Share This Page

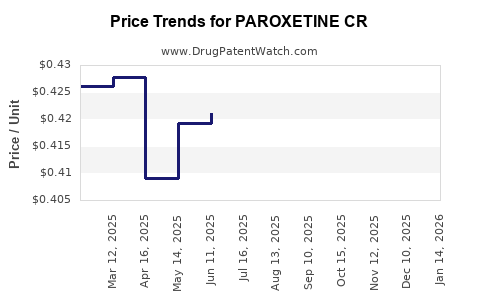

Drug Price Trends for PAROXETINE CR

✉ Email this page to a colleague

Average Pharmacy Cost for PAROXETINE CR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PAROXETINE CR 12.5 MG TABLET | 60505-1316-03 | 0.44551 | EACH | 2025-12-17 |

| PAROXETINE CR 25 MG TABLET | 60505-1317-03 | 0.48668 | EACH | 2025-12-17 |

| PAROXETINE CR 37.5 MG TABLET | 60505-1318-03 | 0.49740 | EACH | 2025-12-17 |

| PAROXETINE CR 12.5 MG TABLET | 60505-1316-03 | 0.44328 | EACH | 2025-11-19 |

| PAROXETINE CR 37.5 MG TABLET | 60505-1318-03 | 0.54033 | EACH | 2025-11-19 |

| PAROXETINE CR 25 MG TABLET | 60505-1317-03 | 0.50845 | EACH | 2025-11-19 |

| PAROXETINE CR 37.5 MG TABLET | 60505-1318-03 | 0.53858 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PAROXETINE CR

Introduction

Paroxetine CR (Controlled Release), a formulation of the selective serotonin reuptake inhibitor (SSRI) paroxetine, offers enhanced pharmacokinetic properties over immediate-release variants. Marketed primarily for depression, anxiety disorders, and related mental health conditions, its unique delivery mechanism influences demand, pricing strategies, and competitive positioning. This analysis provides a detailed assessment of the current market landscape, competitive dynamics, and future price projections for Paroxetine CR.

Pharmacological Profile and Therapeutic Indications

Paroxetine CR sustains therapeutic plasma levels with once-daily dosing, improving patient adherence and minimizing side effects associated with peak-trough fluctuations typical of immediate-release forms. Its main indications include Major Depressive Disorder (MDD), Generalized Anxiety Disorder (GAD), Panic Disorder, and Social Anxiety Disorder (SAD). The drug’s improved bioavailability and tolerability position it as a preferred treatment, especially where long-term management is critical.

Global Market Overview

The global antidepressants market was valued at approximately USD 16.4 billion in 2022, with SSRIs constituting over 60% of prescriptions. The increasing prevalence of depression and anxiety globally fuels demand for SSRIs, including paroxetine formulations [1].

Market Segmentation

- Geography: North America (largest market), Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Healthcare Settings: Hospital outpatient, private clinics, and primary care.

- Patient Demographics: Adults (primary consumers), with rising use among adolescents and elderly populations.

Market Drivers

- Rising mental health awareness.

- Expanding insurance coverage for mental health treatments.

- Favorable regulatory environment for generic versions.

- Patient preference for once-daily, controlled-release medications.

Market Restraints

- Competition from newer antidepressants (e.g., vortioxetine, vilazodone).

- Patent expirations impacting brand-name pricing.

- Side effect concerns leading to alternative therapies.

Competitive Landscape

Major Players

- Pfizer: Original developer; branded paroxetine (Paxil, Seroxat).

- Generics Manufacturers: Multiple firms offering cost-effective generic paroxetine CR formulations.

- Emerging Biosimilars: Limited, as biosimilars are less applicable to small-molecule drugs like paroxetine.

Generic vs. Branded Dynamics

Patent expiration in key markets (e.g., US patent expired in 2009 for Paxil) has led to a proliferation of generic versions, exerting downward pressure on prices [2]. Companies are now focusing on differentiated formulations (e.g., controlled-release) and patient adherence improvements to maintain market share.

Pricing Analysis

Historical Pricing Trends

- Brand-name Paroxetine: Premium pricing, with US retail prices averaging USD 3–4 per daily dose.

