Last updated: July 27, 2025

Introduction

PERCOCET is a combination pharmaceutical drug integrating oxycodone and acetaminophen, primarily prescribed for moderate to severe pain management. Its formulation leverages the synergistic analgesic effects of oxycodone, an opioid, with acetaminophen, a non-opioid analgesic. As the opioid crisis intensifies globally, understanding the market dynamics and future pricing trends of PERCOCET is crucial for stakeholders across pharmaceutical, healthcare, and investment sectors.

This report provides a comprehensive market analysis, evaluates current pricing structures, and projects future price trajectories for PERCOCET, grounded in recent industry data, regulatory developments, and healthcare utilization patterns.

Market Overview

Market Size and Demand Drivers

The global pain management pharmaceuticals market was valued at approximately USD 46 billion in 2021, projected to grow at a CAGR of 4.5% over the next five years (1). PERCOCET sits within the prescription opioid segment, which, despite declining consumption post-2010 due to regulatory tightening, still accounts for substantial revenue in specific markets like the United States.

In the U.S., opioids represent roughly 55% of the analgesic market, with prescriptions mainly driven by chronic pain, post-surgical pain, and cancer pain management (2). PERCOCET, marketed by Teva Pharmaceuticals and other generic manufacturers, commands considerable market share within the combination opioid category, especially for patients requiring effective control with minimal pill burden.

Regulatory and Societal Factors

Regulatory agencies, including the U.S. Food and Drug Administration (FDA), increasingly scrutinize opioid medications citing abuse potential, leading to tighter prescribing guidelines (3). The 2016 CDC guidelines significantly curbed opioid prescriptions, influencing product demand and market size.

Additionally, the rising adoption of abuse-deterrent formulations and shift toward non-opioid alternatives are impacting the demand for combination opioids like PERCOCET. Nonetheless, the ongoing necessity for effective pain management means PERCOCET remains relevant, particularly for short-term or acute pain scenarios.

Key Competitors and Market Share

PERCOCET competes against other combination opioids (e.g., Percocet, Vicodin) and non-opioid analgesics (NSAIDs, anticonvulsants). Market share is distributed among brand-name, generic, and compounded versions:

- Brand-Name PERCOCET: Once dominant, now faces decline owing to patent expirations and generic competition.

- Generics: Account for over 80% of prescriptions, leading to significant price competition.

- Other treatments: Increasingly, patients and providers opt for non-opioid options, affecting long-term market growth.

Current Pricing Landscape

Pricing Structures and Variations

The pricing of PERCOCET varies substantially depending on patent status, formulation specifics, and regional factors:

- Brand-Name Pricing: Historically, brand-name PERCOCET (Merck/Sanofi) sold at a premium, with unit costs around USD 10–15 per tablet for 5 mg oxycodone / 325 mg acetaminophen.

- Generic Version Pricing: Post-patent expiration around 2015-2016, generic versions became widely available, reducing costs to approximately USD 0.20–0.50 per tablet.

- Insurance and Formularies: Reimbursement rates significantly influence out-of-pocket expenses, with branded drugs often subject to higher copayments unless offset by insurance coverage.

Market Dynamics Affecting Pricing

- Regulatory Pressures: The opioid epidemic led to increased scrutiny, with some jurisdictions implementing pricing restrictions or encouraging substitution with non-opioid therapies.

- Supply Chain Factors: Raw material costs, manufacturing complexities, and distribution channels impact pricing stability.

- Generic Competition: The rise of multiple manufacturers has driven prices downward, creating a highly price-sensitive market.

Future Price Projections

Influencing Factors

-

Regulatory Environment: Stringent prescribing policies and increased control measures likely suppress overall demand for opioids, including PERCOCET, exerting downward pressure on pricing.

-

Patent and Market Exclusivity: As patent protections have expired, the influx of generics will sustain low price levels unless new formulations or delivery mechanisms are introduced.

