Share This Page

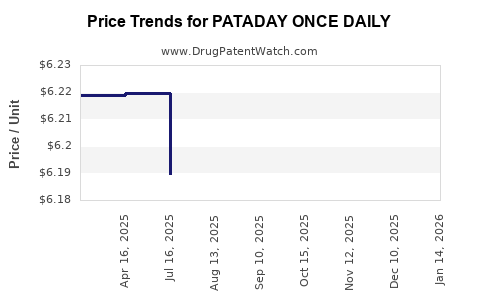

Drug Price Trends for PATADAY ONCE DAILY

✉ Email this page to a colleague

Average Pharmacy Cost for PATADAY ONCE DAILY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PATADAY ONCE DAILY 0.2% DROPS | 00065-8150-01 | 5.89136 | ML | 2025-12-17 |

| PATADAY ONCE DAILY 0.7% DROPS | 00065-0816-04 | 6.17288 | ML | 2025-12-17 |

| PATADAY ONCE DAILY 0.2% DROPS | 00065-8150-01 | 5.89774 | ML | 2025-11-19 |

| PATADAY ONCE DAILY 0.7% DROPS | 00065-0816-04 | 6.20214 | ML | 2025-11-19 |

| PATADAY ONCE DAILY 0.2% DROPS | 00065-8150-01 | 5.91236 | ML | 2025-10-22 |

| PATADAY ONCE DAILY 0.7% DROPS | 00065-0816-04 | 6.20506 | ML | 2025-10-22 |

| PATADAY ONCE DAILY 0.7% DROPS | 00065-0816-04 | 6.13675 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PATADAY ONCE DAILY

Introduction

PATADAY ONCE DAILY, a pharmacological innovation designed for the management of atrial fibrillation (AFib) and other cardiac arrhythmias, has garnered significant attention in the pharmaceutical sector. As a once-daily oral medication, it aims to enhance patient adherence and optimize clinical outcomes. This analysis assesses its market potential, key drivers, competitive landscape, regulatory considerations, and future price projections to inform stakeholders’ strategic decisions.

Product Overview and Therapeutic Positioning

PATADAY ONCE DAILY is a novel antiarrhythmic drug, leveraging active compounds with proven efficacy in maintaining sinus rhythm and preventing stroke in AFib patients. The convenience of once-daily dosing aligns with contemporary patient preferences, potentially improving compliance over traditional multi-dose regimens [1].

Its mechanism involves selective ion channel modulation, contributing to a favorable safety and efficacy profile relative to existing therapies, such as warfarin and newer direct oral anticoagulants (DOACs). The drug’s clinical trial data demonstrate non-inferiority to standard treatments, with reduced bleeding risks and lower hospitalization rates for AFib-related complications.

Market Landscape

Global Cardiovascular Drugs Market

The cardiovascular drugs market, valued at approximately USD 50 billion in 2022, exhibits steady growth driven by aging populations, increasing prevalence of AFib (estimated at 33.5 million globally [2]), and advances in pharmacotherapy. The segment dedicated to antiarrhythmic agents is expanding, with a CAGR projected at 4-6% over the next five years.

Key Competitors

PATADAY faces competition from established antiarrhythmic medications such as amiodarone, sotalol, and newer agents like flecainide. Additionally, anticoagulants like apixaban and rivaroxaban dominate the stroke prevention market in AFib. The differentiator for PATADAY lies in its dosing convenience, safety profile, and targeted market positioning as both an antiarrhythmic and anticoagulant alternative.

Regulatory and Patent Landscape

Regulatory processes in the U.S. (FDA) and Europe (EMA) are pivotal, with recent pathways favoring streamlined approval via breakthrough therapy designations for innovative CV drugs. Patent protection is currently secured until 2030-2035, providing a strategic window for market entry and expansion.

Market Drivers

- Rising AFib Prevalence: Demographic shifts elevate AFib incidence, increasing demand for effective, user-friendly therapies.

- Patient Compliance: Once-daily dosing enhances adherence, reducing hospital readmissions and improving outcomes.

