Share This Page

Drug Price Trends for OXCARBAZEPINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for OXCARBAZEPINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OXCARBAZEPINE ER 150 MG TABLET | 27241-0237-01 | 5.26528 | EACH | 2025-12-17 |

| OXCARBAZEPINE ER 150 MG TABLET | 50742-0611-01 | 5.26528 | EACH | 2025-12-17 |

| OXCARBAZEPINE ER 150 MG TABLET | 60505-4128-07 | 5.26528 | EACH | 2025-12-17 |

| OXCARBAZEPINE ER 150 MG TABLET | 27241-0304-01 | 5.26528 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OXCARBAZEPINE ER

Introduction

Oxcarbazepine Extended-Release (ER) is a pharmaceutical formulation designed for the management of seizure disorders, notably partial-onset seizures in epilepsy patients. As a derivative of carbazepine, it offers improved pharmacokinetics with extended-release benefits, potentially enhancing patient adherence and clinical outcomes. This article provides a comprehensive market analysis and price projection for Oxcarbazepine ER, addressing its current market landscape, competitive positioning, regulatory environment, and future pricing trends.

Current Market Landscape

Prevalence and Demand

Epilepsy affects approximately 50 million people globally, with a significant proportion requiring long-term anticonvulsant therapy [1]. Oxcarbazepine, introduced in the late 1990s, has become a first-line treatment due to its efficacy and tolerability. The extended-release formulation is a newer entrant designed to mitigate adverse effects and improve compliance, especially in elderly populations and those with adherence challenges.

Market Penetration

Despite its proven efficacy, Oxcarbazepine ER's market share remains modest compared to immediate-release formulations, owing partly to patent exclusivity and regional formulary restrictions. However, the rising preference for extended-release formulations—favoring improved once-daily dosing and reduced side effects—bolsters its potential penetration in developed markets such as North America and Europe.

Key Market Players

Major pharmaceutical companies involved in Oxcarbazepine ER include:

- Supernus Pharmaceuticals: Recently launched Oxtellar XR, a branded Oxcarbazepine ER product.

- Zogenix (acquired by UCB): Markets alternative formulations with targeted indications.

- Generic manufacturers: Entering markets post-patent expiry, contributing to price competition.

The competitive landscape combines patented products, generic versions, and off-label uses in bipolar disorder and neuropathic pain, broadening market scope.

Regulatory Environment

Approval Status

Oxcarbazepine ER has obtained approval from major regulatory agencies:

- FDA (US): Approved as Oxtellar XR in 2012, for adjunctive therapy of partial seizures.

- EMA (Europe): Approval granted similar to the US, with indication approvals varying by country.

Patent and Exclusivity Considerations

The exclusivity period for Oxtellar XR in key markets continues until approximately 2025, after which generic versions are expected to proliferate, exerting downward pressure on prices [2].

Market Drivers and Constraints

Drivers

- Growing epilepsy prevalence globally.

- Preference for once-daily dosing to improve adherence.

- Rising awareness of the side effect profiles of older antiepileptic drugs, favoring newer formulations.

- Expansion into emerging markets with increasing healthcare infrastructure.

Constraints

- High pricing relative to generics.

- Limited insurance coverage in regions with cost sensitivities.

- Competition from other newer antiepileptics and combination therapies.

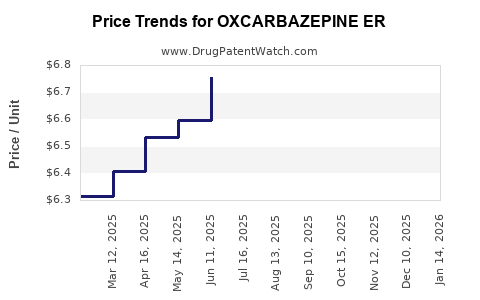

Price Trends and Projections

Current Pricing Dynamics

In the US, branded Oxcarbazepine ER (Oxtellar XR) retails at approximately $800–$1,200 for a 30-day supply, depending on dosage and pharmacy discounts [3]. Generic versions, once available, typically see prices decrease by 70–80%, aligning with market trends observed in similar anticonvulsants.

