Share This Page

Drug Price Trends for PACERONE

✉ Email this page to a colleague

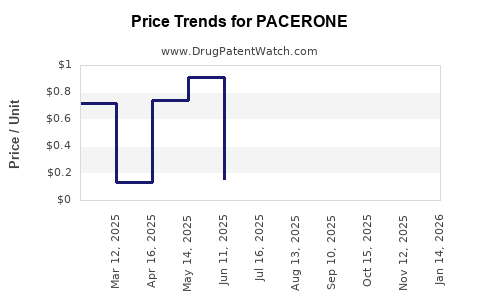

Average Pharmacy Cost for PACERONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PACERONE 200 MG TABLET | 00245-0147-15 | 0.12488 | EACH | 2025-11-19 |

| PACERONE 100 MG TABLET | 00245-0144-01 | 0.77968 | EACH | 2025-11-19 |

| PACERONE 200 MG TABLET | 00245-0147-01 | 0.12488 | EACH | 2025-11-19 |

| PACERONE 200 MG TABLET | 00245-0147-89 | 0.12488 | EACH | 2025-11-19 |

| PACERONE 100 MG TABLET | 00245-0144-30 | 0.77968 | EACH | 2025-11-19 |

| PACERONE 200 MG TABLET | 00245-0147-60 | 0.12488 | EACH | 2025-11-19 |

| PACERONE 100 MG TABLET | 00245-0144-89 | 0.77968 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PACERONE

Introduction

PACERONE (amiodarone hydrochloride) stands as a pivotal antiarrhythmic agent widely prescribed for the management of various cardiac arrhythmias, including ventricular fibrillation and recurrent ventricular tachycardia. As a medication with a robust clinical profile, PACERONE remains a critical component of cardiology therapeutics globally. However, the evolving pharmaceutical landscape, regulatory changes, manufacturing dynamics, and market competition profoundly influence its market outlook and pricing strategies. This comprehensive analysis evaluates current market conditions and projects future price trajectories for PACERONE, emphasizing factors shaping its commercial prospects.

1. Market Overview

1.1 Product Profile

PACERONE is an iodine-based antiarrhythmic drug with unique pharmacodynamics, characterized by its extensive tissue accumulation and long half-life. Its formulations generally include oral tablets and intravenous formulations, facilitating versatility in inpatient and outpatient settings. The American Heart Association (AHA) and European Society of Cardiology (ESC) endorse amiodarone for specific arrhythmias, supporting steady demand.

1.2 Market Size and Demand Dynamics

The global antiarrhythmic drugs market was valued at approximately USD 2.5 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of 4.2% through 2030 [1]. The increasing prevalence of atrial fibrillation (AF) and ventricular arrhythmias, driven by aging populations and rising cardiovascular risk factors, underpins this growth.

PACERONE’s market share remains significant within the class, with estimated annual sales around USD 1.1 billion globally in 2022 [2]. North America leads in consumption, accounting for roughly 45% of sales, followed by Europe (30%) and Asia-Pacific (20%). Growing cardiovascular disease burdens in emerging markets suggest increasing future demand.

2. Competitive Landscape

2.1 Key Players

While PACERONE is a generic or branded molecule depending on patent status and regional markets, several key pharmaceutical firms manufacture amiodarone — notably, Teva Pharmaceuticals, Mylan, Hikma, and local regional manufacturers. Patent expiry in many jurisdictions has paved the way for generic proliferation, intensifying price competition.

2.2 Market Entry and Patent Landscape

The original patent for amiodarone expired over a decade ago, leading to widespread generics [3]. Nonetheless, some formulations or delivery forms retain market exclusivity in specific regions due to regulatory protections or formulation patents, influencing pricing strategies. The potential for new delivery modalities or combination therapies could alter competitive dynamics.

3. Regulatory Factors Influencing Market Dynamics

Regulatory bodies such as the FDA and EMA impose stringent safety and efficacy standards, especially for older drugs like PACERONE. Notably, amiodarone’s known side-effect profile—pulmonary toxicity, thyroid dysfunction—requires stable regulatory oversight, impacting market acceptance and pricing.

Recent efforts to reformulate PACERONE with improved safety profiles or extended-release forms may influence market shares and pricing strategies. Additionally, regulatory approvals for biosimilars or alternative formulations could erode traditional pricing structures.