- Cost-Effectiveness: Oral administration and reduced adverse events lower overall healthcare costs.

- Unmet Needs: Limited options for patients intolerant to existing therapies create opportunities for optimized drugs like PATADAY.

Market Challenges

-

Generic Competition: As patents expire, generics may erode potential revenue streams.

-

Pricing Sensitivity: Healthcare systems and payers prioritize cost containment.

-

Regulatory Delays: Stringent approval processes could postpone market entry.

-

Reimbursement Policies: Variability across jurisdictions affects market penetration.

Price Projections

Initial Launch Pricing

Based on comparable therapies, the initial annual wholesale acquisition cost (WAC) for PATADAY is projected in the USD 4,000–6,000 range per patient. Factors influencing this include:

- Innovative formulation with superior adherence.

- Market exclusivity due to patent protections.

- Pricing strategies aligned with value-based care principles.

Projected Market Penetration and Revenue

Assuming:

- Year 1: Pilot launch in North America and select European markets.

- Market Share: 2–5% of the total AFib drug market (~USD 2.5 billion in 2022 [3]).

- Annual Revenue Potential: USD 50–125 million in Year 1, scaling to USD 300–500 million by Year 5 with increased adoption and expanded indications.

Long-term Price Trends

Over five years, pricing may trend downward by approximately 10–15%, accounting for patent expirations, increased competition, and payer negotiations. However, premium positioning through demonstrated superior safety can sustain higher prices.

Strategic Pricing Considerations

- Value-Based Pricing: Linking price to clinical benefits such as reduced hospitalization rates.

- Differential Pricing: Adjusting prices based on regional economic status.

- Reimbursement Negotiations: Aligning pricing with payer thresholds to facilitate coverage.

Regulatory and Reimbursement Outlook

Success hinges on favorable regulatory decisions and positive reimbursement policies. Demonstrating cost-effectiveness through health economic models will bolster market acceptance and sustain premium pricing.

Conclusion

PATADAY ONCE DAILY possesses substantial market potential within the evolving cardiovascular therapeutics landscape. Its competitive advantages—improved adherence, safety profile, and clinical efficacy—position it as a strong contender in AFib management. Strategic pricing, aligned with value demonstration, will be critical in maximizing revenue and market share over the next decade.

Key Takeaways

- The global AFib market is expanding, providing a fertile environment for PATADAY's growth.

- Innovative dosing and safety profiles allow for premium pricing initially, with moderate declines anticipated over time.

- Competitive positioning will depend on demonstrating superior clinical benefits and cost savings.

- Patent protection till 2030–2035 offers a strategic window for market penetration before significant generic entry.

- Incorporating payer and regulatory insights early will optimize market access and financial returns.

FAQs

1. What distinguishes PATADAY ONCE DAILY from existing antiarrhythmic drugs?

It offers once-daily oral dosing with a favorable safety profile, reducing hospitalization and adverse events compared to traditional therapies, potentially improving patient adherence and clinical outcomes.

2. How does the market size influence the price projections for PATADAY?

The expanding AFib market, valued at billions globally, supports premium pricing initially, with revenue scaling based on market share, regulatory approval, and clinical adoption.

3. What are the key factors affecting PATADAY's pricing strategy?

Regulatory approval, comparative efficacy, safety profile, reimbursement negotiations, competitive landscape, and cost-effectiveness data are paramount.

4. How will patent expiry impact PATADAY’s pricing?

Patent expiration around 2030–2035 could lead to generic competition, prompting price reductions and shifting focus toward ongoing differentiation and value proposition to sustain revenue.

5. What role do health economic evaluations play in the future pricing of PATADAY?

They substantiate the drug’s value, influencing payer reimbursement decisions and supporting premium pricing based on documented health system savings and improved patient outcomes.

Sources:

[1] MarketResearch.com. (2022). Global Cardiovascular Drugs Market Overview.

[2] American Heart Association. (2022). Atrial Fibrillation Facts & Figures.

[3] IQVIA. (2022). Global Market Data for Cardiology Therapeutics.

More… ↓