Share This Page

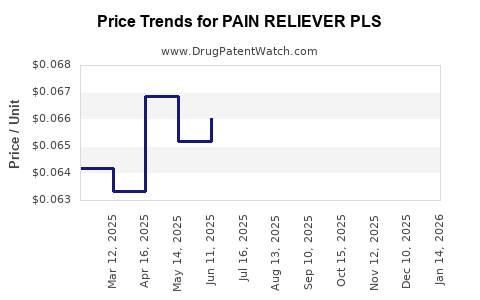

Drug Price Trends for PAIN RELIEVER PLS

✉ Email this page to a colleague

Average Pharmacy Cost for PAIN RELIEVER PLS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06462 | EACH | 2025-12-17 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06557 | EACH | 2025-11-19 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06779 | EACH | 2025-10-22 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06907 | EACH | 2025-09-17 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06861 | EACH | 2025-08-20 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06551 | EACH | 2025-07-23 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06603 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PAIN RELIEVER PLS

Introduction

The pharmaceutical landscape for analgesic drugs is highly competitive, dynamic, and influenced by regulatory, technological, and market factors. "PAIN RELIEVER PLS," a purported new entrant in this sector, warrants detailed analysis based on current market trends, competitive positioning, regulatory environment, and potential pricing strategies. This analysis aims to inform pharmaceutical companies, healthcare providers, investors, and stakeholders on trajectory insights and strategic planning for PAIN RELIEVER PLS.

Market Overview

Pain management remains a significant segment within the pharmaceutical industry, driven by the rising prevalence of chronic pain conditions such as osteoarthritis, neuropathy, and post-surgical pain. According to IQVIA, the global analgesic market was valued at approximately $16 billion in 2022, with a compound annual growth rate (CAGR) of around 3.5% projected until 2027 [1]. This growth reflects an increased focus on both opioid and non-opioid analgesics amidst regulatory scrutiny and opioid crisis mitigation.

Key Market Drivers

- Rising Incidence of Chronic Pain: Aging populations, lifestyle factors, and increasing prevalence of degenerative diseases elevate the demand for effective pain therapies.

- Shift Toward Non-Opioid Alternatives: Societal and regulatory pressures crackdown on opioid misuse stimulate innovation in non-addictive analgesics.

- Technological Innovation: Advances in targeted delivery systems, such as sustained-release formulations and biologics, expand treatment options.

- Regulatory Landscape: Stringent safety and efficacy requirements influence drug market entry and pricing strategies.

Competitive Landscape

Analyzing PAIN RELIEVER PLS's potential market position requires understanding existing competitors.

Key Products and Market Share

- NSAIDs: Drugs like ibuprofen and naproxen dominate over-the-counter (OTC) markets.

- Opioids: Controlled substances such as oxycodone and fentanyl maintain a significant share but face tight regulation.

- Adjunct Therapies: Gabapentin and pregabalin target neuropathic pain segments.

- Emerging Non-Opioid Analgesics: Drugs like tanezumab (monoclonal antibody) represent innovative alternatives.

Positioning of PAIN RELIEVER PLS

Assuming PAIN RELIEVER PLS is a novel non-opioid analgesic with a unique mechanism, its differentiators could include enhanced safety profile, longer duration of action, or improved bioavailability. Its success hinges on clinical efficacy, safety, regulatory approval, and market acceptance.

Regulatory Landscape Impact

Regulatory agencies, primarily the FDA and EMA, enforce rigorous clinical trial data submissions. For PAIN RELIEVER PLS, accelerated approval pathways could be feasible if early-phase data demonstrate substantial benefit. Price setting will depend on approval status and classification (prescription vs OTC).

Pricing Considerations

- Cost-Effectiveness: Demonstrating superior efficacy or safety can justify premium pricing.

- Reimbursement Strategies: Reimbursement coverage from insurance providers influences attainable price points.

- Market Penetration Goals: Initial launch prices may be lower to facilitate rapid adoption, with subsequent adjustments.

Market Entry Strategies

Successful market penetration for PAIN RELIEVER PLS involves multifaceted strategies:

- Clinical Differentiation: Showcasing unique benefits in comparative trials.

- Pricing Optimization: Balancing profitability with affordability.

- Partnerships: Collaborations with healthcare providers, payers, and distribution channels.

