Last updated: July 27, 2025

Introduction

OXYCONTIN, a brand name for oxycodone extended-release (ER), is a potent opioid analgesic used primarily for managing severe chronic pain. Since its introduction, OXYCONTIN has been a key player in pain management, but amid rising concerns over opioid misuse and regulatory scrutiny, its market dynamics have undergone significant shifts. This analysis examines current market position, competitive landscape, regulatory environment, pricing trends, and future projections, aiming to provide strategic insights for stakeholders.

Market Overview

Historical Context and Market Penetration

OXYCONTIN was first approved by the U.S. Food and Drug Administration (FDA) in 1995 and rapidly became a market dominator due to its efficacy and extended-release formulation. The formulation offers sustained pain relief, reducing dosing frequency for chronic pain patients. Its high potency and ease of abuse, however, contributed to widespread misuse, leading to public health crises and stringent regulations.

Current Market Size

The global opioid analgesics market was valued at approximately USD 17.3 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 3.2% through 2030 [1]. OXYCONTIN remains a significant segment within this market, particularly in the United States, which accounts for an estimated 80% of global opioid prescriptions.

Key Market Segments

- Hospitals and Pain Clinics: Primary distribution channels for prescribed OXYCONTIN, especially for severe, long-term pain.

- Pharmacies: Retail and specialty pharmacies serve as secondary distribution points.

- Institutional Use: Limited, with increased restrictions due to opioid epidemic concerns.

Regulatory Environment

Regulatory Restrictions and Impact

The misuse crisis prompted the FDA and DEA to implement tighter controls:

- Rescheduling of Opioids: In 2014, extended-release opioids faced enhanced scheduling, affecting prescribing practices.

- Prescribing Guidelines: CDC guidelines recommend cautious prescribing, reducing OXYCONTIN’s volume.

- Manufacturing and Supply Constraints: Increased scrutiny on manufacturing practices has led to periodic shortages and supply chain disruptions.

Impact on Market Dynamics

These regulatory constraints have led to a decline in new prescriptions, with some healthcare providers shifting towards multimodal pain management or abuse-deterrent formulations of opioids.

Competitive Landscape

Generics and Biosimilars

OXYCONTIN faces intense competition from generic formulations of oxycodone ER, which are typically priced significantly lower than the branded version. Major pharmaceutical companies like Teva, Purdue Pharma (earlier), and others produce authorized generics, which erode branded sales [2].

Alternative Opioids and Non-Opioid Analgesics

- Other Extended-Release Formulations: Purdue’s OXYNEO and brands like Xtampza ER by Teva offer abuse-deterrent properties, challenging OXYCONTIN’s market share.

- Non-Opioid Therapies: Growth in multimodal pain management approaches reduces dependence on opioids.

Abuse-Deterrent Formulations (ADFs)

Since 2010, formulations with abuse-deterrent properties have gained prominence. While OXYCONTIN did introduce reformulations, many competitors offer more advanced ADFs, impacting market positioning.

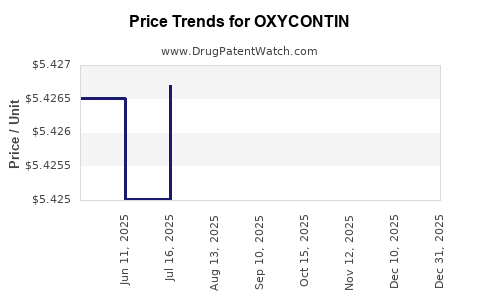

Pricing Trends and Projections

Historical Pricing

Historically, OXYCONTIN priced at approximately USD 10–15 per tablet (30 mg), resulting in an average wholesale price (AWP) exceeding USD 20 per unit, amounting to an annual therapy cost of USD 7,300–10,950 per patient [3].

Recent Price Movements

The price trajectory has been volatile:

- Pre-2010: Stable pricing with significant margins.

- 2010–2015: Price erosion due to increased competition and patent challenges.

- 2016–2022: Price stabilization, with modest declines as generics gained prominence.

- Post-2020: Public health measures and supply constraints led to temporary price increases in some markets.

Future Price Projections

Given regulatory pressures, patent expirations, and the rise of abuse-deterrent formulations, the following projections are plausible:

- Short-term (1–3 years): Slight decline (~5–10%) in branded OXYCONTIN price as generics become more prevalent and prescribing declines continue.

