Share This Page

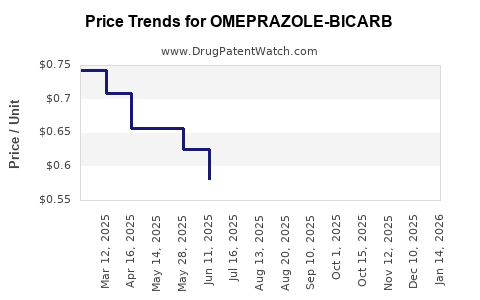

Drug Price Trends for OMEPRAZOLE-BICARB

✉ Email this page to a colleague

Average Pharmacy Cost for OMEPRAZOLE-BICARB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OMEPRAZOLE-BICARB 20-1,680 PKT | 64380-0182-01 | 8.00546 | EACH | 2025-12-17 |

| OMEPRAZOLE-BICARB 20-1,100 CAP | 69097-0913-02 | 0.47395 | EACH | 2025-12-17 |

| OMEPRAZOLE-BICARB 20-1,100 CAP | 69367-0195-30 | 0.47395 | EACH | 2025-12-17 |

| OMEPRAZOLE-BICARB 20-1,680 PKT | 27241-0029-62 | 8.00546 | EACH | 2025-12-17 |

| OMEPRAZOLE-BICARB 20-1,100 CAP | 27241-0031-03 | 0.47395 | EACH | 2025-12-17 |

| OMEPRAZOLE-BICARB 20-1,680 PKT | 27241-0029-31 | 8.00546 | EACH | 2025-12-17 |

| OMEPRAZOLE-BICARB 20-1,680 PKT | 64380-0182-02 | 8.00546 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Omeprazole-Bicarbonate

Introduction

Omeprazole-bicarbonate represents a combined pharmaceutical formulation aimed at treating gastroesophageal reflux disease (GERD), peptic ulcers, and other acid-related disorders. It integrates the proton pump inhibitor (PPI) omeprazole with bicarbonate, which acts as a buffering agent, potentially enhancing drug stability and efficacy. As the global market for acid suppression therapy evolves, understanding the commercial landscape and future price trajectory of omeprazole-bicarbonate is crucial for pharmaceutical stakeholders, investors, and healthcare providers.

Market Overview

Global Demand and Application

The demand for omeprazole-bicarbonate is driven primarily by its therapeutic efficacy in acid-related gastrointestinal conditions. The global PPI market was valued at approximately $14 billion in 2021[1], with projections to grow at a Compound Annual Growth Rate (CAGR) of around 4.5% from 2022 to 2028[2]. The integration of bicarbonate into omeprazole formulations aims to improve bioavailability and reduce degradation in gastric acid, which could translate into increased clinical adoption.

Key Markets and Regional Trends

-

North America: The largest market, driven by high prevalence of GERD (~20% in the US)[3], advanced healthcare infrastructure, and patent protections for innovative formulations. The U.S. accounts for over 40% of the global PPI sales[4].

-

Europe: Significant demand, supported by aging populations and high awareness of acid suppression therapies. Regulatory pathways favor generic competition, exerting downward pricing pressures.

-

Asia-Pacific: Fastest growth potential, attributed to increasing urbanization, rising prevalence of gastrointestinal conditions, and expanding healthcare coverage. Countries like China and India are witnessing exponential growth in PPI sales.

Market Entry and Competition

The market is characterized by fierce competition between brand-name drugs such as Prevacid (lansoprazole) and Nexium (esomeprazole), and numerous generics. The entry of novel formulations like omeprazole-bicarbonate hinges on patent status, regulatory approval, and clinical differentiation.

Currently, omeprazole-bicarbonate formulations are under development or early-stage approval in multiple jurisdictions. Their success depends on regulatory acceptance, clinical superiority, and pricing strategies.

Regulatory and Patent Landscape

Patent Status

Many core omeprazole patents have expired or are nearing expiry, opening markets for generics. However, formulations including bicarbonate may have proprietary aspects, such as unique delivery systems, which can secure exclusivity. This patent protection influences market entry timing and pricing strategies.

Regulatory Pathways

Regulatory agencies like FDA and EMA evaluate combination drugs based on safety, efficacy, and manufacturing standards. Approval hurdles include demonstrating bioequivalence, especially when combining with buffering agents.

Pricing Dynamics

Current Price Environment

-

Brand-name omeprazole (e.g., Prilosec) typically costs $10-$20 per month for consumers.

