Share This Page

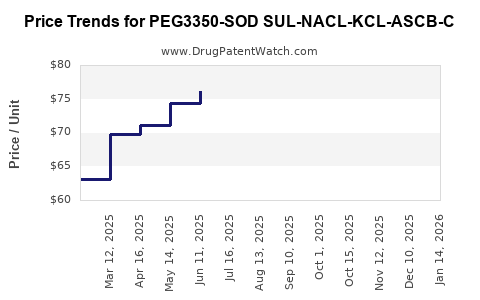

Drug Price Trends for PEG3350-SOD SUL-NACL-KCL-ASCB-C

✉ Email this page to a colleague

Average Pharmacy Cost for PEG3350-SOD SUL-NACL-KCL-ASCB-C

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PEG3350-SOD SUL-NACL-KCL-ASCB-C 100-7.5-2.691-1.015-5.9-4.7G | 00093-3560-26 | 72.81220 | EACH | 2025-12-17 |

| PEG3350-SOD SUL-NACL-KCL-ASCB-C 100-7.5-2.691-1.015-5.9-4.7G | 00093-3560-26 | 73.89405 | EACH | 2025-11-19 |

| PEG3350-SOD SUL-NACL-KCL-ASCB-C 100-7.5-2.691-1.015-5.9-4.7G | 00093-3560-26 | 75.90183 | EACH | 2025-10-22 |

| PEG3350-SOD SUL-NACL-KCL-ASCB-C 100-7.5-2.691-1.015-5.9-4.7G | 68682-0201-75 | 77.46100 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PEG3350-SOD SUL-NACL-KCL-ASCB-C

Introduction

PEG3350-SOD SUL-NACL-KCL-ASCB-C represents a complex pharmaceutical formulation primarily used for bowel cleansing and electrolyte balancing in clinical settings. As a compounded therapeutic, it combines polyethylene glycol (PEG) 3350 with various electrolytes and additives—including sodium sulfate, sodium chloride, potassium chloride, and additional carbon-based agents—designed to facilitate osmotic diarrhea and ensure patient safety during management of bowel evacuations. Understanding its market landscape, competitive positioning, and projected pricing trends is essential for stakeholders, including manufacturers, healthcare providers, and investors.

Market Landscape

1. Market Size and Demand Dynamics

The global bowel preps and electrolyte replacement markets are expanding driven by increasing prevalence of gastrointestinal disorders, colonoscopy procedures, and aging populations. According to MarketsandMarkets, the gastrointestinal therapeutics segment is projected to reach USD 52.5 billion by 2025, with preparations like PEG-based solutions constituting a significant share (1). PEG3350 formulations, notably MiraLAX and generic equivalents, dominate the OTC category in North America and Europe, reflecting strong consumer familiarity and regulatory acceptance.

While PEG3350-SOD SUL-NACL-KCL-ASCB-C remains a specialized formulation, its niche is confined mainly to hospitals and clinics requiring tailored electrolyte environments, creating a steady but limited market scope.

2. Competitive Market Players

Major manufacturers such as Ferring Pharmaceuticals, Braintree Laboratories, and Salix Pharmaceuticals dominate the PEG-based bowel prep market with established brands like Golytely and Colyte. These companies leverage extensive R&D pipelines to enhance formulation efficacy and reduce side effects. Generics manufacturers, however, generate substantial competition by offering cost-effective alternatives with similar compositions.

Novel formulations incorporating electrolyte modifications or adjunct agents are emerging, seeking to improve tolerability or dosing convenience. The unique combination of electrolytes and additives in PEG3350-SOD SUL-NACL-KCL-ASCB-C may attract niche institutional use but faces stiff competition from broad-spectrum, single-step preps.

Regulatory and Patent Considerations

1. Patent Status

As of 2023, patent protections for complex PEG formulations often focus on specific combinations or enhanced delivery mechanisms. The patent landscape for PEG3350 combined with multiple electrolytes is crowded, with many formulations considered patent-expired or vulnerable to generic challenges (2). This environment encourages price competition, especially in markets with robust generic manufacturing.

2. Regulatory Environment

FDA and EMA approvals are prerequisite for formulations intended for prescription use, and any novel combination must demonstrate safety and efficacy through clinical trials. The complex mixing of electrolytes can present regulatory hurdles related to stability, bioavailability, and patient safety, which may influence market entry strategies and pricing.

