Share This Page

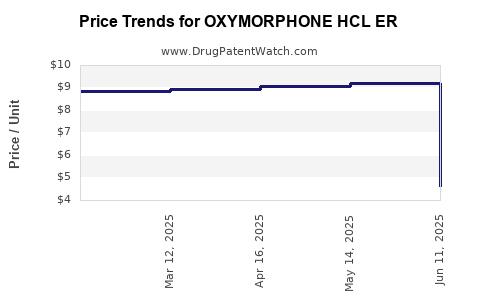

Drug Price Trends for OXYMORPHONE HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for OXYMORPHONE HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OXYMORPHONE HCL ER 10 MG TAB | 64896-0697-01 | 9.27273 | EACH | 2025-06-18 |

| OXYMORPHONE HCL ER 15 MG TAB | 64896-0698-01 | 12.60921 | EACH | 2025-06-18 |

| OXYMORPHONE HCL ER 10 MG TAB | 64896-0697-13 | 9.27273 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for OXYMORPHONE HCL ER

Introduction

Oxymorphone hydrochloride extended-release (HCL ER), marketed under various brand names such as Opana ER, is a potent opioid analgesic indicated for managing severe pain requiring around-the-clock opioid treatment. As a Schedule II controlled substance, its regulatory controls influence market dynamics, pricing strategies, and growth prospects. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, regulatory environment, and future price projections for Oxymorphone HCL ER, targeting stakeholders such as pharmaceutical companies, investors, and healthcare policy analysts.

Market Overview

Global and Regional Market Size

The global opioid analgesics market, valued at approximately $11.2 billion in 2021, is projected to attain a CAGR of around 4.3% through 2028 [1]. A significant segment of this market comprises strong opioids like oxymorphone, which are predominantly used in the United States—a market characterized by a substantial demand for potent pain management solutions due to an aging population and rising incidence of chronic pain conditions [2].

Within the United States, the market for extended-release opioids accounts for roughly 40% of total opioid sales, with Oxymorphone HCL ER occupying a niche position owing to its potency and specific clinical indications. The COVID-19 pandemic initially caused market disruptions; however, post-pandemic recovery has seen increased utilization driven by the chronic pain management needs of aging demographics [3].

Market Drivers

- Rising Prevalence of Chronic Pain: An aging population and chronic disease burden underpin sustained demand for potent analgesics [2].

- Advances in Extended-Release Formulations: Improved delivery systems enhance patient compliance and pain control, fostering growth in prescription volumes.

- Regulatory and Prescriber Preferences: Preference for potent opioids in complex pain conditions sustains the market, although ongoing regulatory scrutiny influences prescribing patterns.

Market Challenges

- Regulatory Constraints: Tight controls and scrutiny over opioid prescribing limit market expansion [4].

- Risk of Abuse and Diversion: The potential for misuse affects market accessibility and pricing strategies.

- Alternative Pain Management Modalities: Adoption of non-opioid therapies and peripheral nerve blocks reduces dependence on opioids.

Competitive Landscape

Key competitors include other Schedule II opioids such as oxycodone, hydromorphone, fentanyl, and morphine. Among these, oxycodone ER formulations such as OxyContin have a broader market presence, overshadowing oxymorphone ER, which is often prescribed in specialized pain clinics.

Manufacturers:

- Paladin Labs and Esteve: Original producers of Opana ER.

- Subsequent Generic Manufacturers: Several pharmaceutical companies hold ANDA (Abbreviated New Drug Application) approvals for generic oxymorphone ER, intensifying price competition.

Market Position:

While branded oxymorphone formulations command premium pricing, increasing availability of generics exerts downward pressure on prices, particularly in mature markets with high generic penetration.

Regulatory Environment and Its Impact on Pricing

Regulatory agencies, notably the U.S. Food and Drug Administration (FDA) and Drug Enforcement Administration (DEA), maintain strict controls over manufacturing, prescribing, and dispensing of oxymorphone ER due to its high abuse potential. Notably, the FDA issued a boxed warning for Opana ER in 2017 concerning risks of misuse, abuse, and potentially fatal respiratory depression [5]. This regulatory backdrop affects pricing, with branded products typically priced higher to offset development and compliance costs, but faced with pressure from generics.

