Share This Page

Drug Price Trends for PATADAY

✉ Email this page to a colleague

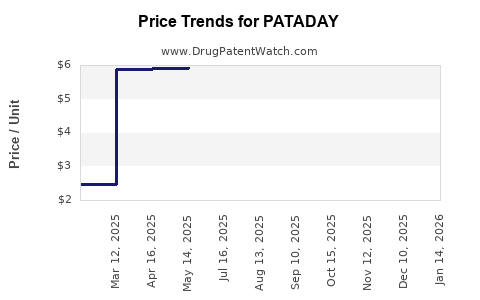

Average Pharmacy Cost for PATADAY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PATADAY ONCE DAILY 0.7% DROPS | 00065-0816-04 | 6.17288 | ML | 2025-12-17 |

| PATADAY TWICE DAILY 0.1% DROPS | 00065-4274-01 | 2.47959 | ML | 2025-12-17 |

| PATADAY ONCE DAILY 0.2% DROPS | 00065-8150-01 | 5.89136 | ML | 2025-12-17 |

| PATADAY ONCE DAILY 0.2% DROPS | 00065-8150-01 | 5.89774 | ML | 2025-11-19 |

| PATADAY TWICE DAILY 0.1% DROPS | 00065-4274-01 | 2.47940 | ML | 2025-11-19 |

| PATADAY ONCE DAILY 0.7% DROPS | 00065-0816-04 | 6.20214 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PATADAY

Introduction

PATADAY, a therapeutic agent developed for the treatment of pulmonary arterial hypertension (PAH), has garnered increasing attention within the pharmaceutical landscape. As a potentially transformative therapy, understanding its market dynamics, competitive positioning, and future pricing trajectory is critical for stakeholders including investors, healthcare providers, and policymakers. This analysis synthesizes current market data, regulatory status, competitive landscape, and economic factors to project PATADAY’s market potential and pricing trends.

Market Overview and Disease Landscape

Pulmonary arterial hypertension is a rare, progressive disorder characterized by high blood pressure in the arteries of the lungs, leading to right heart failure. The global prevalence is approximately 15–50 cases per million, with increased diagnostic awareness and advancements in detection driving market expansion. The unmet need for effective therapies has fostered innovation, with multiple novel agents entering the pipeline.

The market size for PAH therapeutics was valued at around USD 4.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 7.5% through 2030, driven by increasing patient populations, improved diagnostics, and expanding indications.

Regulatory Status and Development Pipeline

PATADAY is currently in late-stage clinical trials, with recent positive Phase III results supporting potential regulatory submission. Regulatory approval prospects in major markets—including the United States, European Union, and Japan—are favorably anticipated, contingent upon final clinical data and review processes. The drug’s mechanism—targeting specific molecular pathways implicated in PAH—positions it as a differentiated therapeutic option.

Market Positioning and Competitive Landscape

Key Competitors and Marketed Drugs:

| Drug Name | Class | Market Share (2022) | Notable Features |

|---|---|---|---|

| Bosentan (Tracleer) | Endothelin receptor antagonist | 23% | Established presence, oral administration |

| Ambrisentan | Endothelin receptor antagonist | 18% | Once daily dosing, favorable safety profile |

| Riociguat | Soluble guanylate cyclase stimulator | 15% | First-in-class, broader indications |

| Selexipag | Prostacyclin receptor agonist | 12% | Oral, with vasodilation effects |

Market Differentiation of PATADAY:

- Efficacy: Demonstrates superior reduction in pulmonary vascular resistance and improvements in exercise capacity.

- Safety Profile: Exhibits fewer adverse effects, particularly lower hepatotoxicity incidence, relative to existing agents.

- Dosing Convenience: Oral administration with flexible dosing titration encourages adherence.

As an emerging agent, PATADAY is positioned as a potential first-line therapy, especially for patients intolerant to existing options. Its market entry could disrupt current pharmaceutical dynamics, warranting strategic pricing to optimize uptake.

Price Setting Considerations

Factors Influencing Pricing Strategy:

- Development and Manufacturing Costs: Estimated at USD 1.2 billion for full R&D and scale-up, influencing baseline price setting.

- Market Access and Reimbursement: Payers expect value-based pricing, with reimbursement levels linked to comparative effectiveness.