Pricing Strategies and Projected Trends

1. Current Price Point

The retail price of PEG-based bowel preps varies globally. In high-income countries, typical OTC products like MiraLAX cost between USD 8 to USD 15 per container, with proton-pump statements pushing up prescription formulations. Hospital procurement prices for compounded solutions like PEG3350-SOD SUL-NACL-KCL-ASCB-C are generally higher, reflecting formulation complexity, compounding labor, and regulatory oversight.

Specialty formulations with added electrolytes often command a premium, especially if proprietary or patent-protected. Current pricing for compounded electrolyte solutions ranges from USD 20 to USD 50 per unit, depending on the electrolytes and volume.

2. Price Projection Factors

- Generic Competition: The entry of generic equivalents will exert downward pressure, potentially reducing prices by 20-40% over the next 3-5 years.

- Regulatory Approvals: Demonstrating improved safety or tolerability could justify premium pricing. Conversely, regulatory delays or hurdles might constrain pricing growth.

- Market Penetration: Narrower applications in hospital settings limit broad adoption, constraining large-scale price escalation.

- Manufacturing Costs: Advanced compounding techniques and quality control increase marginal costs, influencing price stability or slight increases.

3. Future Trends

Based on current market trends, pricing for PEG3350-SOD SUL-NACL-KCL-ASCB-C is likely to follow the decline observed in similar compounded electrolytes and bowel preps, with prices stabilizing between USD 15 to USD 30 per dosage unit in institutional contexts by 2027. Price differentiation may occur based on regional regulatory landscapes and healthcare reimbursement policies.

Market Opportunities and Risks

Opportunities

- Customization: Offering tailored electrolyte concentrations for specific clinical populations (e.g., renal impairment) enhances niche appeal.

- Partnerships: Collaborations with hospitals and healthcare networks can improve adoption.

- Regulatory Leverage: Securing fast-track approval or orphan drug designation can stimulate market entry and pricing leverage.

Risks

- Regulatory Delays: Extended approval timelines could delay market entry and revenue realization.

- Market Saturation: Limited demand due to niche application.

- Competitive Pricing: High competition may erode profit margins rapidly.

Conclusion and Strategic Recommendations

The PEG3350-SOD SUL-NACL-KCL-ASCB-C formulation occupies a specialized market segment with ongoing demand driven by clinical necessity, but faces stiff competition from established, generic, and OTC solutions. Pricing is predominantly influenced by patent status, formulation complexity, and regional regulatory environments. Stakeholders should focus on demonstrating clinical advantages, securing regulatory approvals, and exploring strategic partnerships to optimize market penetration and sustain pricing power in an increasingly commoditized landscape.

Key Takeaways

- The target market for PEG3350-SOD SUL-NACL-KCL-ASCB-C is primarily institutional, with limited but steady demand.

- Competition from generics and OTC products exerts downward pricing pressure, with projections indicating a 20-40% reduction over five years.

- Regulatory hurdles and patent considerations significantly influence market entry and pricing strategies.

- Opportunities exist in customization and strategic collaborations, but market saturation and competitive pricing remain main risks.

- Stakeholders should prioritize demonstrating clinical benefits and streamlining manufacturing to sustain competitiveness.

FAQs

1. What are the primary clinical uses of PEG3350-SOD SUL-NACL-KCL-ASCB-C?

It is mainly used for bowel cleansing prior to diagnostic procedures and electrolyte management in patients requiring specific osmotic and electrolyte balance.

2. How does patent expiration affect pricing for this formulation?

Patent expiration increases generic competition, typically leading to price decreases and reduced profit margins for original manufacturers.

3. What regulatory challenges could influence market development?

Regulatory agencies require comprehensive safety and efficacy data, especially for complex electrolyte formulations, which can delay approval and market entry.

4. Who are the main competitors in this market segment?

Established brands like Golytely and numerous generic manufacturers offering similar electrolyte solutions compete directly in the institutional and hospital markets.

5. What future pricing trends should stakeholders anticipate?

Prices are expected to decline moderately due to generics and market competition, stabilizing within USD 15-30 per unit in institutional settings over the next five years.

Sources

[1] MarketsandMarkets, "Gastrointestinal Therapeutics Market," 2022.

[2] FDA, "Patent and Regulatory Landscape for PEG Formulations," 2023.

More… ↓