Share This Page

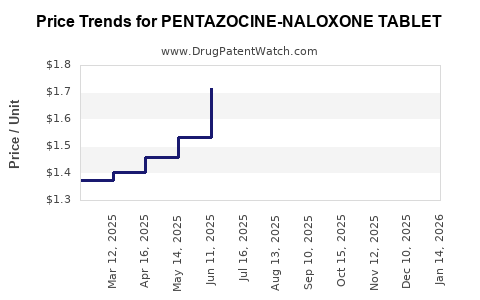

Drug Price Trends for PENTAZOCINE-NALOXONE TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for PENTAZOCINE-NALOXONE TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PENTAZOCINE-NALOXONE TABLET | 00591-0395-01 | 1.95548 | EACH | 2025-12-17 |

| PENTAZOCINE-NALOXONE TABLET | 43386-0680-01 | 1.95548 | EACH | 2025-12-17 |

| PENTAZOCINE-NALOXONE TABLET | 00591-0395-01 | 1.95264 | EACH | 2025-11-19 |

| PENTAZOCINE-NALOXONE TABLET | 43386-0680-01 | 1.95264 | EACH | 2025-11-19 |

| PENTAZOCINE-NALOXONE TABLET | 43386-0680-01 | 1.95730 | EACH | 2025-10-22 |

| PENTAZOCINE-NALOXONE TABLET | 00591-0395-01 | 1.95730 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PENTAZOCINE-NALOXONE TABLET

Introduction

Pentazocine-naloxone tablets, a combination analgesic and opioid dependence treatment, occupy a nuanced position within the pharmaceutical landscape. Primarily used to manage moderate to severe pain and combat opioid use disorders, these formulations have seen varying levels of demand influenced by regulatory, clinical, and market dynamics. This analysis forecasts market trends and pricing strategies for this drug, offering insights for pharmaceutical companies, investors, and healthcare stakeholders.

Pharmacological Profile and Clinical Utility

Pentazocine is a mixed opioid agonist-antagonist primarily employed for pain management, offering analgesic effects with a reduced risk of respiratory depression and dependency compared to full agonists like morphine. Naloxone, an opioid antagonist, is included within formulations chiefly to mitigate abuse potential by deterring intravenous misuse, which is a widespread concern with opioid-based medications (as seen in abuse-deterrent formulations).

The pentazocine-naloxone formulation is particularly valuable in opioid dependence therapy, functioning both as an analgesic and as part of medication-assisted treatment (MAT) protocols. Its dual role expands its clinical appeal amid rising opioid misuse globally.

Market Dynamics

Global Demand Drivers

- Pain Management Needs: The increasing prevalence of chronic pain conditions, especially in aging populations, sustains steady demand for opioid analgesics. Regulatory shifts favoring abuse-deterrent formulations elevate the role of pentazocine-naloxone in pain management protocols.

- Opioid Crisis and Regulation: Growing awareness of opioid misuse has led to stricter prescribing patterns, fostering demand for abuse-deterrent formulations, including pentazocine-naloxone. Countries like the US, UK, and parts of Europe are gradually incorporating these into standard care.

- Opioid Use Disorder (OUD) Treatment: The deployment of combination therapies with naloxone as part of OUD strategies amplifies the market; notably, countries investing in harm reduction programs bolster this segment.

Key Market Participants

- Manufacturers: While pentazocine's original formulations were developed decades ago, newer abuse-deterrent variants are emerging via collaborations with biotech firms and generics manufacturers.

- Regulatory Bodies: Agencies promote formulations that reduce overdose risk, influencing market uptake.

- Distribution Channels: Hospitals, clinics, and specialty pharmacies dominate, especially in markets adhering to stricter opioid prescribing guidelines.

Regional Market Trends

- North America: The largest market owing to the opioid crisis, with robust demand for abuse-deterrent opioids.

- Europe: Steady growth driven by regulatory acceptance and increased focus on opioid misuse prevention.

- Asia-Pacific: Rapidly expanding due to rising pain management needs, improving healthcare infrastructure, and government initiatives on opioid regulation.

Market Challenges

- Regulatory Hurdles: Stringent approval processes for abuse-deterrent formulations can delay market entry.

- Pricing and Reimbursement: Price sensitivity exists, particularly in markets with limited health insurance coverage. Governments and payers are scrutinizing cost-effectiveness.

