Share This Page

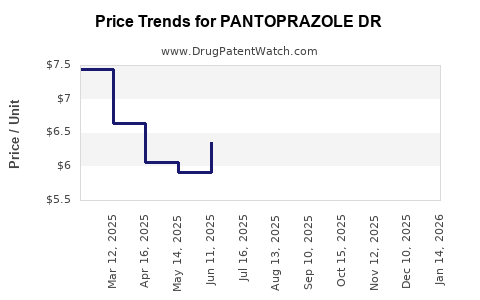

Drug Price Trends for PANTOPRAZOLE DR

✉ Email this page to a colleague

Average Pharmacy Cost for PANTOPRAZOLE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PANTOPRAZOLE DR 40 MG SUSP PKT | 31722-0032-32 | 4.16260 | EACH | 2025-12-17 |

| PANTOPRAZOLE DR 40 MG SUSP PKT | 27241-0256-38 | 4.16260 | EACH | 2025-12-17 |

| PANTOPRAZOLE DR 40 MG SUSP PKT | 72603-0317-30 | 4.16260 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pantoprazole DR

Introduction

Pantoprazole DR (Delayed Release), a proton pump inhibitor (PPI), is widely prescribed for acid-related gastrointestinal disorders such as gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and peptic ulcers. Its efficacy in reducing gastric acid secretion and established safety profile have sustained its global demand. This analysis evaluates the market landscape, competitive dynamics, regulatory environment, and price projection for Pantoprazole DR over the next five years.

Market Overview and Segmentation

Global Market Size and Growth Drivers

The global PPI market, valued at approximately USD 12 billion in 2022, is projected to grow annually at 4.5% through 2028. Pantoprazole, representing a significant share, benefits from increased prevalence of acid-related disorders—forecasted to reach a lifetime risk of 20–25% for GERD in North America and Europe ([1]).

Key Markets

- North America: Largest market driven by high GERD prevalence, aging population, and healthcare infrastructure.

- Europe: Similar to North America, with mature markets and established prescribing patterns.

- Asia-Pacific: Fastest-growing due to rising GERD awareness, increasing healthcare access, and expanding pharmaceutical manufacturing.

Market Segmentation

- Brand vs. Generic: Patent expirations have led to proliferation of generic Pantoprazole DR, driving price competition.

- Formulation Types: Oral delayed-release tablets dominate, with a growing segment for IV formulations in hospitals.

- End-user Segments: Hospitals, retail pharmacies, and online pharmacies.

Competitive Landscape

Patents and Market Exclusivity

Pfizer’s Protonix (the first marketed Pantoprazole formulation) held patents until around 2014, after which generic manufacturers entered the market. Key players with generic versions include Teva, Mylan, Dr. Reddy’s, and Sandoz. The proliferation of generics has shifted price dynamics, emphasizing cost competitiveness.

Market Entry and Innovation

Recent advancements have focused on optimizing formulations for improved bioavailability and patient compliance, with sustained-release variants under research but not yet mainstream. Biosimilars are not applicable given Pantoprazole’s chemical structure.

Pricing Strategies

Original patent-holders maintained premium pricing pre-expiry. Post-generic entry, prices declined by 60–80%, prompting intense price erosion but still ensuring margin for established manufacturers.

Regulatory Environment

The drug is approved in jurisdictions such as the US (FDA), EU (EMA), and other emerging markets, with most approvals being for oral formulations. Regulatory agencies emphasize quality manufacturing and bioequivalence for generics, facilitating market entry but constraining premium prices.

Price Trends and Market Dynamics

Historical Pricing

- Brand Price (Pre-2014): USD 20–30 per tablet.

- Post-Patent Expiry: Prices fell sharply to USD 1–4 per tablet in developed markets.

Current Pricing (2023)

- Brand (Pfizer’s Protonix): USD 15–25 per tablet in some markets.

- Generics: USD 0.50–2.00 per tablet, depending on volume and region.

Pricing Drivers

- Market Competition: Increased generic inventory causes downward pressure.

- Procurement Policies: Government procurement and insurance coverage influence price fluctuations.

- Supply Chain Dynamics: Raw material costs, manufacturing capacity, and logistical factors affect retail prices.