- Mid-term (3–5 years): Stabilization at a lower price point, potentially around USD 8–12 per tablet, constrained by increased competition and regulatory controls.

- Long-term (5+ years): Prices may further decline or stabilize as demand adjusts to alternative therapies and supply chain reforms.

Anticipate notable price volatility, driven by policy shifts, patent expirations, and market demand fluctuations, with a potential rebound if reformulations demonstrate superior abuse-deterrent features or if regulatory relaxations occur.

Market Projections and Future Trends

-

Declining Prescriptions and Market Share: The CDC’s cautious prescribing guidelines and increased awareness have led to a 20–30% reduction in OXYCONTIN prescriptions over the past five years [4].

-

Emergence of Abuse-Deterrent and Novel Formulations: Continued investment in ADFs, including implantable and combination therapies, might sustain demand in specialized markets. Such innovations could command premium pricing in niche segments.

-

Regulatory and Legal Environment: Ongoing litigation and policy reforms could further restrict supply, potentially causing price fluctuations but also creating opportunities for competitors with better abuse deterrence or alternative therapies.

-

Impact of Opioid Alternatives: Growing utilization of non-opioid analgesics, including nerve blocks and neuromodulation, may diminish the traditional market for OXYCONTIN, emphasizing the importance of diversification strategies.

-

Legal and Ethical Considerations: Ethical debates and legal liabilities create market hesitancy, fostering a landscape favoring non-branded generics or alternative pain management modalities.

Strategic Recommendations

- Monitoring Policy and Regulatory Changes: Companies should stay ahead of evolving regulations to anticipate supply and pricing impacts.

- Investing in Abuse-Deterrent Technologies: Developing next-generation formulations may sustain premium pricing.

- Diversifying Portfolio: Expanding into non-opioid analgesics can offset declining opioid demand.

- Engaging in Market Education: Promoting responsible prescribing and safe use can mitigate regulatory crackdowns and create trust.

- Exploring International Markets: Emerging economies with growing pain management needs may offer new growth avenues, subject to regulatory feasibility.

Key Takeaways

- The OXYCONTIN market faces ongoing decline due to regulatory crackdowns, increasing competition from generics, and shifts toward non-opioid therapies.

- Despite a shrinking core market, niche segments with abuse-deterrent formulations and specialized use may sustain higher price points temporarily.

- Prices are projected to decline modestly over the next 3–5 years, stabilized by generics and regulatory pressures.

- Market entrants should focus on innovation, particularly abuse-deterrent features, and diversify beyond opioids.

- Stakeholders must monitor policy developments and public health debates to adapt strategies effectively.

FAQs

1. Will OXYCONTIN retain market relevance amid increasing opioid regulation?

While regulatory restrictions reduce overall prescriptions, niche markets and abuse-deterrent formulations may preserve some relevance, especially for severe, treatment-resistant pain patients.

2. How do generic oxycodone ER formulations impact OXYCONTIN pricing?

Generics exert significant price pressure, leading to substantial declines in branded OXYCONTIN prices, often making the branded version less competitive unless it offers superior features like enhanced abuse deterrence.

3. Are there promising alternatives to OXYCONTIN for pain management?

Yes. Non-opioid therapies, including neuromodulation, nerve blocks, and non-addictive pharmaceuticals, are gaining ground, further challenging the traditional extended-release opioid market.

4. What role do abuse-deterrent formulations play in OXYCONTIN’s future?

They could differentiate OXYCONTIN in a declining market, potentially commanding higher prices, but regulatory approval and consumer acceptance remain critical factors.

5. How might legal actions influence OXYCONTIN’s market dynamics?

Litigation related to opioid misuse and regulation can lead to supply restrictions, price volatility, or shifts in market focus towards alternative pain therapies.

References

[1] Grand View Research. Opioid Analgesics Market Size & Trends, 2022-2030.

[2] FDA. Drug Approvals and Patent Data.

[3] IQVIA. Prescription Price & Volume Data, 2022.

[4] CDC. Guidelines for Prescribing Opioids for Chronic Pain, 2022.

Note: All data and projections are indicative and subject to change based on dynamic market and regulatory developments.