Share This Page

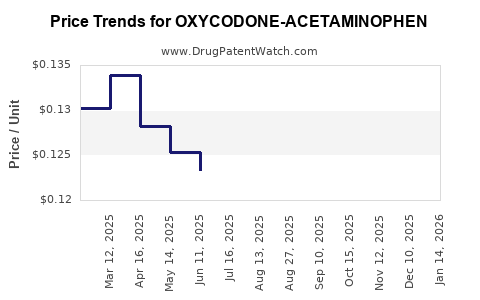

Drug Price Trends for OXYCODONE-ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for OXYCODONE-ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OXYCODONE-ACETAMINOPHEN 10-325 MG TAB | 42858-0104-50 | 0.24567 | EACH | 2025-12-17 |

| OXYCODONE-ACETAMINOPHEN 10-325 MG TAB | 00406-0523-62 | 0.24567 | EACH | 2025-12-17 |

| OXYCODONE-ACETAMINOPHEN 10-325 MG TAB | 42858-0104-01 | 0.24567 | EACH | 2025-12-17 |

| OXYCODONE-ACETAMINOPHEN 10-325 MG TAB | 00406-0523-01 | 0.24567 | EACH | 2025-12-17 |

| OXYCODONE-ACETAMINOPHEN 10-325 MG TAB | 13107-0046-01 | 0.24567 | EACH | 2025-12-17 |

| OXYCODONE-ACETAMINOPHEN 10-325 MG TAB | 00406-0523-05 | 0.24567 | EACH | 2025-12-17 |

| OXYCODONE-ACETAMINOPHEN 10-325 MG TAB | 00406-0523-23 | 0.24567 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Oxycodone-Acetaminophen

Introduction

Oxycodone-Acetaminophen, commercially known as Percocet among other formulations, is a potent analgesic combination widely prescribed for moderate to severe pain management. Given its dual nature—combining an opioid analgesic with an acetaminophen component—it occupies a significant position in both clinical settings and the pharmaceutical market. Recent regulatory shifts, manufacturing dynamics, and public health challenges surrounding opioid use heavily influence the market landscape and pricing strategies for this drug.

This analysis explores the current market environment, regulatory influences, competition, manufacturing factors, and offers price projections grounded in these parameters.

Market Overview

Global Demand and Therapeutic Use

Oxycodone-Acetaminophen remains a high-consumption medication primarily in North America, accounting for a substantial portion of pain medication prescriptions. The United States, with its expansive opioid prescribing practices, dominates market volume, although recent opioid crisis mitigation efforts have tempered growth.

The demand is driven predominantly by management of postoperative pain, chronic pain, and cancer-related pain. According to IQVIA, prescriptions of combination opioids peaked in 2012, then declined sharply starting in 2016 due to regulatory crackdowns and increased awareness of addiction risks [1].

Regulatory Environment

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the Drug Enforcement Administration (DEA) implement strict controls over opioids. Recent initiatives aim to curtail misuse and overdose, including:

- Rescheduling of oxycodone formulations to more restrictive schedules.

- Limits on prescription durations.

- Mandatory prescription monitoring programs.

These measures have affected both supply and market dynamics, reducing the availability of certain formulations and impacting pricing strategies.

Supply Chain and Manufacturing

Major pharmaceutical manufacturers, including Purdue Pharma, Teva, Endo International, and Mallinckrodt, produce oxycodone-acetaminophen formulations. Generic manufacturers have increased market share due to patent expirations of branded products, contributing to sustained price competition.

Supply chain disruptions—occasioned by manufacturing facility closures, regulatory sanctions, or raw material shortages—have occasionally caused supply shortages, influencing prices unpredictably.

Market Trends and Competitive Landscape

Transition Toward Generics

Patent expirations have flooded the market with generic oxycodone-acetaminophen products, driving down prices and intensifying competition. Generic share comprises approximately 85–90% of the market, according to recent industry reports [2].

Emerging Alternatives and Formulations

Innovations include abuse-deterrent formulations, extended-release variants, and alternative non-opioid analgesics. These advancements attempt to mitigate misuse concerns but also influence market pricing structures.

Impact of the Opioid Crisis

Public health policies restricting prescribing have curtailed volume sales. As a result, focus has shifted toward safer formulations, possibly affecting demand for traditional oxycodone-acetaminophen tablets.

