Share This Page

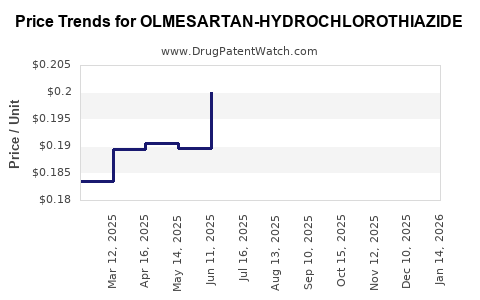

Drug Price Trends for OLMESARTAN-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for OLMESARTAN-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OLMESARTAN-HYDROCHLOROTHIAZIDE 20-12.5 MG TAB | 33342-0173-10 | 0.16890 | EACH | 2025-12-17 |

| OLMESARTAN-HYDROCHLOROTHIAZIDE 20-12.5 MG TAB | 33342-0173-07 | 0.16890 | EACH | 2025-12-17 |

| OLMESARTAN-HYDROCHLOROTHIAZIDE 40-25 MG TAB | 72603-0292-02 | 0.20845 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Olmesartan-Hydrochlorothiazide

Introduction

Olmesartan-Hydrochlorothiazide, a fixed-dose combination medication, is indicated primarily for the management of hypertension. As a dual-action antihypertensive agent, it combines a potent angiotensin II receptor blocker (Olmesartan) with a diuretic (Hydrochlorothiazide), offering enhanced blood pressure control. Understanding its market dynamics and pricing trends is essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Landscape and Competitive Positioning

Global Market Overview

The global antihypertensive drugs market was valued at approximately USD 31.8 billion in 2021 and is projected to reach USD 50 billion by 2027, growing at a CAGR of around 8%[1]. Fixed-dose combinations (FDCs) like Olmesartan-Hydrochlorothiazide constitute a significant subset of this market, driven by rising hypertension prevalence and the demand for simplified treatment regimens.

Prevalence of Hypertension and Market Drivers

Hypertension affects over 1.2 billion people worldwide, with rising cases in low- and middle-income countries[2]. Factors such as aging populations, sedentary lifestyles, obesity, and increased awareness contribute to expanding the market. Healthcare providers increasingly favor FDCs like Olmesartan-Hydrochlorothiazide due to better adherence, fewer pill burdens, and improved therapeutic efficacy.

Key Competitors and Market Share

The FDC antihypertensive segment is populated by several formulations, including combinations like Amlodipine-Valsartan, Lisinopril-Hydrochlorothiazide, and Telmisartan-Hydrochlorothiazide. Olmesartan-Hydrochlorothiazide holds a competitive position due to its superior tolerability profile and proven efficacy, especially in resistant hypertension cases.

Major pharmaceutical manufacturers, including Daiichi Sankyo (the original developer), Novartis, and Teva, have introduced generic versions post-patent expiry, intensifying market competition.

Patent and Regulatory Landscape

Daiichi Sankyo markets branded Olmesartan-Hydrochlorothiazide under the brand name Benicar-HCT. Patent protections lasting until approximately 2025-2027 in key regions have prevented generics until then. Market entry of generics is expected to induce significant price reductions, as observed with other antihypertensive FDCs.

Regulatory pathways such as the FDA’s ANDA process enable rapid generic approvals post-patent expiry, intensifying competitive pressures.

Pricing Strategies and Projections

Historical Pricing Trends

In the US, the branded Olmesartan-Hydrochlorothiazide branded product was initially priced around USD 300-350 per month (approximately USD 10-12 per pill). Post-patent expiry, generic versions entered the market at approximately 50-70% discount, bringing prices down to USD 100-150 per month, aligning with generic antihypertensives[3].

Impact of Generic Entry

Likely post-2025, the market will experience a sharp decline in prices due to increased generic competition. Historically, similar FDCs have seen price reductions of 60-80% within two years of generic entry. Consequently, the average wholesale price (AWP) could fall below USD 50 per month for a standard prescription.