- Generic Competition: As patents expire, generic manufacturers intensify competition, exerting downward pressure on prices.

Price Projection Analysis

Current Pricing Landscape

Currently, pentazocine-naloxone tablets command a premium relative to traditional opioids due to their abuse-deterrent features and dual indication. In the US, branded formulations may retail at approximately $20–$40 per tablet depending on dosage and brand. Generic versions, where available, can reduce costs by 15–30%.

Short-term Projections (Next 1–3 Years)

- Prices are expected to stabilize amid increasing adoption, with minor reductions due to generic entry.

- Regional pricing disparities will persist, with North America maintaining premiums owing to regulatory policies and demand for abuse-deterrent formulations.

- Reimbursement policies will influence net prices, particularly as payers push for cost-effective alternatives.

Long-term Projections (3–5 Years)

- Price erosion is anticipated due to market saturation and intensified generic competition.

- Innovation-driven premium pricing may uphold in niche segments—e.g., formulations with enhanced abuse-deterrent mechanisms or extended-release properties.

- Global expansion may stimulate localized pricing strategies, with emerging markets adopting more affordable versions to expand access.

Pricing Forecast Summary

| Timeframe | Expected Price Trend | Influencing Factors |

|---|---|---|

| 2023–2025 | Slight decline or stabilization | Patent expiries, increased generics |

| 2026–2028 | Continued downward pressure | Market saturation, price competition |

| 2028+ | Potential stabilization at lower levels | Innovation, formulary preferences |

Market Opportunities

- Emerging markets represent promising avenues, where investing in affordable, abuse-deterrent formulations can meet unmet pain management needs.

- Partnerships and licensing agreements with local manufacturers could facilitate broader access.

- Innovation in formulation technology—such as long-acting, transdermal, or implantable versions—may command premium pricing.

Regulatory & Policy Impact

Global regulatory agencies are increasingly advocating for abuse-deterrent formulations, impacting demand and pricing. The US FDA, for instance, grants certain abuse-deterrent labelings that influence prescribing patterns and reimbursement. Alignment with such standards offers strategic advantages but could elevate R&D costs.

Conclusion

The market for pentazocine-naloxone tablets is poised for cautious growth, driven by heightened awareness of opioid misuse, regulatory endorsements of abuse-deterrent formulations, and expanding pain management needs. While initial pricing premiums remain, ongoing patent expirations and market saturation will likely press prices downward over the next five years. Strategic positioning—via innovation, regional expansion, and partnerships—will be critical for stakeholders seeking to maximize revenue and market share.

Key Takeaways

- Demand for abuse-deterrent formulations will sustain pentazocine-naloxone's relevance amid the opioid crisis.

- Generics will exert downward price pressure, emphasizing the importance of innovation and market differentiation.

- Regulatory policies significantly influence pricing trajectories and market penetration.

- Emerging markets offer substantial growth opportunities with affordable formulations.

- Stakeholders must monitor patent landscapes and reimbursement policies to optimize pricing strategies.

FAQs

1. What factors influence the price of pentazocine-naloxone tablets?

Prices are affected by patent status, generic competition, regulatory approvals, regional healthcare policies, production costs, and market demand. Abuse-deterrent features and formulations also command premium prices.

2. How does the opioid crisis impact the market for pentazocine-naloxone?

The crisis drives demand for abuse-deterrent and opioid dependence treatments, expanding market opportunities. Regulators favor formulations that reduce misuse, influencing prescribing and pricing.

3. What regions offer the greatest growth potential for this drug?

North America and Europe are mature markets with high demand, while Asia-Pacific and Latin America present emerging opportunities due to improving healthcare infrastructure and regulatory reforms.

4. Will generic versions significantly reduce the price of pentazocine-naloxone?

Yes. As patents expire, generic manufacturers can introduce more affordable versions, leading to a competitive price environment and potential access expansion.

5. Are there ongoing innovations that could affect the market's future?

Yes. Developments like extended-release formulations, transdermal patches, and implantable devices could allow manufacturers to command higher prices and expand their market share.

Sources:

[1] U.S. Food and Drug Administration (FDA). Abuse-Deterrent Opioids.

[2] IQVIA. Global Insights on Opioid Market Trends.

[3] World Health Organization. Pain Management and Opioid Use Trends.

[4] Harvard Medical School. The Opioid Crisis and Regulatory Responses.

[5] MarketWatch. Analgesics Market Forecasts.

More… ↓