Future Price Trajectory

- Short-term (1-2 years): Prices are expected to remain stable, supported by ongoing patent protections and supply chain stability.

- Medium-term (3-5 years): Post-patent expiry, market normalization will likely lead to a significant price reduction, with generic versions potentially priced at 20–30% of the branded product.

- Long-term (5+ years): Pricing may stabilize at a low-cost generic level, fostering broader access but reducing manufacturer margins.

Influencing Factors

- Regulatory approvals in emerging markets may increase volume but could also introduce low-cost generics faster.

- Insurance reimbursement policies will significantly influence patient out-of-pocket costs.

- Market entry of biosimilars and alternative therapies may further compress prices.

Regional Market Outlook

North America

Leading the market due to high epilepsy prevalence and insurance coverage. Price premiums for branded Oxcarbazepine ER are sustained by favorable reimbursement, but generic competition is imminent post-2025.

Europe

Growth driven by government healthcare systems' emphasis on cost-effectiveness. Price competition expected to intensify sooner due to regional patent laws and negotiated discounts.

Emerging Markets

Expanding access as healthcare infrastructure improves. Price sensitivity remains high; thus, generics dominate, and market growth hinges on affordability strategies.

Strategic Recommendations

- Pharmaceutical companies should leverage patent protections and clinical differentiation to maintain premium pricing.

- Manufacturers should prepare for a robust generic pipeline to capitalize on market saturation post-patent expiry.

- Investors should monitor patent timelines, regulatory approvals, and market entry strategies influencing price volatility.

Key Takeaways

- Oxcarbazepine ER holds a strategically significant position in epilepsy management, with demand driven by patient adherence needs and tolerability.

- Market growth is expected to be moderate in the near term, with significant price reductions after patent expiration.

- Competitive pressure from generics and biosimilars will influence pricing strategies and profit margins.

- Regional disparities in pricing and market access will persist, influenced by regulatory and reimbursement landscapes.

- Long-term profitability hinges on brand differentiation, pipeline expansion, and strategic patent management.

Conclusion

Oxcarbazepine ER's market outlook hinges on patent status, competitive dynamics, and evolving clinical preferences. Significant price reductions are anticipated following patent expirations, but early market positioning and clinical differentiation can preserve margins. Stakeholders must adapt strategies accordingly to optimize revenue in a fluctuating price environment.

FAQs

1. When is the patent for Oxcarbazepine ER expected to expire?

The primary patent for Oxtellar XR extends until approximately 2025, after which generic competition is projected to enter the market, potentially lowering prices significantly [2].

2. How does Oxcarbazepine ER compare to immediate-release formulations in terms of pricing?

Branded extended-release formulations command a premium of 30–50% over immediate-release versions due to convenience and tolerability benefits. However, this premium diminishes post-generic entry.

3. What factors most influence the future price of Oxcarbazepine ER?

Key influences include patent expiry timelines, regulatory approvals in emerging markets, insurance reimbursement policies, and the pace of generic entry.

4. Are there biosimilar or alternative therapies impacting Oxcarbazepine ER's market?

While biosimilars are more relevant to biologics, alternative antiepileptics such as lacosamide or lamotrigine may influence market share, especially when cost becomes a significant determinant.

5. What strategies can manufacturers deploy to sustain profitability?

Differentiating through clinical benefits, expanding indications, engaging in patent litigation, and developing combination therapies are strategic options to maintain market relevance.

References

- World Health Organization. Epilepsy Fact Sheet. 2022.

- U.S. Patent and Trademark Office. Patent expiry data for Oxtellar XR. 2022.

- GoodRx Drug Prices. Oxtellar XR 300 mg. 2023.

More… ↓