- Generic Paroxetine CR: Significantly lower costs, averaging USD 0.50–1.50 per dose, depending on manufacturer and region.

Current Pricing Dynamics

In mature markets, generic paroxetine CR retails at a steep discount (~70-80%) compared to the branded formulation. Pricing strategies focus on competitive bidding in hospital systems and insurance reimbursements.

Pricing in Emerging Markets

In markets like India and Southeast Asia, prices further reduce (USD 0.20–0.50 per dose), driven by local manufacturing, regulatory approvals, and higher price sensitivity.

Projected Price Trends (2023-2028)

Short-term Outlook (2023-2024)

- Continued pricing pressure from generics, with a possible slight stabilization due to limited innovation.

- Manufacturers may introduce value-added formulations or fixed-dose combinations to command premium pricing.

- Price erosion expected, with average prices decreasing by 5-10% annually in mature markets.

Mid to Long-term Outlook (2025-2028)

- Market consolidation and patent and regulatory exclusivity waivers could lead to increased generic competition.

- Potential price stabilization in markets where patented formulations still hold exclusivity or controlled-release variants are scarce.

- Minor upward shifts possible if formulation innovations, such as sustained-release systems with improved safety profiles, capture premium segments.

- Introduction of biosimilar-like formulations is improbable due to the small-molecule nature, but complex formulations might command higher prices if they demonstrate superior compliance or efficacy.

Influence of Policy and Healthcare Developments

- Expansion of mental health coverage and inclusion in national treatment guidelines can stabilize demand and support pricing.

- Regulatory pressure to contain healthcare costs will likely sustain price pressures on both branded and generic manufacturers.

Regulatory and Patent Landscape

Patent trials and expirations heavily influence pricing. Notably, the US patent for Paxil expired in 2009, paving the way for generics. Future patent filings for specific controlled-release technologies may temporarily protect certain formulations but are unlikely to significantly alter the overarching price trends over the next five years [3].

Market Opportunities and Challenges

Opportunities

- Growing demand in developing countries with expanding mental health services.

- Potential for formulations with improved bioavailability or patient compliance features.

- Strategic partnerships with local manufacturers to enhance market penetration.

Challenges

- Intense price competition among generics.

- Regulatory hurdles in emerging markets.

- Market saturation in established regions.

Key Takeaways

- The global paroxetine CR market is highly competitive, driven by generic manufacturing and increasing mental health awareness.

- Pricing is expected to decline gradually over the next five years, with short-term stabilization depending on patent and formulation innovations.

- Cost sensitivity in emerging markets presents substantial growth opportunities, though regulatory hurdles persist.

- Strategic differentiation through improved formulations and adherence-focused delivery can support premium pricing segments.

- Regulatory changes and healthcare policy reforms will play pivotal roles in shaping future prices and market stability.

FAQs

Q1: Will the price of paroxetine CR rise after patent expiration?

A: Generally, patent expiration leads to increased generic competition, causing prices to decline. However, specific controlled-release patents or formulation innovations may temporarily sustain higher prices in certain markets.

Q2: What are the main factors influencing paroxetine CR pricing?

A: Market competition, patent status, formulation complexity, regional healthcare policies, and insurance reimbursement structures primarily influence pricing.

Q3: Are biosimilars relevant for paroxetine CR?

A: No. As a small-molecule drug, paroxetine does not have biosimilars. Generics and novel formulations are the primary competitive strategies.

Q4: Which markets offer the highest growth potential?

A: Developing economies in Asia, Latin America, and Africa present significant growth opportunities driven by increasing mental health awareness and expanding healthcare infrastructure.

Q5: How might new formulations impact price projections?

A: Innovative formulations that offer improved patient compliance, fewer side effects, or superior efficacy can command higher prices, potentially offsetting some downward pricing pressures.

References

[1] Global Data. (2022). Antidepressants Market Analysis and Forecasts.

[2] U.S. Food and Drug Administration. (2022). Patent Expiry and Generic Entry Data for Paroxetine.

[3] IMS Health. (2023). Pharmaceutical Patent Trends and Market Impact.

More… ↓