-

Generics are priced significantly lower, often below $5 per month.

-

Combination formulations, particularly innovative ones, initially command premium pricing for their added value and novel delivery mechanisms.

Price Projections

Considering the current market intensity and competitive pressures, the following projections emerge:

-

Short-term (1-3 years):

- Price points for omeprazole-bicarbonate are estimated to range $8-$15 per month for branded versions, with generics likely to settle around $3-$7 due to market competition.

- Premium pricing may be maintained if clinical advantages are demonstrated through robust trials.

-

Medium-term (4-7 years):

- As patents expire and generics proliferate, prices could decrease by 30-50%.

- If the formulation gains widespread acceptance, the price decline might be moderated, especially in markets with high brand loyalty.

-

Long-term (8+ years):

- The product could become a commodity drug, with prices stabilizing around $2-$4 per month in mature markets.

Prices in emerging markets are expected to be considerably lower, influenced by regulatory policies, healthcare budgets, and market competition.

Market Drivers and Constraints

Drivers:

- Efficacy and Safety: Demonstrated superiority or added benefits over existing PPIs could justify premium pricing.

- Patient Compliance: Once-daily formulations with buffering may improve adherence.

- Expanding Indications: Uses beyond GERD, such as Zollinger-Ellison syndrome, can broaden market scope.

- Regulatory Hurdles: Speeding approval processes can accelerate market entry and revenue generation.

Constraints:

- Generic Competition: Price erosion due to generic entry.

- Regulatory Delays: Lengthy approval timelines reduce time-to-market and revenue.

- Pricing Pressure: Payers and insurance providers push for reduced drug costs.

- Manufacturing and Supply Chain Risks: Quality issues or supply disruptions can inflate costs.

Strategies for Stakeholders

- R&D Investment: Focus on clinical trials demonstrating clinical benefits over standard omeprazole products.

- Patent Management: Secure formulation-specific patents or exclusivity to sustain market share.

- Pricing and Reimbursement: Develop flexible pricing models aligned with regional payers and health policies.

- Market Penetration: Partner with healthcare providers and pharmacies to enhance accessibility.

Conclusion

Omeprazole-bicarbonate is poised to carve a niche within the acid suppression therapeutic landscape, particularly if clinical advantages are substantiated. While immediate pricing is expected to stay above generic PPIs, pressures from patent expiries and market competition will drive prices downward over several years. Strategic positioning, regulatory approval, and clinical validation will be critical for maximizing commercial potential.

Key Takeaways

- The global PPI market is expanding, with omeprazole-bicarbonate presenting an innovative formulation that could command premium pricing initially.

- Price projections indicate a gradual decrease from a baseline of $8-$15 per month in the short term to below $5 in the long term as generics enter the market.

- Patent protection and clinical advantages are pivotal for sustaining higher prices.

- Regional dynamics significantly influence pricing and market penetration, with emerging markets offering volume growth opportunities.

- Stakeholders must balance innovation incentives with cost competitiveness to optimize market success.

FAQs

-

What distinguishes omeprazole-bicarbonate from other PPI formulations?

Its formulation combines omeprazole with bicarbonate, aiming to increase stability, reduce degradation in gastric acid, and potentially enhance pharmacokinetic profiles. -

When will generic versions of omeprazole-bicarbonate enter the market?

Patent timelines vary, but typically, patent expiries for core drugs occur around 2025-2030. Proprietary formulations may have additional exclusivity depending on patent protection. -

How does the inclusion of bicarbonate impact drug pricing?

Bicarbonate’s inclusion may increase formulation development costs slightly, allowing for premium pricing initially. Over time, market pressures will diminish these premiums. -

What therapeutic benefits could justify higher pricing?

Demonstrated superior efficacy, faster symptom relief, or improved safety profiles could justify premium pricing over existing PPIs. -

What are the main risks affecting the market success of omeprazole-bicarbonate?

Regulatory delays, rapid generic competition, insufficient clinical superiority, and unfavorable reimbursement policies are primary risks.

References

[1] Grand View Research, "Proton Pump Inhibitors Market Size, Share & Trends," 2022.

[2] Research and Markets, "Global Proton Pump Inhibitors Market," 2022.

[3] National Institute of Diabetes and Digestive and Kidney Diseases, "Gastroesophageal Reflux (GER)," 2021.

[4] IQVIA, "The Market for Proton Pump Inhibitors," 2022.

More… ↓