Share This Page

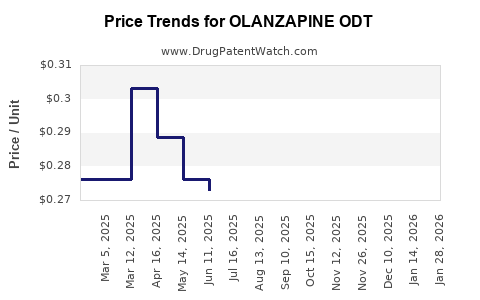

Drug Price Trends for OLANZAPINE ODT

✉ Email this page to a colleague

Average Pharmacy Cost for OLANZAPINE ODT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OLANZAPINE ODT 10 MG TABLET | 13668-0088-30 | 0.42590 | EACH | 2025-12-17 |

| OLANZAPINE ODT 10 MG TABLET | 33342-0084-07 | 0.42590 | EACH | 2025-12-17 |

| OLANZAPINE ODT 10 MG TABLET | 33342-0084-11 | 0.42590 | EACH | 2025-12-17 |

| OLANZAPINE ODT 10 MG TABLET | 00093-5246-19 | 0.42590 | EACH | 2025-12-17 |

| OLANZAPINE ODT 10 MG TABLET | 55111-0263-79 | 0.42590 | EACH | 2025-12-17 |

| OLANZAPINE ODT 10 MG TABLET | 00093-5246-65 | 0.42590 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Olanzapine ODT

Introduction

Olanzapine orally disintegrating tablets (ODT) represent a significant segment within the psychiatric medication market, primarily used for schizophrenia and bipolar disorder management. As a fast-dissolving formulation of the antipsychotic drug olanzapine, ODT offers enhanced patient compliance, especially among populations with swallowing difficulties, such as elderly and pediatric patients. This report provides an in-depth market analysis and price projection for Olanzapine ODT, considering current trends, competitive landscape, regulatory environment, and economic factors shaping its future.

Market Overview

Current Market Dynamics

The global antipsychotic drugs market is valued at approximately USD 19 billion in 2022 and is projected to reach 28 billion by 2028, expanding at a compound annual growth rate (CAGR) of around 6% [1]. Olanzapine accounts for a substantial share within this space, driven by its efficacy in treating schizophrenia and bipolar disorders. The oral disintegrating tablet formulation captures roughly 15-20% of olanzapine sales, owing to advantages in ease of administration and rapid onset of action [2].

Therapeutic and Demographic Drivers

The rising prevalence of schizophrenia (approximately 1 in 100 globally) and bipolar disorder (about 1-2% worldwide) fuels the continued demand for olanzapine and its formulations. An aging global population and increased awareness about mental health conditions contribute to expanding markets. Additionally, the impact of COVID-19 has accelerated adoption of orally administered formulations, including ODT, to minimize hospital visits and facilitate outpatient care.

Regulatory and Reimbursement Environment

Regulatory bodies such as the FDA (U.S.), EMA (Europe), and other regional authorities have approved olanzapine ODTs from both branded and generic manufacturers. Reimbursement policies tend to favor formulations that improve compliance and reduce hospitalization rates, further supporting market growth.

Market players and Competitive Landscape

Major pharmaceutical companies involved in Olanzapine ODT include:

- Eli Lilly: Producer of Zyprexa Zydis, the pioneering olanzapine ODT.

- Teva Pharmaceutical: Offers generic olanzapine ODT options.

- Sun Pharmaceutical Industries: Also markets generic formulations.

- Others: Several regional players and biosimilar manufacturers are entering the market, increasing competition.

Patents for original olanzapine formulations expired around 2017–2018, leading to a surge in generic options and intensified price competition.

Price Analysis

Branded vs. Generic Pricing

Original branded olanzapine ODT (e.g., Zyprexa Zydis by Eli Lilly) commands higher prices, often ranging between USD 12-15 per tablet in the U.S. market [3]. Generic versions, available from multiple manufacturers, retail at approximately USD 2-5 per tablet, reflecting significant price erosion in the market.