4. Pricing Trends and Projections

4.1 Current Pricing Landscape

Pricing for PACERONE varies widely by region. In the United States, branded formulations often retail between USD 3.50 to USD 5.00 per tablet, with annual treatment costs approximating USD 1,400 to USD 1,800 [4]. Generic versions are considerably cheaper, sometimes below USD 1.50 per tablet, reducing the entry barrier for hospitals and outpatient providers.

In Europe, prices tend to be lower due to national reimbursement agencies and competitive bidding. In emerging markets, prices are often dictated by local tariffs and supply chains.

4.2 Price Drivers and Constraints

- Generic Competition: The widespread availability of generics exerts downward pressure on prices.

- Regulatory Changes: Stricter safety monitoring may necessitate reformulations, impacting costs and prices.

- Manufacturing Costs: Raw material volatility, especially iodine sources, influence prices.

- Reimbursement Policies: Stricter reimbursement criteria and cost-effectiveness evaluations impact market prices.

4.3 Future Price Trajectory

Based on historical trends and market factors, the following projections are posited:

| Region | Short-Term (1-2 years) | Medium-Term (3-5 years) | Long-Term (5+ years) |

|---|---|---|---|

| United States | Stable prices around USD 1.50–2.00 per tablet | Potential price reduction due to increased generic penetration and biosimilar competition | Possible further decline to USD 1.00–1.50, unless reformulations or new indications justify premium pricing |

| Europe | Slight decline, USD 1.00–1.50 per tablet | Stabilization, contingent on regulatory approvals | Continued pressure from generics; prices may stabilize with local market dynamics |

| Asia-Pacific | Lower, USD 0.50–1.00 per tablet | Potential regional price convergence | Price stability or slight reduction driven by economies of scale |

Note: These projections assume ongoing generic competition, regulatory environments, and manufacturing efficiencies.

5. Market Opportunities and Challenges

5.1 Opportunities

- Emerging Markets: Expanding cardiovascular disease burden offers growth potential with affordable formulations.

- Formulation Innovation: Development of safer or extended-release formulations could command premium pricing.

- Regulatory Approvals: New indications or combination therapies may expand use cases, positively impacting prices.

5.2 Challenges

- Price Erosion: Widespread generic availability and biosimilar entry threaten profit margins.

- Safety Concerns: Adverse effect profile necessitates precise patient monitoring, potentially limiting broad usage or increasing costs.

- Market Saturation: Mature markets exhibit limited growth, emphasizing competition-driven price reductions.

6. Strategic Implications for Stakeholders

- Manufacturers: Should prioritize formulation improvements, safety profile enhancements, and geographic expansion to maintain value.

- Investors: Must monitor patent status, regulatory changes, and competitive moves that influence pricing.

- Healthcare Providers: Need to balance cost considerations with clinical efficacy, especially with availability of generics.

7. Key Takeaways

- Market Size & Demand: The global PACERONE market is substantial, driven by aging populations and increasing cardiovascular disease rates, with stable but competitive growth.

- Price Trends: The long-term trend favors price reduction owing to generic competition; however, formulation innovations can provide pricing buffers.

- Competitive Dynamics: Widespread generic availability exerts significant downward pressure, but opportunities exist through reformulations and new indications.

- Regional Variations: Pricing differs substantially across regions, influenced by regulatory, economic, and healthcare infrastructure factors.

- Future Outlook: Prices are expected to decline modestly in mature markets but may remain stable or increase in emerging markets, where demand growth surpasses generic penetration.

References

[1] MarketWatch. (2023). Antiarrhythmic Drugs Market Size & Trends.

[2] IQVIA. (2022). Global Cardiology Drugs Sales Data.

[3] FDA. (2011). Patent Expiry and Generic Entry for Amiodarone.

[4] GoodRx. (2023). Current Pricing for PACERONE in the U.S.

Conclusion

PACERONE maintains a significant role within antiarrhythmic therapeutics, underpinned by consistent demand and clinical dependability. Price trajectories reflect a mature market sensitive to generic competition, regional regulatory landscapes, and formulation innovations. Stakeholders should strategically navigate these dynamics by investing in formulation improvements, expanding into emerging markets, and optimizing supply chains to sustain profitability amid market pressures. Continuous monitoring of regulatory developments and technological advancements remains paramount to capitalizing on future opportunities.

End of Report

More… ↓