Last updated: July 27, 2025

Overview of Pantoprazole

Pantoprazole, a proton pump inhibitor (PPI), is widely prescribed for gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and other acid-related disorders. Since its approval in the late 1990s, pantoprazole has become a cornerstone therapy owing to its efficacy, safety profile, and broad availability. Its market penetration is underpinned by extensive off-label uses and a global prescribing footprint.

Market Dynamics and Key Drivers

1. Growing Global Burden of Acid-Related Disorders

The escalating prevalence of GERD and peptic ulcers due to lifestyle changes, obesity, and increasing age amplify demand for PPIs like pantoprazole. According to GlobalData, the GERD market alone is projected to reach USD 12.4 billion by 2025, with PPIs comprising the majority share [1].

2. Patent Expiry and Generic Competition

Pantoprazole's patent expired in various jurisdictions by mid-2010s, paving the way for robust generic competition. Generic versions now account for a substantial portion of market volume; however, brand-name sales persist, especially in regions with prescription-driven procurement.

3. Healthcare Infrastructure and Access

Developed markets maintain high penetration due to advanced healthcare systems and high prescription rates. Emerging markets show rapid growth driven by expanding healthcare access and increasing awareness of acid-related conditions.

4. Regulatory and Manufacturing Trends

Streamlined approval processes and manufacturing efficiencies facilitate the entry of generics, aiding price competitiveness. However, patent litigation and regulatory hurdles sometimes delay generic penetration in certain geographies.

Current Market Landscape

Regional Market Share

- United States: The largest single market, driven by high prevalence, established prescribing habits, and insurance coverage. The US OTC sector also influences sales volume, though most prescriptions remain brand-bound.

- Europe: Mature, with significant generic uptake. Notable markets include Germany, France, and the UK, where price competition is more intense.

- Asia-Pacific: Rapid growth, driven by large populations, increasing healthcare infrastructure, and rising chronic disease prevalence. China and India represent critical markets with significant potential for volume expansion.

Manufacturers and Suppliers

Major generic manufacturers include Teva Pharmaceuticals, Mylan, Sandoz, and local players in emerging markets. Brand manufacturers are primarily Pfizer and pharmaceutical subsidiaries that retain a foothold via commercial and clinical channels.

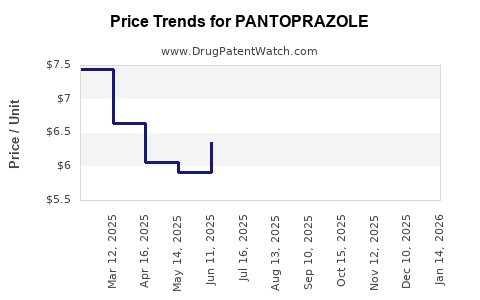

Pricing and Cost Trends

Historical Pricing

Post-patent expiry, prices declined significantly—typically ranging from 30% to 70%, depending on market dynamics [2]. In the US, generic pantoprazole is often priced around USD 0.20–0.50 per pill; branded versions can cost several dollars per dose.

Current Price Spectrum

- United States: Price range varies widely; generic options dominate, with some pharmacies offering discounts via coupon programs, EDLP (Every Day Low Pricing), or insurance contracts.

- Europe: European prices are comparatively higher, influenced by national healthcare policies and negotiated prices; a standard 40mg tablet may retail at EUR 0.30–0.80.

- Emerging Markets: Prices are lower, often USD 0.10–0.30 per pill, reflecting lower income levels and procurement policies.

Forecasting Price Trends (2023–2028)

Given market maturity in developed countries and expanding demand in emerging markets, several projections observe the following:

- Stabilization in Developed Markets: Prices for generic pantoprazole are expected to stabilize due to intense competition. Marginal decreases are likely, driven by discounts, value-added formulations, and increasing biosimilar options possibly encroaching on PPI share.

- Potential Price Increases in Specialty Segments: Certain formulations—such as intravenous (IV) pantoprazole—may see price hikes due to manufacturing complexity and clinical use in hospital settings.

- Emerging Market Growth: Increased demand in Asia-Pacific and Latin America will sustain volume growth, possibly offsetting slight price declines through economies of scale.

Specific Price Projections

- United States: Expect a marginal decline of 2–4% annually in average retail prices for generics, with compound annual growth rate (CAGR) around -1% in value due to discounts.

- Europe: Slight price reductions of 1–3% annually, maintaining stable or slightly decreasing market values.

- Asia-Pacific: Price stability or slight increases owing to supply chain optimization and local manufacturing capacity.

Market Opportunities and Challenges

Opportunities

- Expansion into niche segments like pediatric formulations and IV versions.

- Growing demand in regions where healthcare infrastructure is improving.

- Potential development of combination therapies or new delivery systems to enhance adherence and efficacy.

Challenges

- Increasing price sensitivity and reimbursement pressures.

- Competitive innovation with next-generation PPIs or alternative therapies.

- Patent litigation or regulatory delays affecting future pricing strategies.

Key Takeaways

- Pantoprazole remains a high-volume, cost-effective treatment with a mature market in developed nations and expanding potential in emerging markets.

- Post-patent, price competition has driven significant reductions in generic prices, yet stable demand sustains revenue streams.

- Future price stabilization or slight declines are anticipated, with targeted growth in hospital and specialty formulations.

- Regulatory environments, patent landscapes, and healthcare policies critically shape pricing trajectories.

- Companies should focus on optimizing manufacturing, expanding into untapped regional markets, and innovating delivery mechanisms to capitalize on market trends.

FAQs

1. What factors influence the price of pantoprazole globally?

Prices are affected by patent status, generic competition, regional healthcare policies, procurement mechanisms, manufacturing costs, and market demand.

2. How does patent expiration impact pantoprazole prices?

Patent expiration facilitates generic entry, leading to significant price erosion—typically a 30–70% reduction—though brand versions retain some premium.

3. Are there regional differences in pantoprazole pricing?

Yes. Developed countries generally have higher prices due to regulatory and reimbursement structures, whereas emerging markets benefit from lower manufacturing costs and competitive pricing.

4. What future market trends could affect pantoprazole prices?

The advent of biosimilars, formulation innovations (e.g., IV, adherence-enhancing formulations), and regulatory changes could influence prices and market share.

5. How should companies position themselves to capitalize on this market?

By diversifying formulations, optimizing supply chains for cost leadership, engaging in regional market expansion, and monitoring regulatory developments, firms can enhance profitability amid competitive pressures.

References

[1] GlobalData, "Gastroesophageal Reflux Disease (GERD) Market Analysis," 2022.

[2] IMS Health, "Impact of Patent Expirations on PPI Pricing," 2021.