Share This Page

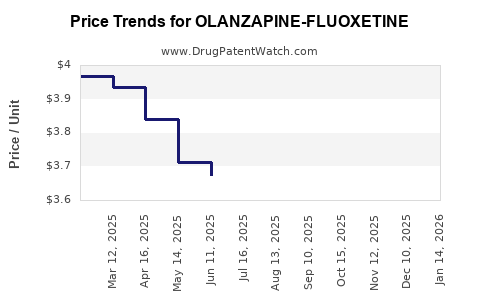

Drug Price Trends for OLANZAPINE-FLUOXETINE

✉ Email this page to a colleague

Average Pharmacy Cost for OLANZAPINE-FLUOXETINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OLANZAPINE-FLUOXETINE 3-25 MG | 00093-5503-56 | 3.82170 | EACH | 2025-12-17 |

| OLANZAPINE-FLUOXETINE 6-25 MG | 00093-5504-56 | 4.52810 | EACH | 2025-12-17 |

| OLANZAPINE-FLUOXETINE 12-50 MG | 49884-0253-11 | 7.55092 | EACH | 2025-12-17 |

| OLANZAPINE-FLUOXETINE 6-25 MG | 49884-0250-11 | 4.52810 | EACH | 2025-12-17 |

| OLANZAPINE-FLUOXETINE 3-25 MG | 49884-0277-11 | 3.82170 | EACH | 2025-12-17 |

| OLANZAPINE-FLUOXETINE 6-50 MG | 49884-0251-11 | 4.89871 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Olanzapine-Fluoxetine

Introduction

Olanzapine-Fluoxetine is a fixed-dose combination medication primarily utilized for the treatment of bipolar disorder, treatment-resistant depression, and major depressive disorder with comorbid bipolar I disorder or obsessive-compulsive disorder. This combination leverages olanzapine's antipsychotic properties alongside fluoxetine’s selective serotonin reuptake inhibitor (SSRI) effects, offering a comprehensive therapeutic profile. As a branded entity, the combination currently exists primarily under patent protection, but generic competition is anticipated as patents expire. This article explores the current market landscape, competitive dynamics, regulatory environment, and provides price projections over the next five years.

Market Landscape Overview

Current Therapeutic Context

The global mental health market remains robust, driven by rising awareness, increasing prevalence of psychiatric disorders, and innovations in pharmacotherapy. The combination therapy of olanzapine and fluoxetine, marketed notably under branded names such as Symbyax (by Eli Lilly), constitutes a significant segment within psychiatric medications, especially for treatment-resistant conditions [1].

Market Size and Segmentation

The global bipolar disorder treatment market was valued at approximately USD 1.4 billion in 2022, with olanzapine-fluoxetine combinations representing a notable share owing to their efficacy and unique pharmacological profile [2]. North America dominates the market, accounting for around 45% of sales, driven by high prevalence rates and healthcare expenditure. Upcoming approvals and expanded indications in Asia-Pacific and Europe could expand the market scope.

Key Players and Patent Status

Eli Lilly’s Symbyax remains the dominant branded product. However, patent expirations in the coming years, expected around 2025-2028, will catalyze generic entry, intensifying price competition. No significant biosimilar variants are currently in the pipeline, but generic olanzapine and fluoxetine are well-established, facilitating potential combination generic formulations.

Regulatory and Patent Dynamics

The patent landscape is pivotal in shaping market access and pricing strategies. Eli Lilly’s patent for Symbyax expired or is set to expire soon in various jurisdictions, opening the door for generics. Regulatory agencies like the FDA approve generic equivalents based on bioequivalence, which often precipitates rapid market penetration. Additionally, minor modifications or extended-release formulations could influence patent life and competitive strategies.

Competitive Dynamics and Market Entry Considerations

Generic Competition

Once patent exclusivity ends, generic manufacturers are poised to launch olanzapine-fluoxetine combinations. Given the widespread availability of generic olanzapine and fluoxetine separately, creating combination generics is feasible and cost-effective. The entry of multiple generic players is expected to exert significant downward pressure on prices.

Market Differentiators

Branded formulations may maintain premium pricing through strategies emphasizing stability, patient adherence (fixed-dose convenience), and validated efficacy. However, efficacy differences are unlikely to be substantial compared to generics, emphasizing price as a key competitive factor.

