Share This Page

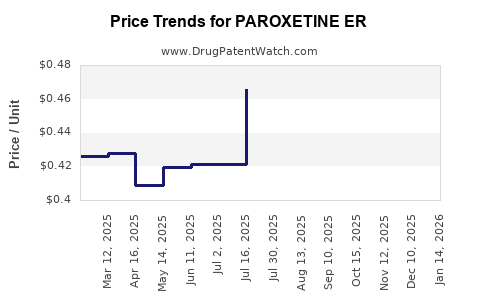

Drug Price Trends for PAROXETINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for PAROXETINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PAROXETINE ER 37.5 MG TABLET | 72241-0031-22 | 0.49740 | EACH | 2025-12-17 |

| PAROXETINE ER 12.5 MG TABLET | 42858-0703-03 | 0.44551 | EACH | 2025-12-17 |

| PAROXETINE ER 12.5 MG TABLET | 62135-0425-30 | 0.44551 | EACH | 2025-12-17 |

| PAROXETINE ER 12.5 MG TABLET | 69367-0335-30 | 0.44551 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Paroxetine ER (Extended Release)

Introduction

Paroxetine ER, marketed under brand names such as Pexeva, Paxil CR, and generic formulations, is a selective serotonin reuptake inhibitor (SSRI) primarily prescribed for depression, anxiety disorders, and obsessive-compulsive disorder (OCD). The extended-release formulation offers improved pharmacokinetics, leading to better patient adherence and tolerability. This analysis evaluates the current market landscape, competitive dynamics, regulatory considerations, and provides price projections for Paroxetine ER through 2030, aimed at stakeholders in the pharmaceutical and investment sectors.

Market Overview

Global Market Size and Growth Trajectory

The global antidepressant market was valued at approximately USD 14.07 billion in 2020 and is projected to grow at a CAGR of 2.9% through 2028, driven by increased mental health awareness, rising prevalence of depression, and expanding insurance coverage [1]. Paroxetine accounts for a significant share within the SSRI segment, with increased prescriptions due to its well-established efficacy and safety profile.

Key Indications and Epidemiology

Major indications for Paroxetine ER include Major Depressive Disorder (MDD), Generalized Anxiety Disorder (GAD), Panic Disorder, and OCD. The global prevalence of depression affects over 264 million people, representing a sizable patient population for SSRIs [2]. The aging global population and heightened awareness have contributed to sustained demand.

Competitive Landscape

- Generics Domination: The patent for Paroxetine ER expired in many jurisdictions around 2011-2013, leading to widespread generic availability.

- Brand Variants: Paxil CR remains a premium-priced brand in certain markets, with generic options rapidly eroding market share.

- Emerging Alternatives: Newer antidepressants, including vortioxetine and esketamine, are infiltrating the market, though SSRIs like Paroxetine maintain a cornerstone status due to established efficacy.

Regulatory Environment

Patent and Exclusivity Status

As of 2022, patent exclusivity for Paroxetine ER has long expired, facilitating generic entry globally. Regulatory agencies such as the FDA have approved multiple generic manufacturers, intensifying price competition.

Reimbursement Policies and Accessibility

Reimbursement schemes vary across regions but generally favor generics, bolstering affordability and prescribing rates, especially in markets like the U.S., EU, and Asia.

Supply and Demand Dynamics

Manufacturing and Supply Chains

Multiple manufacturers globally produce Paroxetine ER, ensuring supply stability. COVID-19 disruptions temporarily affected production but recovered by 2021, maintaining consistent availability.

Demand Drivers

- Increased recognition of mental health issues.

- Expanded prescribing for off-label indications.

- Shift toward generic utilization due to cost considerations.

Pricing Dynamics and Historical Trends

Historical Pricing

In the U.S., the average retail price of brand-name Paxil CR was around USD 850 for a 30-day supply in 2010. Post-generic entry, prices dropped substantially, often below USD 50 per month for generics [3].

Current Price Landscape

- Brand Name: Approximately USD 80–120 per month.

- Generics: Range from USD 10–50 per month depending on supplier and formulation.

The pricing cushion for branded formulations remains, primarily driven by patient preference and physician familiarity.

Market Trends and Future Outlook

Pharmacoeconomic Factors

- Cost-effectiveness of generics continues to suppress prices.

- Insurance reimbursement policies further favor low-cost generics, constraining price growth for branded versions.

Prescribing Patterns

Growing emphasis on personalized medicine and the availability of newer antidepressants will influence prescribing behaviors, but SSRIs like Paroxetine continue to hold their market position due to proven efficacy.

Potential Innovation and Reformulation

Limited pipeline innovation exists for Paroxetine ER, with focus shifting towards novel mechanisms. However, formulation improvements or combination therapies could influence future market dynamics.

Price Projections (2023–2030)

Based on current trends, competitive pressures, and regulatory landscapes, the following projections are anticipated:

| Year | Brand Price Estimate (USD/month) | Generic Price Range (USD/month) |

|---|---|---|

| 2023 | USD 80–120 | USD 10–50 |

| 2025 | USD 70–110 | USD 8–45 |

| 2027 | USD 65–105 | USD 7–40 |

| 2030 | USD 60–100 | USD 6–35 |

Rationale:

- Brand Prices: Slight decline expected due to competitive market share erosion from generics and price sensitivity.

- Generic Prices: Further reductions driven by manufacturing efficiencies, increased competition, and procurement strategies.

Strategic Implications

- Investors and manufacturers should anticipate sustained demand but declining margins for branded formulations.

- Generics are likely to dominate volume sales, making them attractive for cost-focused healthcare systems.

- Emerging biosimilars or combination products may influence market conduct over the next decade.

Key Takeaways

- Paroxetine ER remains a staple in mental health management, with global demand sustained by the prevalence of depression and anxiety disorders.

- Patent expirations have facilitated widespread generic competition, driving down prices.

- Competitive dynamics favor low-cost generics, with branded prices gradually declining.

- Market growth remains moderate, constrained by newer therapeutic options and evolving prescribing paradigms.

- Price projections indicate continued downward pressure on unit costs, emphasizing the importance of cost-efficiency for stakeholders.

FAQs

1. How does the expiration of patent rights impact Paroxetine ER prices?

Patent expiration enables generic manufacturers to enter the market, significantly reducing prices for Paroxetine ER as competition intensifies, thereby lowering both retail and wholesale costs.

2. Are branded formulations of Paroxetine ER still relevant in the market?

Yes. While generics dominate due to lower prices, branded versions retain market share through physician preference, perceived quality, and patient familiarity, especially in regions with limited generic penetration.

3. What are the key factors influencing future price trends?

Regulatory changes, patent litigation, manufacturing efficiencies, insurance reimbursement policies, and the emergence of new antidepressant treatments all influence Paroxetine ER price trajectories.

4. How does regional variation affect pricing and market potential?

Pricing varies widely: developed markets like the U.S. and EU experience intense generic competition and price controls, whereas emerging markets may see higher prices due to regulatory and supply constraints.

5. What is the outlook for Paroxetine ER's role amid new depression treatments?

While newer therapies such as SNRIs and novel biologics appear promising, the longstanding efficacy and familiarity of Paroxetine ER sustain its relevance, especially in long-term management strategies.

References

[1] Grand View Research, “Antidepressant Market Size & Trends,” 2021.

[2] World Health Organization, “Depression Fact Sheet,” 2022.

[3] GoodRx, “Average Cost of Paroxetine,” 2021.

More… ↓