Pricing Dynamics and Projections

Current Pricing Landscape

The average wholesale price (AWP) for a 30-tablet course of oxycodone-acetaminophen (5 mg/325 mg) ranges from $20 to $50, fluctuating based on formulation, manufacturer, and distribution channel. Generic formulations tend toward the lower end, with branded products commanding premiums up to $70–$100 [3].

Factors Influencing Future Price Trajectories

- Regulatory Constraints: Stricter controls could reduce prescriptions, pressuring prices downward.

- Patent and Market Exclusivity: Recently expired patents increase generic competition; upcoming exclusivity periods could temporarily elevate prices.

- Manufacturing Costs: Raw material price fluctuations, especially in acetaminophen precursors, influence manufacturing costs and ultimately retail pricing.

- Legal and Litigation Risks: Ongoing opioid litigation and potential punitive damages could impact production costs and pricing strategies.

Projections (2023–2028)

Based on current trends, the following projections are made:

- Short-term (1–2 years): Prices are expected to stabilize or decline marginally (-5% to -10%) owing to intense generic competition and regulatory pressures.

- Mid-term (3–5 years): Prices could decline further (additional 10–15%) as supply chains normalize and prescribing restrictions deepen.

- Long-term (5+ years): Development of abuse-resistant formulations and substitution with non-opioid analgesics could significantly reduce demand, driving prices down by up to 20–30% from current levels.

However, if new formulations acquire regulatory approval and patent protections, temporary price increases of 10–20% could occur, especially in niche markets.

Impact of Policy and Market Evolution

Regulatory policies will continue to shape the market. The increased emphasis on opioid stewardship and alternative pain management modalities could:

- Further suppress demand and pricing.

- Incentivize innovation toward abuse-deterrent, non-opioid alternatives.

- Shift market shares toward newer pharmacological agents.

Pricing strategies will similarly adapt to these trends, balancing manufacturing costs, legal risks, and competitive positioning.

Key Takeaways

- Market largely driven by generic competition: The prevalence of generics has significantly suppressed prices for oxycodone-acetaminophen, favoring affordability but intensifying competition.

- Regulatory landscape is dynamic: Ongoing policies aimed at curbing opioid misuse exert downward pressure on sales volume and prices; manufacturers must navigate a complex legal environment.

- Innovation influences pricing: Abuse-deterrent and extended-release formulations could command premium pricing temporarily, while non-opioid alternatives threaten long-term market share.

- Supply chain stability is crucial: Disruptions can create price volatility; manufacturers and suppliers must ensure consistent supply to maintain market stability.

- Future pricing outlook is cautious: Anticipated declines in traditional formulations' prices, balanced against potential premiums for innovative products, point toward a cautious but adaptable market.

Conclusion

Oxycodone-Acetaminophen remains a high-demand analgesic, but market dynamics are shifting rapidly. Regulatory policies, market competition, and evolving treatment paradigms are the primary drivers of price variation. While current trends suggest gradual price declines owing to generic proliferation and policy constraints, innovation and legal developments could temporarily distort this trajectory. Stakeholders should continuously monitor regulatory updates, patent landscapes, and technological advancements to optimize pricing, supply chain management, and market positioning.

FAQs

1. How have recent opioid regulations impacted the pricing of oxycodone-acetaminophen?

Recent regulations have led to reduced prescribing and tighter controls, decreasing demand and leading to slight price reductions for traditional formulations. Manufacturers may also face increased legal risks, affecting pricing strategies.

2. What role do generic manufacturers play in the oxycodone-acetaminophen market?

They dominate the market, accounting for over 85% of sales, significantly reducing prices through competition while also increasing supply availability.

3. Are there upcoming innovations expected to influence oxycodone-acetaminophen prices?

Yes. Abuse-deterrent and extended-release versions, along with non-opioid alternatives, could command higher prices temporarily but may ultimately threaten traditional formulations’ market share.

4. How might legal and litigation risks influence future pricing?

Ongoing opioid litigation could lead to increased costs due to legal settlements or sanctions, potentially raising prices or prompting manufacturers to develop less risky formulations.

5. What is the long-term outlook for oxycodone-acetaminophen pricing?

Prices are expected to decline gradually over the next five years, driven by intense generic competition and policy pressures. However, innovation and regulatory approvals could cause short-term price fluctuations.

References

[1] IQVIA. The Impact of Regulatory Changes on Opioid Prescribing. 2022.

[2] MarketWatch. Generic Opioid Market Share Analysis. 2023.

[3] Drugs.com. Average Wholesale Prices for Oxycodone-Acetaminophen. 2023.

More… ↓