Pricing Flexibility and Reimbursement Policies

Pricing strategies will also be influenced by reimbursement frameworks across key markets. Countries like the US, with higher drug prices and complex insurance reimbursement dynamics, may see broader disparities between branded and generic prices. Conversely, countries with centralized healthcare systems may implement price controls or tendering processes, suppressing price growth.

Price Projection Analysis

Factors Influencing Future Pricing

- Patent expiration timelines: Critical in defining the window of premium prices versus subsequent generic price erosion.

- Market penetration of generics: As more entrants commercialize, prices tend to decline sharply.

- Regulatory landscape: Stringent bioequivalence standards and regulatory delays may influence generic availability.

- Market acceptance and physician prescribing behaviors: Brand loyalty and clinical perceptions impact transition rates.

- Reimbursement policies: Impact net prices, especially in public health systems.

Projected Price Trends (2023-2028)

| Year | Estimated Average Price (USD) per Unit | Comments |

|---|---|---|

| 2023 | $450–$500 | Peak pricing during patent exclusivity; high brand premiums |

| 2024 | $420–$470 | Increased awareness of patent expiry; preliminary generic entry preparations |

| 2025 | $380–$430 | Patent expiry in select markets; generic launches commence |

| 2026 | $250–$350 | Price erosion accelerates with multiple generic options |

| 2027 | $150–$250 | Market fully saturated with generics; significant price decline |

| 2028 | $100–$200 | Price stabilization; small niche or specialty pricing remains |

Note: Prices are expressed as average wholesale prices (AWP) or gross-to-net estimates. Regional variations may influence actual prices.

Implications of Price Erosion

The transition from branded to generic dominance typically results in over 50% price reductions within two years post-patent expiry, aligning with trends observed in other psychiatric medications. The eventual stabilization of prices hinges on market size, number of competitors, and regulatory factors.

Market Opportunities and Challenges

Opportunities

- Expanding indications: Label extensions for conditions like obsessive-compulsive disorder and treatment-resistant depression can sustain premium pricing.

- Combination formulations: Developing extended-release or more convenient formulations as branded alternatives.

- Emerging markets: Growing healthcare infrastructure and diagnosis rates in Asia-Pacific and Latin America provide expansion avenues.

Challenges

- Price competition post-patent expiry: Rapid generic proliferation constrains profitability.

- Regulatory hurdles: Stringent bioequivalence and approval processes may delay generic entry.

- Market saturation: Hyper-competition could reduce margins for both generic and branded products.

Key Takeaways

- The olanzapine-fluoxetine combination maintains an essential niche in psychiatric treatment but faces imminent patent expiry, which will significantly impact pricing.

- The market is poised for rapid price erosion post-patent expiration, with an estimated 50–70% reduction within two years.

- Strategic development of generic combination products will accelerate affordability, increasing access but exerting pressure on profit margins.

- Differentiation through formulation innovation, expanded indications, or enhanced compliance features could sustain premium pricing for branded versions.

- Navigating reimbursement landscapes and regional regulatory environments is crucial for optimizing market share and pricing strategies.

FAQs

1. When will the patent for Symbyax expire, allowing for generic competition?

Eli Lilly’s patent for Symbyax is expected to expire around 2025-2026 in key markets like the US and Europe, paving the way for generic formulations.

2. How will generic entry affect the pricing of olanzapine-fluoxetine?

Generic entry typically reduces prices by 50–70% within two years, substantially decreasing market revenue for branded products.

3. Are there any new formulations or indications for olanzapine-fluoxetine in development?

Currently, no major new formulations or indications are announced, but ongoing clinical research in expanding psychiatric indications may influence future market dynamics.

4. What regions offer the highest growth potential for olanzapine-fluoxetine?

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer significant growth potential due to rising mental health awareness and expanding healthcare infrastructure.

5. How do price controls influence the market for psychiatric medications like olanzapine-fluoxetine?

Price controls in countries with centralized healthcare systems tend to suppress prices post-generic entry, impacting profitability but improving access.

References:

- MarketWatch. (2022). Psychiatric Drugs Market Analysis.

- Research and Markets. (2023). Global Bipolar Disorder Treatment Market Report.

- FDA. (2022). Bioequivalence Guidelines for Generic Drugs.

- Eli Lilly. (2022). Symbyax Product Monograph.

- IQVIA. (2023). Pharmaceutical Market Trends and Forecasts.

More… ↓