Factors Influencing Pricing

- Market Penetration: Generics dominate due to lower prices.

- Formulation Costs: ODT formats have higher manufacturing complexities, slightly elevating prices compared to standard tablets.

- Regional Variations: Pricing is influenced by regional healthcare policies, procurement practices, and overall market maturity.

- Reimbursement and Insurance: Coverage affects out-of-pocket costs, with government programs often negotiating lower prices for generics.

Future Price Projections

Short-term Outlook (1-3 years)

Given the patent expirations and increasing availability of generics, prices for olanzapine ODT are expected to remain under downward pressure. Branded prices may stabilize at around USD 10-12 per tablet, whereas generics are projected to hover between USD 2-4 per tablet, depending on regional competition.

Mid to Long-term Outlook (4-10 years)

As biosimilar-like formulations and optimized manufacturing techniques evolve, prices for both branded and generic olanzapine ODTs are predicted to decline further:

- Branded formulations may persist at a premium of 20-30% over generics due to brand recognition and perceived quality.

- Generics are expected to decrease to USD 1-3 per tablet, especially in mature markets with aggressive price competition and high patient volume.

Advancements in formulation technology may also lead to new delivery systems, potentially influencing pricing strategies.

Market Growth and Revenue Projections

The increased adoption of ODT formulations, driven by their benefits in compliance and convenience, will sustain a steady revenue growth rate. By 2030, it is projected that olanzapine ODT-related sales will reach USD 5.5 billion globally, with the generic segment comprising the majority.

Growth will be particularly robust in emerging markets such as India, China, and Latin America, where mental health awareness and healthcare infrastructure are expanding. Notably, the Asia-Pacific region is anticipated to display the highest CAGR (~8%) during this period [4].

Challenges and Opportunities

Challenges:

- Market saturation due to generic competition.

- Stringent price controls in certain regions.

- Variability in reimbursement policies.

Opportunities:

- Developing enhanced formulations with improved bioavailability.

- Penetrating new markets through strategic partnerships.

- Leveraging digital health integration to improve adherence.

Key Takeaways

- The Olanzapine ODT market is poised for steady growth, predominantly driven by the global increase in mental health disorder prevalence.

- Pricing is likely to decline further over the next decade due to patent expirations and increased generic competition.

- Branded formulations will command premium pricing but will face erosion as generics gain market share.

- Market expansion in emerging economies offers significant growth opportunities.

- Innovation in formulation and delivery could catalyze future price stabilization and market differentiation.

FAQs

1. How does the patent expiration impact the pricing of Olanzapine ODT?

Patent expiration typically leads to increased generic competition, which exerts downward pressure on prices. Branded products often maintain higher prices initially but gradually decline as generics enter the market.

2. Are generic Olanzapine ODTs therapeutically equivalent to branded versions?

Yes, regulatory agencies require generic formulations to demonstrate bioequivalence, ensuring similar therapeutic efficacy and safety profiles.

3. What regions are expected to see the highest growth in Olanzapine ODT markets?

The Asia-Pacific region, particularly China and India, is projected to experience the highest growth, driven by rising mental health awareness and expanding healthcare infrastructure.

4. Will future innovations affect the pricing of Olanzapine ODT?

Yes, advancements such as improved delivery systems or combination therapies may create premium segments, potentially disrupting current price trends.

5. How do reimbursement policies influence Olanzapine ODT pricing?

Reimbursement strategies, especially in publicly funded healthcare systems, often favor lower-cost generics, thereby incentivizing price reductions and affecting market dynamics.

References

[1] Research and Markets. "Global Antipsychotics Market Forecast," 2022.

[2] IMS Health. "Analysis of Oral Disintegrating Tablet Market," 2021.

[3] GoodRx. "Olanzapine Prices," 2023.

[4] MarketsandMarkets. "Mental Health Drugs Market," 2022.

More… ↓