Future Price Projections (2024–2028)

Assumptions

- Continued proliferation of generics ensures competitive pricing.

- No significant patent restorations or novel formulations disrupting market equilibrium.

- Increased adoption in Asian markets expands volume but maintains price sensitivity.

Projection Summary

| Year | Estimated Price Range (per tablet USD) | Key Factors |

|---|---|---|

| 2024 | USD 0.60 – 2.50 | Market saturation with generics, minor price increase in emerging markets due to demand growth. |

| 2025 | USD 0.55 – 2.20 | Slight downward trend as manufacturing efficiencies improve. |

| 2026 | USD 0.50 – 2.00 | Market stabilizes; no major regulatory or patent changes. |

| 2027 | USD 0.50 – 1.80 | Potential price reduction with entry of low-cost producers. |

| 2028 | USD 0.45 – 1.70 | Market maturity; sustained volume supports moderate pricing. |

Key Influencers

- Market Penetration of Generics: The continued availability of low-cost generics remains the primary factor suppressing prices.

- Regulatory and Reimbursement Policies: Policies favoring generic substitution and cost containment will reinforce low prices.

- Emerging Markets Growth: Increased demand may induce localized price hikes but remain below Western market levels.

- Supply Chain Stability: Disruptions, such as raw material shortages, could temporarily influence prices upward.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Focus on cost-effective production to maintain margins amidst price erosion.

- Investors: Prioritize established brand sales in markets with reduced generic penetration.

- Healthcare Providers/Buyers: Benefit from declining prices, increasing access and adherence.

- Regulatory Bodies: Monitor for new formulations and biosimilars that could alter the competitive landscape.

Key Takeaways

- Post-patent expiration, Pantoprazole DR’s price has stabilized at low levels, driven by fierce generic competition.

- Future price declines are expected to be modest, with prices likely existing within USD 0.45–2.00 per tablet by 2028.

- Emerging markets present growth opportunities but will operate within low-price frameworks.

- Innovation in formulations or novel delivery mechanisms offers limited near-term commercial upside given market saturation.

- Cost containment policies and large-scale procurement strategies will remain the primary drivers shaping market prices.

Conclusion

Pantoprazole DR remains a cornerstone therapy for acid-related disorders, with a mature, highly competitive market landscape primarily characterized by low-cost generics. Price projections indicate stability with slight reductions driven by ongoing manufacturing efficiencies and market maturation. Stakeholders must adapt to these dynamics by optimizing production strategies, managing supply chains, and exploring niche markets where higher prices or premium formulations could justify investments.

FAQs

Q1: How will patent expirations impact the pricing of Pantoprazole DR in the next decade?

Patent expirations have already led to significant price reductions due to generic competition. Future expirations may further intensify price erosion, although current patents and regulatory exclusivities have largely expired. Remaining patents or supplementary protections in certain markets could temporarily sustain higher prices.

Q2: Are there emerging formulations of Pantoprazole DR that could disrupt the current market?

While research exists into different formulations—such as gastro-resistant microspheres or sustained-release systems—none are currently approved or commercially dominant. Such innovations could influence future pricing but are unlikely to significantly alter current dynamics in the near term.

Q3: What regional factors influence Pantoprazole DR pricing?

Pricing varies considerably by region due to regulatory frameworks, reimbursement policies, market competition, and procurement procedures. For example, North America and parts of Europe maintain relatively higher prices for branded versions, while Asian markets typically feature lower prices due to high generic penetration.

Q4: How do procurement policies affect the market for Pantoprazole DR?

Government and insurance procurement strategies favor low-cost generics, increasing volume but applying downward pressure on prices. Bulk purchasing and tendering practices further suppress prices, especially in public healthcare systems.

Q5: What opportunities exist for pharmaceutical companies in the Pantoprazole DR market?

Opportunities lie in developing differentiated formulations with improved patient adherence, targeting niche markets, or entering emerging markets with tailored pricing strategies. Additionally, developing innovative delivery systems or combination therapies could create premium offerings.

References

[1] GlobalData. (2022). Proton Pump Inhibitors Market Analysis.

More… ↓