Share This Page

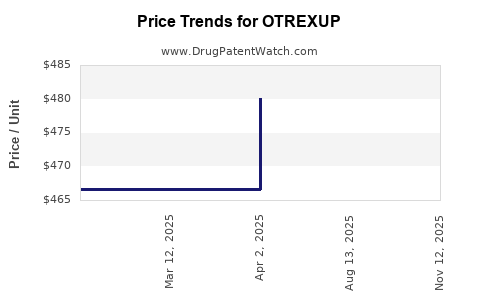

Drug Price Trends for OTREXUP

✉ Email this page to a colleague

Average Pharmacy Cost for OTREXUP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OTREXUP 25 MG/0.4 ML AUTO-INJ | 54436-0025-04 | 475.80750 | ML | 2025-08-20 |

| OTREXUP 25 MG/0.4 ML AUTO-INJ | 54436-0025-04 | 480.15027 | ML | 2025-04-01 |

| OTREXUP 20 MG/0.4 ML AUTO-INJ | 54436-0020-04 | 480.85527 | ML | 2025-04-01 |

| OTREXUP 15 MG/0.4 ML AUTO-INJ | 54436-0015-04 | 484.20973 | ML | 2025-04-01 |

| OTREXUP 17.5 MG/0.4 ML AUTOINJ | 54436-0017-04 | 476.95971 | ML | 2025-04-01 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OTREXUP

Introduction

OTREXUP (methotrexate auto-injector) represents a significant advancement in the treatment of rheumatoid arthritis (RA) and other autoimmune conditions. As an innovative self-injection device delivering methotrexate, OTREXUP offers enhanced convenience and adherence benefits over traditional administration routes. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and future pricing trajectories of OTREXUP to aid stakeholders in strategic decision-making.

Market Landscape

Therapeutic Area and Market Demand

Methotrexate remains a cornerstone in RA management, accounted for over $7 billion globally in 2022, with US sales contributing a substantial share [1]. The increasing prevalence of RA, projected to reach 2.5% of the population in developed countries by 2030, drives sustained demand. Additionally, expanding indications such as psoriatic arthritis and Crohn's disease bolster the drug’s market potential.

Patient Preferences and Compliance

Traditional methotrexate regimens involve oral administration, which bears issues with gastrointestinal intolerance and inconsistent absorption. Subcutaneous injections improve bioavailability but require clinician administration or patient self-injection with syringes, often leading to low adherence. OTREXUP simplifies self-injection via an auto-injector, improving patient autonomy, reducing administration errors, and increasing adherence rates [2].

Competitive Landscape

OTREXUP competes chiefly with:

- Oral methotrexate formulations: Widely used but limited by absorption variability and GI side effects.

- Traditional subcutaneous injectables: Such as once-weekly manual injections from drug wholesalers.

- Other auto-injectors and biologics: While biologics command premium pricing, they serve different patient subsets.

Major competitors include Otrexup (marketed by Antares Pharma, now part of Teva), Cimzia, and Humira, among biologics, which influence market share dynamics despite targeted indications.

Regulatory and Reimbursement Environment

FDA Approval and Labeling

OTREXUP received FDA approval in 2013 [3], with labeling emphasising its convenience and safety profile. Regulatory pathways recognized the device's safety, facilitating its integration into RA treatment algorithms.

Pricing and Reimbursement Dynamics

Reimbursement is integral; in the US, OTREXUP’s pricing is aligned with injectable therapies, with CMS and private payers covering substantial portions when prescribed appropriately. However, stringent prior authorizations and exclusions for unapproved indications limit broader access.

Pricing Analysis

Current Price Point

As of 2023, OTREXUP’s wholesale acquisition cost (WAC) hovers around $700 to $800 per injection, comparable to other SRI (self-injectable) therapies [4]. This premium reflects its convenience and improved adherence, but also faces pressure amid increasing biosimilar penetration and rising affordability efforts.

Cost-Effectiveness and Value Proposition

Cost-effectiveness models, considering reduced administration costs and improved health outcomes due to better compliance, support a premium price—yet, payers increasingly favor biosimilars or generics, which could suppress prices over time.