In parallel, efforts to restrict opioid availability, including dosage limits, prescription monitoring programs, and REMS (Risk Evaluation and Mitigation Strategies), curb excessive marketing and overprescription, impacting consumption volumes and price stability.

Historical Pricing Trends

- Branded Formulations: At peak, Brand Opana ER was priced in the range of $50–$70 per tablet for 10 mg doses, translating to annual treatment costs upward of $18,250 for a standard regimen [6].

- Generic Versions: After patent expiration and market entry of generics around 2017–2018, prices declined sharply, with generic 10 mg oxymorphone ER tablets selling for approximately $20–$35 per tablet, depending on suppliers and distribution channels.

Given the ongoing regulatory constraints and social concerns about opioid misuse, the price trajectory has largely stabilized but remains sensitive to legislative changes and market access issues.

Price Projection for 2023-2028

Factors Influencing Future Prices

- Patent and Exclusivity Status: The original patent for Opana ER expired in 2017, leading to generic competition that caps pricing. Any supplementary patents or exclusivities could temporarily sustain higher prices.

- Market Demand Trends: An anticipated decline in overall opioid prescriptions amidst tighter controls will modulate demand, influencing prices downward.

- Regulatory and Reimbursement Environment: Public health policies favouring non-opioid therapies could further suppress opioid prices. Conversely, in specialized pain management contexts, high-dose formulations or formulations with abuse-deterrent properties could fetch premium prices.

Projected Price Range

- Generics: Expect continued pricing in the $20–$35 per tablet range, with marginal fluctuations based on manufacturing costs and distribution dynamics. Any new formulations or abuse-deterrent technologies could push prices somewhat higher temporarily.

- Branded Products: Likely to be phased out or pushed to niche markets, with prices diminishing further below historical peaks, around $30–$50 per tablet, primarily in specialized healthcare settings.

Market Outlook and Investment Implications

The overall outlook for oxymorphone ER remains subdued due to regulatory pressures and shifting prescribing practices. For investors, the focus should be on generic manufacturers with robust supply chains and flexible pricing strategies, rather than on branded product sales. Pharmaceuticals investing in abuse-deterrent formulations or alternative non-opioid analgesics may present longer-term growth prospects, given the global movement toward reducing opioid dependence.

Key Takeaways

- The market for Oxymorphone HCL ER is characterized by significant regulatory controls, declining branded sales, and increasing generic competition.

- Price stability is largely dictated by patent status, regulatory environment, and the broader opioid prescribing climate.

- The future price trajectory suggests continued low to moderate prices for generics, with branded products declining further in the wake of patent expiration and generic market saturation.

- Market growth prospects are limited; strategic focus should favor innovation in abuse-deterrent formulations and alternative pain therapies.

- Stakeholders must monitor regulatory developments, legal liabilities, and shifting healthcare policies impacting demand and pricing.

FAQs

1. What are the main factors influencing the price of Oxymorphone HCL ER?

Regulatory restrictions, patent status, generic competition, prescribing trends, and societal attitudes toward opioids critically impact pricing. Abuse-deterrent technology and formulation innovations also play roles.

2. How does patent expiration affect Oxymorphone ER pricing?

Patent expiration opens the market to generics, significantly reducing prices due to increased competition, while leaving branded prices high until generics dominate.

3. What is the current price range for generic Oxymorphone HCL ER?

As of 2023, generic 10 mg tablets typically sell between $20 and $35 per tablet, depending on supplier negotiations, distribution channels, and regional factors.

4. Are there any regulatory developments that could alter the market for Oxymorphone ER?

Yes. Regulatory agencies continue to implement tighter controls on opioid prescriptions and marketing, which may decrease demand and influence pricing strategies further.

5. What are future investment opportunities in the opioid analgesic market?

Investors should consider companies innovating in abuse-deterrent formulations, non-opioid pain management, or digital and behavioral health solutions aiming to reduce opioid reliance.

Sources

[1] Market Watch. "Global Opioid Analgesics Market," 2022.

[2] CDC. "Chronic Pain and Opioid Use in the US," 2021.

[3] IQVIA. "Healthcare Market Insights," 2022.

[4] FDA. "Opioid Prescribing and Regulation Updates," 2022.

[5] FDA. "Boxed Warning for Opana ER," 2017.

[6] GoodRx. "Oxymorphone ER Pricing," 2023.

More… ↓