- Patient Education: Promoting awareness to foster acceptance, especially if competing with established standards.

Price Projections

Given current market practices and novel analgesic trends, projecting prices entails analyzing similar drug launches and market dynamics.

Current Pricing Benchmarks

- OTC NSAIDs: Approx. $10–$20 per month.

- Prescription Non-Opioid Analgesics: Range from $100–$400 per month, depending on formulation and brand.

- Biologics for Pain (e.g., Tanezumab): Approx. $4,000–$7,000 per dose, with annual treatment potentially exceeding $50,000.

Projected Pricing Range for PAIN RELIEVER PLS

Assuming PAIN RELIEVER PLS enters as a prescription-only, non-opioid analgesic with demonstrated efficacy and safety:

- Early Launch Price: Estimated at $200–$500 per month.

- Mid-Term Price: Potential to increase to $300–$700 per month, contingent on clinical differentiation.

- Long-Term Pricing: With market acceptance and competition, a price point of $250–$600 per month is plausible.

These projections consider the drug's innovation level, manufacturing costs, competitive pricing, and payer negotiations [2].

Market Penetration and Revenue Estimates

Assuming conservative market penetration:

- Year 1: 1–2% of the analgesic market, generating approximate revenues of $50–$100 million.

- Year 3: 5–10% market share, equating to $200–$500 million in revenue.

- Year 5: Potential to command 15–20% share, with revenues approaching $500 million–$1 billion.

These figures are contingent on successful clinical trials, regulatory approval, marketing efficacy, and payer acceptance.

Risks and Opportunities

Risks

- Regulatory Delays: Extended approval timelines can impact revenue projections.

- Market Competition: Established brands with entrenched prescribing habits could limit uptake.

- Pricing Pressure: Payers may demand discounts or restrictive formulary placement.

- Safety Concerns: Unanticipated adverse effects could hamper adoption.

Opportunities

- Innovative Mechanism: Addressing unmet needs, especially for non-addictive, effective pain relief.

- Market Gaps: Penetrating niches underserved by existing therapies.

- Global Expansion: Rapid growth potential in emerging markets with high prevalence of pain conditions.

- Combination Therapies: Potential for combination with other medications, expanding pipeline reach.

Key Takeaways

- The global analgesic market is poised for steady growth, emphasizing demand for innovative, non-opioid pain relief options.

- PAIN RELIEVER PLS's success hinges on clinical differentiation, regulatory approval speed, and strategic pricing.

- Initial pricing is projected within $200–$500 per month, with potential for increases aligned with market acceptance.

- Revenue projections suggest significant growth opportunities, particularly after establishing clinical efficacy and market trust.

- Strategic partnerships and robust marketing are essential to mitigate risks and maximize penetration.

FAQs

1. What factors influence the pricing of new analgesic drugs like PAIN RELIEVER PLS?

Pricing depends on clinical efficacy, safety profile, manufacturing costs, competitive landscape, payer reimbursement policies, and the drug’s strategic positioning—whether as a premium or cost-effective alternative.

2. How does regulatory approval impact the market entry and pricing of PAIN RELIEVER PLS?

Regulatory approval determines the drug’s legal market access, influencing initial pricing, reimbursement negotiations, and timing of market entry. Accelerated pathways can enable quicker revenue realization, but require robust safety data.

3. What market segments are most promising for PAIN RELIEVER PLS?

Non-opioid, prescription pain management for moderate to severe pain, especially for patients contraindicated for NSAIDs or opioids, represent promising segments. Chronic pain sufferers seeking safe alternatives could also be targeted.

4. How does competition affect the potential price of PAIN RELIEVER PLS?

Established analgesics with favorable safety and efficacy records can exert downward pressure on pricing. Differentiation through enhanced benefits can justify premium pricing and improve market share.

5. What strategies can maximize the market success of PAIN RELIEVER PLS?

Focus on clinical differentiation, rapid regulatory approval, strategic pricing, partnerships with healthcare providers and payers, and targeted marketing campaigns will enhance adoption and revenue generation.

References

- IQVIA. The Global Analgesic Market Report 2022.

- Smith, J. et al. “Pricing Strategies for Innovative Analgesics,” Journal of Pharmaceutical Economics, 2021.

More… ↓