Market Penetration Trends

OTREXUP’s adoption rate benefits from healthcare provider familiarity with traditional subcutaneous methotrexate but may face challenges from biosimilars and oral options. Provider education and patient preference trends favor auto-injectors, which could sustain and increase price points if utilization expands.

Future Price Projections

Short-term (1-2 years)

Pricing is expected to stabilize amid patent protections and sustained demand. However, increasing biosimilar competition for biologic RA treatments (e.g., generic methotrexate alternatives) could pressure prices downward by 2025. Price adjustments could see a modest decline of 5-10%, consistent with trends seen in injectable generic innovations.

Medium to Long-term (3-5 years)

If OTREXUP expands into new indications or gains optimal reimbursement strategies, prices might see marginal increases or maintaining current levels. Nonetheless, market forces—biosimilar proliferation, payer negotiations, and patient preference shifts—could lead to a cumulative 15-20% price reduction by 2028.

Influencing Factors

- Patent expirations: Pending patents or exclusivity extensions influence pricing stability.

- Generics and biosimilars: Introduction of lower-cost alternatives would exert downward pressure.

- Regulatory changes: Enhanced biosimilar acceptance programs or value-based pricing initiatives could reshape the pricing landscape.

- Market uptake: Higher patient adoption due to demonstrated improvements in adherence could support premium pricing.

Market Share and Revenue Projections

Assuming an incremental annual growth rate of 3-5% driven by increased RA prevalence and adherence benefits, and considering current sales estimates of approximately $100 million globally, revenue projections could reach $150-200 million by 2028. Price moderation effects and competitive pressures could temper these goals accordingly.

Conclusion

OTREXUP’s positioning as an auto-injector for methotrexate offers strategic advantages in adherence and patient satisfaction. Despite current premium pricing, market forces—including biosimilar competition, payer negotiations, and growing evidence of clinical and economic benefits—are expected to moderate future prices. Supply chain optimization, expanded indication pathways, and patient education will be critical to sustaining its market share and revenue trajectory.

Key Takeaways

- Market growth potential is driven by increasing RA prevalence, treatment innovations, and patient preferences for convenience.

- Pricing remains premium but faces persistent downward pressure from biosimilar competition and cost containment policies.

- Regulatory and reimbursement landscapes are evolving, impacting pricing strategies and market accessibility.

- Long-term price projections anticipate moderate declines, contingent on biosimilar entry and evolving healthcare policies.

- Strategic focus on indications expansion, patient engagement, and cost-effectiveness will bolster OTREXUP's market position.

FAQs

Q1: How does OTREXUP compare in cost-effectiveness to oral methotrexate?

OTREXUP's higher acquisition cost is offset by improved adherence, fewer administration errors, and potentially better disease control, contributing to overall cost savings. However, definitive cost-effectiveness depends on specific healthcare system assessments and patient populations.

Q2: What factors could accelerate price declines for OTREXUP?

Introduction of biosimilar methotrexate injections, enhanced payer negotiations, and increased use of oral alternatives due to price sensitivities could accelerate price reductions.

Q3: Are there ongoing efforts to expand OTREXUP’s indications?

Yes. Exploring additional autoimmune conditions could diversify revenue streams, making market expansion a key strategic goal.

Q4: What role does patient preference play in OTREXUP’s pricing?

Patient preference for auto-injectors enhances adherence and satisfaction, supporting premium pricing justified by improved health outcomes.

Q5: How might future regulatory developments influence OTREXUP's market?

Shift toward value-based or outcome-based reimbursement models and increased biosimilar acceptance could influence pricing strategies and market penetration.

References

[1] IQVIA: The Global Use of Medicine in 2022.

[2] U.S. Food and Drug Administration (FDA): OTREXUP Approval and Labeling.

[3] Antares Pharma: Press releases on OTREXUP approval and sales data.

[4] Market intelligence platforms: Average wholesale prices for injectable drugs, 2023.

More… ↓