive pulmonary disease (COPD). Since its FDA approval in 2009, PERFOROMIST has established itself as a critical asset in the COPD treatment landscape, competing primarily with other LABAs and combination therapies. This analysis evaluates current market dynamics, competitive positioning, manufacturing considerations, reimbursement landscape, and projects future pricing trends for PERFOROMIST over the next five years.

Market Overview

Global COPD Treatment Market:

The global COPD treatment market was valued at approximately USD 12.2 billion in 2022, with a projected Compound Annual Growth Rate (CAGR) of 4.5% through 2030 (MarketResearch.com). Key drivers include increasing COPD prevalence, especially among aging populations, and technological advances in inhaler formulations.

PERFOROMIST’s Segment:

As a niche, inhalation-based bronchodilator therapy, PERFOROMIST specifically targets patients requiring long-term maintenance for COPD. Its unique distinction as an inhalation solution—administered via the PARI LC PLUS nebulizer—positions it favorably among patients who prefer or require nebulized treatments, often those with severe respiratory impairment.

Market Penetration & Competitive Landscape:

Main competitors include:

- Dulera (mometasone/formoterol): combination inhaler.

- Brovana (arformoterol): another nebulized LABA.

- Symbicort and Advair: ICS/LABA inhalers dominating the inhaler segment.

- Generic formulations and emerging biologics: potential future entrants impacting pricing.

While PERFOROMIST’s market share remains largely stable within nebulized formulations, its penetration is limited relative to inhalers, largely due to prescribing patterns, insurance coverage, and patient preferences.

Regulatory and Reimbursement Considerations

FDA and Health Authority Status:

Approved in the US, PERFOROMIST benefits from a well-established regulatory position. The drug’s approval as a nebulized monotherapy underlines its role as a treatment option for patients contraindicated for inhaler devices.

Insurance and Reimbursement Landscape:

Reimbursement dynamics significantly influence market access. As a specialty medication, PERFOROMIST often falls under pharmacy benefit management (PBM) negotiations. Its pricing must align with reimbursement trends to maintain market viability, especially given the increasing emphasis on cost-effectiveness in COPD treatment.

Current Pricing and Cost Analysis

List Price:

As of late 2022, the average wholesale price (AWP) for a 30-day supply (1 vial containing 20 mcg/2 ml) of PERFOROMIST ranged between USD 250 to USD 280 (Red Book, 2022). Actual net prices are typically lower due to discounts and rebates negotiated by PBMs.

Reimbursement Trends:

Insurance coverage tends to favor inhalers over nebulized solutions, influencing patient access and prescribing patterns. Nonetheless, for severe COPD patients with inhaler intolerance, PERFOROMIST remains clinically valuable.

Market Forecast and Price Projections (2023-2028)

Factors Influencing Future Pricing:

-

Patent and Market Exclusivity:

PERFOROMIST’s patent protection in the US is slated to expire around 2025, potentially opening opportunities for generic competitors. The advent of generics typically leads to significant price erosion, with historical trends showing reductions of 20-50% within 2-3 years post-generic entry.

-

Manufacturing and Supply Chain Dynamics:

Advances in formulation and manufacturing efficiencies could moderate production costs, impacting net pricing positively. Conversely, raw material shortages or supply chain disruptions could temporarily inflate costs.

-

Reimbursement Pressure and Value-Based Pricing:

Payers increasingly demand value-based evaluations. If PERFOROMIST demonstrates cost-effectiveness over alternatives, payers may support higher pricing within formulary constraints.

-

Emerging Competition:

Introduction of new combination therapies and biologic agents for COPD could marginalize nebulized LABA segments, exerting downward pressure on pricing.

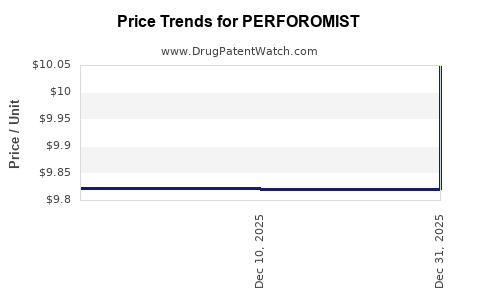

Projected Price Trends:

| Year |

Predicted Average Price (USD) |

Anticipated Drivers |

| 2023 |

USD 250–280 |

Stabilization pre-generic entry, existing market dynamics |

| 2024 |

USD 235–265 |

Patent expiration approaching, potential generic market entry |

| 2025 |

USD 200–240 |

Increased generic competition, pricing adjustments |

| 2026 |

USD 180–220 |

Continued generic penetration, pressure from inhaler alternatives |

| 2027 |

USD 170–210 |

Market consolidation, price erosion |

| 2028 |

USD 160–200 |

Mature generic market, possible new competitors |

Market and Pricing Risks

- Generic Entry: The primary risk is the rapid erosion of value following patent expiry.

- Market Shift Toward Inhalers: Preference for metered-dose inhalers (MDIs) and dry powder inhalers (DPIs) could diminish nebulized formulations' attractiveness.

- Reimbursement Restrictions: Cost containment measures may limit reimbursement levels, reducing profitability.

- Emergence of Novel Therapies: Biologics or novel inhaled agents could displace existing LABA formulations, including PERFOROMIST.

Strategies for Market Positioning

- Differentiation through Value: Highlight clinical benefits, especially for patients intolerant to inhalers.

- Pricing Flexibility: Prepare for competitive pricing strategies post-generic entry.

- Reimbursement Engagement: Fortify relationships with payers to maintain favorable formulary access.

- Expansion and Diversification: Explore new indications or combination formulations to sustain revenue streams.

Key Takeaways

- Competitive Landscape: PERFOROMIST faces imminent generic competition expected around 2025, likely leading to significant price reductions.

- Pricing Trends: Expect a steady decline in average prices over the next five years, with potential halving post-generic entry.

- Market Dynamics: The nebulized segment constitutes a niche market, with growth opportunities constrained by evolving inhaler preferences and reimbursement policies.

- Strategic Focus: Companies should prioritize differentiation, payer negotiations, and diversification to sustain profitability amid escalating competition.

- Reimbursement and Access: Maintaining favorable reimbursement pathways remains critical as pricing pressures intensify.

FAQs

Q1: When is PERFOROMIST expected to face generic competition?

A1: Patent exclusivity is anticipated to expire around 2025, opening the door for generic entrants, which will heighten price competition.

Q2: How will generic entry impact PERFOROMIST’s pricing?

A2: Historical trends suggest a reduction of 20-50% within the first 2-3 years post-generic approval, significantly affecting revenues.

Q3: What factors could mitigate future price declines?

A3: Demonstrated clinical superiority, strategic payer negotiations, and expansion into new indications or formulations could help sustain pricing levels.

Q4: Is the nebulized route still relevant in COPD management?

A4: Yes, especially for patients with inhaler intolerance or severe disease, maintaining a niche despite the rise of inhalers.

Q5: What market opportunities exist beyond COPD?

A5: Exploration of other respiratory indications or combination therapies could diversify revenue streams and offset declines in the current niche.

Sources

[1] MarketResearch.com. Global COPD Treatment Market Size & Share, 2022-2030.

[2] Red Book. Pharmaceutical Pricing Data, 2022.

[3] US Food and Drug Administration. PERFOROMIST FDA Approval Documentation.

[4] IQVIA. Pharmaceutical Market Trends and Reimbursement Data, 2022.