Future Price Projections (2023-2030)

| Year | Estimated Average Wholesale Price (USD/month) | Key Factors |

|---|---|---|

| 2023 | USD 250 – 300 (branded) | Limited generic competition; patent protections still in effect |

| 2024 | USD 200 – 250 | Anticipation of patent expiry; initial generic launches |

| 2025 | USD 100 – 150 | Increased generic market penetration; price erosion begins |

| 2026 | USD 60 – 90 | Widespread generic availability; price stabilization |

| 2027 | USD 45 – 70 | Post-patent expiry; generic dominance solidified |

| 2028–2030 | USD 40 – 50 | Market maturation; potential biosimilar or alternative formulations emerging |

Regional Variations

Pricing is notably heterogeneous by region. In emerging markets like India and Brazil, prices are generally lower (~USD 10-20/month), owing to different regulatory and reimbursement frameworks. Developed markets (US, EU) exhibit higher prices pre- and post-generic entry, reflecting higher healthcare costs and premium pricing strategies.

Market Drivers Influencing Future Pricing

- Patent expirations: Primarily 2025–2027, catalyzing price reductions.

- Regulatory approvals: Factors such as accelerated generic approvals and biosimilars impact market entry timing.

- Insurance coverage and reimbursement policies: These influence patient access and thus price elasticity.

- Competitive innovation: Development of improved formulations or combination therapies may affect pricing strategies.

Market Opportunities and Challenges

Opportunities

- Growing hypertensive patient pool offers expanding demand.

- Combination therapies improve adherence and offer growth avenues.

- Generic proliferation presents opportunities for cost leadership and market share gains.

Challenges

- Price erosion due to generic entry pressures.

- Regulatory hurdles in different markets.

- Market saturation in high-income regions.

- Emerging competition from novel antihypertensive agents and biosimilars.

Regulatory and Patent Strategies

Proprietary protection in major markets remains a critical factor. Companies should monitor patent filings and litigation, which could delay generic entry or provide opportunities for secondary patents. Post-patent strategies include launching authorized generics, pricing variations, and market segmentation to preserve margins.

Final Recommendations for Stakeholders

- Pharmaceutical companies should prepare for generic competition by diversifying product portfolios for Olmesartan-Hydrochlorothiazide or investing in innovative formulations.

- Investors should anticipate significant price reductions post-2025, affecting revenue streams.

- Healthcare providers should consider cost-effective prescribing strategies aligning with evolving market prices.

Key Takeaways

- The market for Olmesartan-Hydrochlorothiazide is poised for substantial change post-patent expiry circa 2025, with prices projected to decline by up to 80% within three years.

- Competitive pressures from generics and biosimilars will intensify, necessitating strategic positioning for stakeholders.

- Regional disparities impact pricing strategies and market access; emerging markets present growth opportunities due to lower prices and increasing hypertension prevalence.

- Formulation innovation and combination approaches remain critical for maintaining market share amid competition.

- Regulatory trends and patent landscapes will significantly influence pricing trajectories and market timing.

FAQs

1. When is Olmesartan-Hydrochlorothiazide expected to face significant generic competition?

Patent protections are anticipated to expire around 2025–2027 in major markets like the US and EU, opening the door for generic versions and consequent pricing declines.

2. How much can prices for Olmesartan-Hydrochlorothiazide decrease after patent expiry?

Historical data on similar antihypertensive FDCs suggest price reductions of approximately 60–80% within two to three years of generic market entry.

3. What are the main factors influencing regional price differences?

Regulatory environments, healthcare reimbursement policies, market maturity, and competitive landscape drive regional variations in drug pricing.

4. Are there opportunities for branded formulations post-generic entry?

Yes, through value-added services, differentiated formulations, or improved delivery systems, branded manufacturers can maintain a niche despite price erosion.

5. How should healthcare providers adapt their prescribing practices?

Providers should prioritize cost-effective generics when clinically appropriate, monitor evolving formularies, and consider patient adherence benefits associated with combination therapies.

References

[1] MarketWatch. "Antihypertensive Drugs Market Size & Forecast." 2022.

[2] World Health Organization. "Hypertension." 2022.

[3] IQVIA. "US Prescription Drug Price Trends." 2022.

More… ↓