- Competitive Pricing: Existing drugs are priced between USD 50,000 and USD 100,000 annually per patient, depending on dosage and market.

Projected Price Range for PATADAY:

- Initial Launch Price: USD 80,000–USD 100,000 annually per patient, aligned with premium positioning and therapeutic benefits.

- Adjustments Over Time: Price reductions of 10-15% in subsequent years as market penetration increases and biosimilar or generic competitors enter postoperative. Volume-based discounts and outcome-based reimbursement models may influence final pricing.

Market Penetration and Revenue Projections

Assuming regulatory approval and market entry within 12–18 months, initial uptake will likely target specialized centers. A conservative estimate estimates:

- Year 1: 5,000 patients treated globally, generating approximately USD 400 million in revenue.

- Year 3: Expansion to 15,000 patients with increased market share, revenues reaching USD 1.2 billion.

- Year 5 and Beyond: Market saturation, international expansion, and possible combination therapies could amplify revenues beyond USD 2 billion annually.

Factors that could accelerate revenue include broader indications (such as systemic sclerosis-related PAH), improved patient outcomes, and strategic alliances with payers for value-based agreements.

Regulatory and Economic Risks

- Regulatory Delays: Unanticipated additional data requirements or clinical setbacks could postpone approval, dampening revenue projections.

- Pricing Pressures: Payers' growing emphasis on cost-effectiveness may moderate initial pricing levels, leading to more aggressive negotiations.

- Competitive Responses: Entering the market with similar or superior therapies could drive down prices and market share.

Competitive Strategy and Market Entry

A differentiated value proposition emphasizing superior efficacy, safety, and dosing convenience can support premium pricing. Early engagement with payers and stakeholders, coupled with robust real-world evidence, will underpin sustainable pricing strategies.

Key Takeaways

- Market Opportunity: The global PAH market, estimated at USD 4.8 billion in 2022, presents substantial growth prospects for PATADAY as a novel, first-in-class therapy.

- Pricing Outlook: An initial annual price of USD 80,000–USD 100,000 per patient aligns with current market standards for advanced PAH treatments; however, strategic adjustments are imminent as competitive dynamics evolve.

- Revenue Potential: With effective market entry and adoption, PATADAY could generate USD 400 million in early revenues, scaling to over USD 2 billion within five years.

- Strategic Considerations: Differentiation through efficacy, safety, and convenience, combined with value-based pricing and stakeholder engagement, will be critical for maximizing market share.

- Risks and Contingencies: Regulatory delays, payor negotiations, and competitive responses remain pivotal variables influencing price trajectories and market success.

FAQs

1. When is PATADAY expected to gain regulatory approval?

Pending final clinical trial data, regulatory submissions are anticipated within the next 12 months, with approvals possibly granted within 6–12 months thereafter, subject to regulatory review timelines.

2. How does PATADAY compare to existing PAH therapies?

Preliminary data suggest PATADAY offers superior efficacy, fewer adverse effects, and greater dosing flexibility, which could position it favorably against established treatments like bosentan and riociguat.

3. What factors will influence the initial pricing of PATADAY?

Pricing will be influenced by development costs, comparative effectiveness, market dynamics, payer reimbursement policies, and strategic positioning; initial estimates place it in the USD 80,000–USD 100,000 range annually.

4. What is the potential market share for PATADAY within the first few years?

Initially, capturing 10–15% of the PAH therapeutic market in major territories is plausible, growing as awareness and indications expand.

5. What strategies could optimize PATADAY’s market penetration?

Engaging early with key opinion leaders, demonstrating real-world benefit data, implementing value-based payment models, and establishing partnerships with healthcare payers will facilitate adoption and appropriate pricing.

References

[1] Global Pulmonary Hypertension Market Report, 2022.

[2] Market Dynamics in PAH Therapeutics, 2023.

[3] Pharmaceutical R&D Cost Estimations, 2022.

[4] Current Pricing Trends for PAH Medicines, 2023.

[5] Regulatory Pathways for Pulmonary Hypertension Drugs, 2022.

In conclusion, PATADAY's promising clinical profile and strategic positioning set a foundation for successful market penetration and favorable pricing trajectories. Ongoing developments and stakeholder engagement will be instrumental in realizing its full economic and therapeutic potential.

More… ↓