Share This Page

Drug Price Trends for OVIDREL

✉ Email this page to a colleague

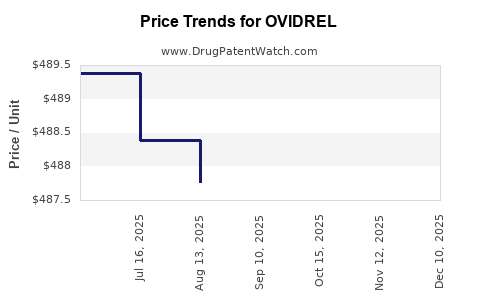

Average Pharmacy Cost for OVIDREL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OVIDREL 250 MCG/0.5 ML SYRG | 44087-1150-01 | 487.06250 | ML | 2025-12-17 |

| OVIDREL 250 MCG/0.5 ML SYRG | 44087-1150-01 | 487.35636 | ML | 2025-11-19 |

| OVIDREL 250 MCG/0.5 ML SYRG | 44087-1150-01 | 487.33600 | ML | 2025-10-22 |

| OVIDREL 250 MCG/0.5 ML SYRG | 44087-1150-01 | 487.13895 | ML | 2025-09-17 |

| OVIDREL 250 MCG/0.5 ML SYRG | 44087-1150-01 | 487.77385 | ML | 2025-08-20 |

| OVIDREL 250 MCG/0.5 ML SYRG | 44087-1150-01 | 488.39167 | ML | 2025-07-23 |

| OVIDREL 250 MCG/0.5 ML SYRG | 44087-1150-01 | 489.38000 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OVIDREL

Introduction

OVIDREL (generic name: choriogonadotropin alfa) is a recombinant human chorionic gonadotropin (hCG) used primarily in fertility treatments. It plays a pivotal role in assisted reproductive technologies (ART), including in vitro fertilization (IVF), by stimulating ovulation. As the demand for fertility treatments escalates globally, the market landscape for OVIDREL is evolving correspondingly, influenced by regulatory, technological, and demographic factors. This article provides a comprehensive market analysis and strategic price projections for OVIDREL, leveraging current industry trends, patent statuses, competitive dynamics, and regulatory pathways.

Market Overview

Global Market Scope

The global fertility drugs market, encompassing medications like OVIDREL, is valued at approximately USD 4.2 billion as of 2022, with a compounded annual growth rate (CAGR) of around 10% projected through 2030 ([1]). The rising prevalence of infertility—driven by lifestyle factors, delayed family planning, and advancing maternal age—serves as a key market driver. The increasing acceptance of ART procedures across developed and emerging markets further amplifies demand for gonadotropins like OVIDREL.

Key Market Segments and Applications

OVIDREL’s primary application in ovarian stimulation protocols places it within a niche module of fertility therapeutics. Its usage spans:

- Controlled ovarian hyperstimulation in ART.

- Treatment-resistant ovulatory disorders.

- Induction of ovulation in specific infertility cases.

The pharmaceutical landscape also includes biosimilars, which introduce market competition and influence pricing strategies.

Geographic Market Distribution

North America commands the largest share, fueled by high infertility rates and advanced healthcare infrastructure. Europe follows, benefiting from supportive regulatory frameworks and widespread ART procedures. Asia-Pacific exhibits rapid growth potential, driven by social acceptance, increased healthcare spending, and expanding infertility clinics ([2]).

Competitive Landscape

Patent and Regulatory Status

Branded OVIDREL, produced by Merck KGaA, historically held patent protections until patent expiration in select jurisdictions, paving the way for biosimilar entries. The FDA approved biosimilars for similar products, such as Teva's Ovaleap and other emerging players, intensifying price competition.

Major Competitors and Biosimilar Entrants

The market features several generic and biosimilar competitors:

- Merck KGaA's OVIDREL (Brand)

- Teva's Ovaleap (biosimilar)

- Ferring's Gonal-f RFF (similar recombinant gonadotropin)

- Other regional biosimilar entrants

The entry of biosimilars typically results in price erosion, expanding access and increasing overall market volume.