-

Pandemic Impact: COVID-19 has accelerated telemedicine and prescription trends, but economic disruptions could influence procurement and pricing strategies.

-

Emerging Alternatives: Advances in non-opioid analgesics and non-pharmacologic therapies threaten long-term demand, potentially diminishing market size and price stability.

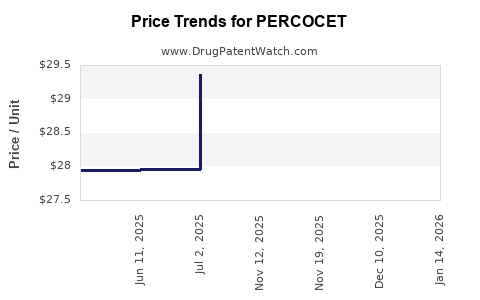

Projected Price Trends (2023–2028)

-

Immediate Term (2023–2025): Prices for generic PERCOCET are expected to stabilize between USD 0.20–0.50 per tablet, maintaining discounts due to high generic competition.

-

Mid to Long Term (2026–2028): Pricing may see a slight decline, averaging USD 0.15–0.30 per tablet, driven by continued generics proliferation and possible market share erosion to alternative therapies.

-

Potential Price Increase Scenarios: Limited, possibly driven by manufacturing cost inflation or regulatory barriers to new formulations. However, such increases are unlikely to surpass inflation-adjusted levels.

Market Outlook Summary

While revenue from PERCOCET is unlikely to grow substantially due to regulatory and societal pressures, the prevailing trend favors low-cost generics maintaining a key position for short-term pain relief. The ongoing opioid crisis and alternative treatment innovations will continue defining its market trajectory.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focus on developing abuse-deterrent or non-opioid formulations to sustain market relevance.

- Healthcare Providers: Emphasize adherence to prescribing guidelines, favoring non-opioid therapies where appropriate.

- Payers and Policy Makers: Promote policies reducing opioid reliance, including coverage for alternative therapies.

Key Takeaways

- The global PERCOCET market is constrained by regulatory scrutiny and societal shifts away from opioids but remains relevant for certain patient populations.

- Current prices of generic PERCOCET tablets are low, averaging USD 0.20–0.50 per unit, with limited prospects for significant near-term growth.

- Market trends point towards further price stabilization or slight decrease, driven by increased generic competition and evolving pain management protocols.

- Long-term prospects for PERCOCET hinge on innovation in formulation and positioning within the broader shift toward non-opioid analgesics.

- Stakeholders must monitor regulatory developments and healthcare policy changes to adapt strategies effectively.

FAQs

1. How has the opioid crisis impacted PERCOCET's market?

Regulatory measures and changing prescribing practices have led to a decline in demand for opioids like PERCOCET, especially in markets like the U.S. where restrictions have tightened access and promoted alternative therapies.

2. What is the current price range for generic PERCOCET tablets?

Generic versions typically retail between USD 0.20 and USD 0.50 per tablet, depending on distributor, region, and healthcare coverage.

3. Are there any upcoming regulatory changes likely to affect PERCOCET prices?

Potential regulations aimed at curbing opioid prescriptions or introducing abuse-deterrent formulations may influence pricing and availability, but specific legislative forecasts remain uncertain.

4. What alternatives are replacing PERCOCET in pain management?

Non-opioid analgesics, nerve blocks, physical therapy, and non-pharmacologic interventions are increasingly favored, reducing dependence on combination opioids.

5. Will PERCOCET ever regain its market dominance?

Given current trends, significant market resurgence is unlikely without innovation, such as abuse-deterrent formulations or new indications, and contingent on regulatory and societal acceptance.

Sources:

[1] MarketsandMarkets, "Pain Management Drugs Market," 2022.

[2] IQVIA, "Global Opioid Prescribing Trends," 2021.

[3] U.S. CDC, "Guidelines for Prescribing Opioids," 2016.