Last updated: July 27, 2025

Introduction

Oseltamivir, marketed under the brand name Tamiflu®, is an antiviral medication primarily used for the treatment and prophylaxis of influenza A and B. Since its development, oseltamivir has become a cornerstone in influenza management, especially during seasonal outbreaks and pandemic situations. The shifting landscape of infectious disease epidemiology, evolving patent statuses, pricing strategies, and global health priorities demand a comprehensive market analysis and precise price projections for oseltamivir. This report distills current market dynamics, competitive positioning, regulatory environment, and projection frameworks crucial for stakeholders.

Market Overview

Global Market Size and Revenue

The global oseltamivir market has experienced rapid growth, driven largely by seasonal influenza outbreaks, pandemic preparedness, and increased awareness of antiviral treatments. In 2022, the market was valued at approximately USD 1.2 billion, with projections indicating a compound annual growth rate (CAGR) of 6.3% from 2023 to 2028, reaching an estimated USD 1.75 billion by 2028 [1].

Key Regional Markets

-

North America: Dominates due to high influenza prevalence, advanced healthcare infrastructure, and widespread patent protections. The U.S. accounts for over 60% of the global revenue, emphasizing the centrality of the American healthcare market in oseltamivir’s revenue streams.

-

Europe: A significant market influenced by influenza seasonality, with adherence to influenza vaccination programs complemented by antivirals.

-

Asia-Pacific: Rapidly expanding market fueled by population density, emerging healthcare infrastructure, and governmental stockpiling initiatives, particularly in Japan, South Korea, and China.

Market Drivers

-

Pandemic Preparedness: COVID-19 spotlighted the importance of preparedness for respiratory viruses, although oseltamivir is specific to influenza. However, its strategic stockpiling, especially in conjunction with vaccines, bolstered its market size.

-

Vaccination Synergy: Continued reliance on vaccination complemented by antiviral therapy sustains demand for oseltamivir.

-

Regulatory Approvals & Expanded Indications: Approvals for pediatric use, prophylactic indications, and combined treatments expand the accessible patient population.

Market Challenges

-

Competition from Other Antivirals: The emergence of newer agents, such as baloxavir marboxil (Xofluza®), impacts market share.

-

Generic Entry & Patent Expiry: The original patent expired in many regions around 2016-2017, leading to increased generic competition, exerting downward pressure on prices [2].

-

Limited Efficacy & Resistance: Variability in clinical efficacy and reports of resistance development pose perennial challenges for market continuity.

Competitive Landscape

Patent Status & Generic Availability

The patent lifecycle of oseltamivir significantly influences pricing. Following patent expiration, generic manufacturers entered the market, often offering medications at 30-50% lower prices than brand-name counterparts [3].

Brands & Manufacturers

- Roche (Tamiflu®): The original patent holder, with victory in patent litigation securing exclusive rights until patent expiry.

- Generic Manufacturers: Multiple—especially in India, China, and other emerging markets—producing cost-effective alternatives post-patent expiry.

Innovative and Adjunct Treatments

- Xofluza® (baloxavir marboxil): A single-dose oral antiviral with a different mechanism, impacting oseltamivir's market share, especially in certain patient segments.

Regulatory & Policy Environment

Regulatory authorities like FDA, EMA, and counterparts in emerging markets influence market access, reimbursement policies, and pricing. Emergency use authorizations during influenza seasons or pandemics sometimes temporarily alter market dynamics.

Price regulation varies globally, with government agencies often negotiating or capping prices. In the U.S., for example, the CDC's stockpiling initiatives influence procurement strategies, often leading to negotiated prices based on volume discounts.

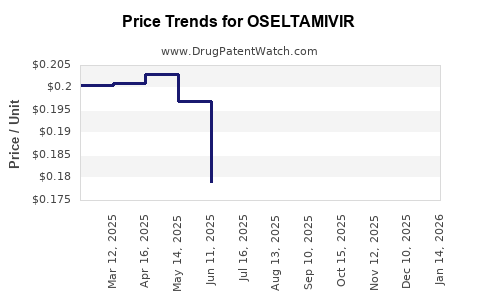

Pricing Trends and Projections

Historical Pricing Trends

Pre-patent expiry, the brand-name oseltamivir was priced around USD 60-$80 per treatment course in the U.S. market [4]. Post-patent expiry, generic versions ranged between USD 10-$20 per course, marking a significant reduction.