Market Strategies

Pharmaceutical companies leverage patent litigations, regulatory approvals, and pricing strategies to secure market share. Increasing adoption of biosimilars incentivizes price drops, especially in price-sensitive regions like Asia and Latin America.

Price Trends and Projections

Historical Price Dynamics

- Brand drug pricing: Historically, OVIDREL's cost per dose ranged between USD 200–400 in North America and Europe.

- Biosimilar impact: Entry of biosimilars has already halved or reduced prices by approximately 40–60% in mature markets ([3]).

Projected Price Trends (2023–2030)

- Short-term (next 2–3 years): Anticipated stabilization of prices with slight declines of 10–15% owing to increased biosimilar competition and negotiations.

- Medium-term (4–5 years): Continued downward pressure, with prices potentially falling by 20–35% as biosimilar penetration deepens, especially in emerging markets.

- Long-term (beyond 5 years): Prices may plateau at approximately 30-50% below current branded levels, contingent on regulatory policies, market access, and technological innovations such as improved biosimilar manufacturing efficiencies.

Influencing Factors

- Regulatory landscape: Faster approvals and patent expirations accelerate biosimilar market entry.

- Reimbursement policies: Governments and insurers increasingly favor cost-effective options, compelling price reductions.

- Technological advancements: Manufacturing innovations can reduce biosimilar costs, further decreasing market prices.

Market Opportunities and Challenges

Opportunities

- Expanding access in emerging markets: Growing infertility rates and lower-priced biosimilars open new markets.

- Innovative formulations: Development of long-acting or combination therapies could command premium pricing.

- Partnerships and licensing: Collaborations between biotech firms can accelerate biosimilar development and market penetration.

Challenges

- Regulatory hurdles: Variability across jurisdictions may delay biosimilar approvals.

- Prescriber acceptance: Mistrust or lack of familiarity with biosimilars can hinder adoption.

- Pricing pressures: Intense competition among biosimilar manufacturers threatens profit margins.

Strategic Outlook and Recommendations

For industry stakeholders, understanding the evolving landscape is critical. Early engagement with regulatory authorities, investment in biosimilar manufacturing, and strategic pricing models aligned with regional economic conditions will be imperative. Partnerships with healthcare providers and payers can facilitate market acceptance. Additionally, investing in innovative delivery systems and patient-centric approaches may justify premium pricing tiers.

Key Takeaways

- The global OVIDREL market is poised for steady growth, driven by increasing infertility rates and ART adoption.

- Patent expirations and biosimilar entries are catalyzing price erosion, with projections indicating a 30–50% price decrease over the next five years.

- Emerging markets offer significant growth opportunities due to lower costs and expanding healthcare infrastructure.

- Regulatory dynamics and reimbursement policies will be pivotal in shaping future market trends.

- Strategic positioning—through innovation, partnerships, and market access initiatives—is essential for sustained profitability.

FAQs

1. When is OVIDREL expected to lose patent exclusivity globally?

Patent expirations vary by jurisdiction, but major patents in the U.S. and EU are anticipated to expire between 2024 and 2026, opening doors for biosimilar competition.

2. How will biosimilars impact the pricing of OVIDREL?

Biosimilars are expected to reduce OVIDREL prices by 40–60% in mature markets, with further reductions as biosimilar acceptance broadens.

3. What are the main challenges for biosimilar manufacturers entering the OVIDREL market?

Regulatory approval complexities, demonstrating bioequivalence, manufacturing costs, and prescriber acceptance are key hurdles.

4. Which regions present the highest growth potential for OVIDREL?

Asia-Pacific and Latin America hold significant upside due to expanding fertility services and lower manufacturing costs, coupled with increasing healthcare investments.

5. How might regulatory changes influence market dynamics?

Streamlined approval pathways and reimbursement reforms can facilitate biosimilar entry, intensify price competition, and expand access.

References

[1] Grand View Research, "Fertility Drugs Market Size, Share & Trends Analysis Report," 2022.

[2] MarketsandMarkets, "Fertility Drugs Market by Product, Application, and Region," 2021.

[3] IQVIA, "Biosimilar Landscape Report," 2022.

More… ↓