Last updated: July 27, 2025

Introduction

Oxybutynin, a well-established urinary antispasmodic, has played a pivotal role in managing overactive bladder (OAB) and urinary incontinence. As a first-line treatment since its approval, oxybutynin's market dynamics have evolved driven by demographic shifts, technological innovations, and pricing strategies. This report presents a comprehensive analysis of oxybutynin's current market landscape and projects future pricing trends based on recent developments.

Market Overview

Therapeutic Use and Clinical Positioning

Oxybutynin, introduced in the 1970s, functions by antagonizing muscarinic receptors in the bladder, reducing involuntary contractions. Its affordability and efficacy have secured its position as a symptomatic management option for OAB, particularly in elderly populations. Formulations include oral tablets, transdermal patches, gels, and recently, extended-release versions.

Market Size and Growth

The global urinary incontinence market, valued at approximately USD 10 billion in 2022, exhibits a Compound Annual Growth Rate (CAGR) of about 4–6% [1]. Oxybutynin accounts for a significant segment within this market, driven by:

-

Increasing prevalence of OAB, particularly among aging populations (estimated at 33 million in the U.S. alone) [2].

-

Rising awareness and diagnosis rates.

-

Expanding acceptance of non-invasive treatments.

Key Market Players

Major manufacturers include Bayer, Pfizer (now part of Pfizer Inc. after acquisition), Teva Pharmaceuticals, and Mylan. The introduction of generic formulations post-patent expiry in the early 2010s significantly increased market competition and reduced prices.

Market Dynamics Influencing Oxybutynin

Patents and Generic Competition

Patent expiry of the original oxybutynin formulations, notably the oral immediate-release version, precipitated a price decline and proliferation of generics. The availability of interchangeable generic products has made oxybutynin a cost-effective choice, especially in developing markets.

Formulation Innovations

Transdermal patches and extended-release formulations provide improved adherence and tolerability, though at a premium price point compared to immediate-release tablets. These innovations influence overall market segmentation.

Regulatory and Reimbursement Environment

Reimbursement policies favor cost-effective treatment plans, supporting the use of generic oxybutynin. However, regulatory disparities across regions influence market penetration and pricing strategies.

Emerging Competitors and Alternatives

Newer agents, including beta-3 adrenergic agonists like mirabegron, offer alternative mechanisms with fewer anticholinergic side effects. These agents are gaining market share but generally command higher prices, which may influence the demand elasticity for oxybutynin.

Pricing Landscape and Historical Trends

Current Pricing Structures

Post-generic entry, the average wholesale price (AWP) for immediate-release oxybutynin tablets ranges between USD 0.10 and USD 0.50 per tablet, varying by region [3]. Extended-release formulations typically retail at 2–3 times that price. Transdermal patches attract a premium, often exceeding USD 2 per day.

Factors Influencing Pricing

-

Manufacturing costs: Low due to generic manufacturing processes.

-

Market competition: Increased rival products reduce prices over time.

-

Regulatory approval and market access: Variations impact the final patient price.

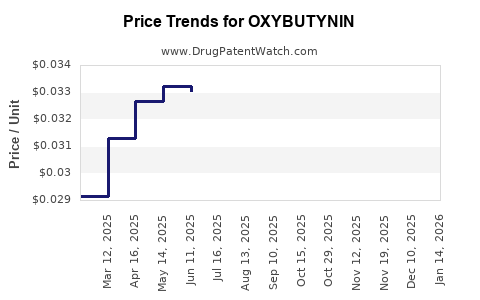

Price Trends Since Patent Expiry

Prices saw a steep decline following patent expiration around 2012, stabilizing at lower levels. Market saturation and entry of generics have maintained a downward pressure on prices, especially in mature markets like the U.S. and Europe.

Future Price Projections

Short-term Outlook (1–3 years)

-

Price stabilization: The price for generic oxybutynin tablets is expected to remain low, with minor fluctuations due to supply chain dynamics and regional discounts.

-

Premium formulations: Transdermal and extended-release products may sustain higher prices but face intense competition, limiting price increases.

-

Impact of biosimilars and new formulations: Minimal effect, given oxybutynin's small molecule status.

Medium-term Outlook (4–7 years)

-

Market saturation: Most mature markets will witness further price plateauing or marginal decline.

-

Pricing in emerging markets: Anticipated to be lower due to competitive pressures and healthcare budget constraints.

-

Possible introduction of value-based pricing models: As healthcare systems shift towards outcome-based reimbursement, prices may adjust accordingly.

Long-term Outlook (>7 years)

-

Potential obsolescence: Competition from newer, better-tolerated agents may reduce demand, pressuring prices downward.

-

Patent and regulatory uncertainties: No significant patent protections are anticipated; thus, price hikes are unlikely without disruptive innovations.

-

Emerging technologies: Development of novel delivery mechanisms or combination therapies could alter market dynamics, potentially impacting oxybutynin’s pricing.

Regional Variations and Market Strategies

-

United States: Competitive generics have driven prices down significantly; however, branded versions maintain a premium for convenience or specific formulations.

-

European Union: Similar trends with additional differences arising from national reimbursement policies and formulary preferences.

-

Emerging Economies: Significantly lower prices due to manufacturing costs, local regulations, and purchasing power.

Implications for Stakeholders

Pharmaceutical companies focusing on oxybutynin should prioritize price competitiveness through generic expansion and formulation differentiation. Healthcare providers and payers should leverage low-cost generics to optimize resource allocation. Policymakers may consider regulatory pathways that balance affordability with innovation incentives.

Key Takeaways

-

Market maturity: Post-patent expiry, oxybutynin’s market has stabilized with low prices driven by generic competition.

-

Pricing trends: Expect minimal fluctuation in price levels over the next 3 years, with potential slight declines in emerging markets.

-

Formulation impact: Extended-release and transdermal formulations retain premium pricing, though facing increasing competition.

-

Future outlook: Market contraction anticipated as newer therapies, such as beta-3 agonists, penetrate the market, potentially further suppressing oxybutynin prices.

-

Strategic positioning: Manufacturers should focus on cost-effective manufacturing, formulation innovation, and regional market tailoring to maximize profitability.

FAQs

1. Will the price of oxybutynin increase due to new formulations?

No. While innovative formulations like transdermal patches command higher prices, overall oxybutynin prices are likely to remain stable or decline due to growing competition and market saturation.

2. How does patent expiration influence oxybutynin pricing?

Patent expiration leads to the entry of generic competitors, significantly lowering prices and increasing market accessibility.

3. Are biosimilars or new molecular entrants expected for oxybutynin?

No. As a small molecule drug with extensive patent expiry and generic presence, biosimilars are unlikely. New entrants may be limited to reformulations or combination products rather than entirely novel molecules.

4. Which regions will see the most price reductions?

Emerging markets and regions with healthcare budgets constrained by government policies will experience the steepest price declines.

5. What role will alternative therapies play in future oxybutynin demand?

Agents like mirabegron are gaining popularity due to better tolerability, which could reduce demand for oxybutynin over time, especially if price reductions reach a threshold that makes oxybutynin less competitive.

References

[1] MarketWatch, “Global Urinary Incontinence Market Size & Share Analysis,” 2022.

[2] NIH, “Overactive Bladder: Epidemiology and Burden,” 2021.

[3] IQVIA, “Pharmaceutical Pricing Data,” 2023.