Factors Influencing Future Prices

- Patent Status: Once expired, generic competition exerts significant downward pressure.

- Manufacturing Costs: Technological advances have reduced production costs, enabling manufacturers to sustain lower prices.

- Market Demand: Seasonal and pandemic-driven fluctuations influence supply and demand dynamics.

- Regulatory & Reimbursement Frameworks: Government procurement policies and insurance reimbursements impact effective consumer prices.

Price Projections (2023-2028)

- Brand-Name Market: Consolidation may keep Tamiflu® prices relatively stable for the next few years in jurisdictions where brand-prescription persists, likely in the USD 70-$100 per course range.

- Generics Market: Driven by emerging markets and expanded manufacturing, generic prices are expected to decline further, stabilizing around USD 8-$15 per course by 2028.

- Pandemic & Emergency Use Pricing: During outbreaks, prices may temporarily rise due to shortages, but overall, the trend favors lower average prices as emergency stocks are replenished.

Impact of Emerging Resistance and New Treatments

Resistance development could diminish the drug's efficacy, prompting use shifts to newer agents like baloxavir, possibly impacting oseltamivir’s market share and pricing. Conversely, ongoing research and patent protections for new formulations could sustain premium pricing for advanced derivatives.

Key Market Opportunities

- Expansion into pediatric and prophylactic indications broadens consumer base.

- Strategic partnerships with governments for stockpiling enhance volume sales.

- Investment in manufacturing efficiency can further lower production costs, underpinning aggressive pricing strategies.

- Incorporation of oseltamivir in combination therapy regimens may sustain demand.

Risks & Uncertainties

- Emergence of resistance, particularly via H275Y mutation, may reduce clinical efficacy.

- Competition from novel antivirals can erode market share.

- Regulatory and policy changes, including price controls, affect profit margins.

- Public and private healthcare budget constraints could limit procurement volumes.

Conclusion

The oseltamivir market is transitioning from a patented, highly priced product to a commoditized, competitively priced generic commodity across many regions. Price projections suggest a continued downward trend, driven by patent expirations, manufacturing efficiencies, and intense competition. While brand-name sales may stabilize with moderate premiums, rapid generic proliferation and evolving viral resistance patterns will shape future pricing and market share.

Stakeholders should monitor regulatory environments, resistance trends, and emerging treatment alternatives to optimize pricing strategies, supply chain management, and market positioning.

Key Takeaways

- The global oseltamivir market is predominantly influenced by seasonal influenza trends, pandemic preparedness, and generic competition.

- Patent expiry significantly reduces prices; generics are expected to dominate the next wave of sales, with prices decreasing by approximately 70-80% from peak brand-name levels.

- Regulatory and reimbursement policies play critical roles in determining actual transaction prices, especially in emerging markets.

- Resistance development and competitive antiviral agents like baloxavir are potential disruptors that could influence future market sizes and pricing.

- Strategic collaborations, expanding indications, and cost optimization are key to maintaining profitability in a highly competitive environment.

FAQs

1. How does patent expiry affect oseltamivir pricing?

Patent expiry opens the market to generic manufacturers, drastically reducing prices—often by up to 80%. This shift enhances access but compresses profit margins for original patent holders.

2. Are there newer alternatives to oseltamivir with better efficacy?

Yes, baloxavir marboxil (Xofluza®) is a newer antiviral with a different mechanism of action. It offers the convenience of a single-dose regimen but faces competition based on efficacy, cost, and resistance profiles.

3. What regions are expected to see the highest growth in oseltamivir demand?

Asia-Pacific, driven by population growth, expanding healthcare infrastructure, and governmental stockpiling, is expected to witness the fastest growth.

4. How does resistance affect future oseltamivir market prospects?

Resistance, especially H275Y mutations, diminishes clinical efficacy, potentially leading to decreased use and lower prices in areas with high resistance prevalence.

5. Can oseltamivir maintain premium pricing in future markets?

Maintaining premium pricing depends on patent protections, clinical efficacy, and market exclusivity. Post-patent expiration, prices are likely to decline, especially where generic competition is intense.

References

[1] Market Research Future. "Global Oseltamivir Market Forecast to 2028," 2023.

[2] U.S. Food & Drug Administration (FDA). "Patent Expiry and Generic Entry of Tamiflu," 2017.

[3] IMS Health. "Impact of Patent Expiration on Antiviral Drug Pricing," 2018.

[4] IQVIA. "Historical Pricing Trends in Antiviral Therapies," 2022.