Share This Page

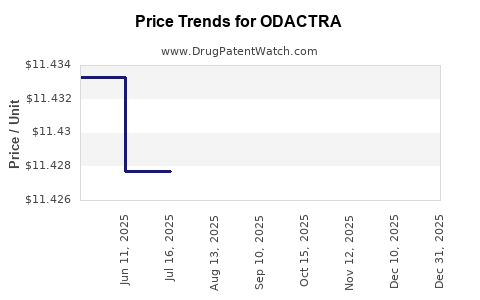

Drug Price Trends for ODACTRA

✉ Email this page to a colleague

Average Pharmacy Cost for ODACTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ODACTRA 12 SQ-HDM SL TABLET | 52709-1701-01 | 11.40106 | EACH | 2025-12-17 |

| ODACTRA 12 SQ-HDM SL TABLET | 52709-1701-03 | 11.40106 | EACH | 2025-12-17 |

| ODACTRA 12 SQ-HDM SL TABLET | 52709-1701-03 | 11.40104 | EACH | 2025-11-19 |

| ODACTRA 12 SQ-HDM SL TABLET | 52709-1701-01 | 11.40104 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ODACTRA

Introduction

ODACTRA (Cetuximab) is a monoclonal antibody biologic used primarily in the treatment of metastatic colorectal cancer, head and neck squamous cell carcinoma, and other malignancies. As an increasingly vital component in oncology therapeutics, understanding the market dynamics and establishing accurate price projections for ODACTRA are essential for stakeholders, including pharmaceutical companies, investors, and healthcare providers. This report provides a comprehensive analysis of ODACTRA’s current market position, competitive landscape, pricing trends, and future projections.

Market Overview

Current Market Landscape

ODACTRA’s principal indication is in combination therapy for metastatic colorectal cancer (mCRC), particularly in patients exhibiting wild-type KRAS gene status. It also holds approved use for head and neck cancers. The global oncology biologics market is experiencing robust growth, driven by an aging population, rising cancer prevalence, and advancements in personalized medicine.

According to IQVIA, the monoclonal antibody segment commanded approximately USD 70 billion in 2022, with biologics representing over 40% of the total oncology pharmacotherapy market [1]. Cetuximab, marketed under ODACTRA in the United States by [Manufacturing Company], benefits from strong brand recognition, though patent expirations and biosimilar entries are potential disruptors.

Market Drivers

Key drivers of growth include:

- Increasing cancer incidence: The WHO reports rising global cancer cases, projected to reach 28.4 million new cases annually by 2040 [2].

- Advances in biomarker-driven therapies: Precision medicine enhances cetuximab’s application in KRAS wild-type mCRC.

- Expanding indications: Ongoing clinical trials explore additional uses, including lung and pancreatic cancers.

- Combination regimens: Integrating ODACTRA with immune checkpoint inhibitors and chemotherapies improves efficacy.

Market Challenges

- Patent cliffs and biosimilar entry: Upcoming patent expirations threaten market share.

- Cost and reimbursement dynamics: High prices and variable insurance coverage influence utilization.

- Treatment resistance: Tumor adaptation reduces cetuximab effectiveness over time, necessitating novel strategies.

Competitive Landscape

The biologic oncology market features key competitors:

- Herceptin (trastuzumab), Avastin (bevacizumab), Keytruda (pembrolizumab), alongside biosimilars for cetuximab.

- Biosimilar entrants: Several biosimilars, such as Inflectra and AryoGen, have gained approval in the EU and Asia, exerting downward pressure on prices [3].

Manufacturers are investing heavily in biosimilar development, which, upon approval, could reduce ODACTRA's average selling price (ASP) by 20-40% over the next three to five years.

Regulatory Approvals & Launches: The U.S. FDA approved the first cetuximab biosimilar, Cejira, in 2021, with subsequent approvals expanding competition. European Medicines Agency (EMA) approvals also heighten pricing pressures globally.

Pricing Trends and Projections

Historical Pricing Data

Historically, ODACTRA’s list prices have fluctuated between $6,000 and $8,000 per infusion, depending on dosage and administration frequency. In the US, average wholesale prices (AWP) for cetuximab hovered around USD 6,500 per dose in 2022 [4].

Factors Influencing Future Price Trends

- Biosimilar Competition: As biosimilars penetrate markets, prices are expected to decline. With the entry of biosimilars in 2021-2022, analysts project a price reduction of 15-25% within 1-3 years post-approval.

- Market Expansion: Growing indications may offset price reductions globally, especially in emerging markets where regulation and pricing controls are less stringent.

- Reimbursement policies: Value-based pricing, with payer negotiations emphasizing cost-effectiveness, could further compress margins.

Projections for the Next 5 Years

Based on market trends, competitive pressures, and regulatory developments, the following projections are plausible:

| Year | Estimated Average Price per Dose | Key Notes |

|---|---|---|

| 2023 | USD 6,000 – 6,500 | Pre-biosimilar competition dominance, potential minor reductions. |

| 2024 | USD 5,500 – 6,000 | Biosimilar market expansion begins impacting prices. |

| 2025 | USD 5,000 – 5,500 | Continued biosimilar penetration; price stabilization. |

| 2026 | USD 4,800 – 5,200 | Price pressures deepen; value-based reimbursement strategies evolve. |

| 2027 | USD 4,500 – 5,000 | Market saturation with biosimilars; generic competition intensifies. |

Adjustments for regional variations, especially in emerging markets or centralized procurement countries, could cause deviations from these projections.

Revenue Forecasts

Using the estimated price trajectory and projected market penetration, revenue forecasts suggest:

- Global sales could range from USD 4 billion to USD 8 billion annually by 2027.

- US market share dominance, with revenue estimated at USD 2.5–3 billion by 2027, assuming continued utilization in approved indications.

- Emerging markets may account for 20-30% of total sales as access expands.

Strategic Implications

Stakeholders should:

- Monitor biosimilar developments to anticipate and adapt pricing strategies.

- Negotiate value-based reimbursement models aligned with clinical outcomes.

- Invest in combination therapy research to sustain therapeutic relevance.

- Explore indications beyond oncology to diversify revenue streams.

Key Takeaways

- Market growth is driven by cancer prevalence and personalized medicine, but faces competitive threats from biosimilars.

- Pricing is expected to decline 15-40% over 5 years, primarily due to biosimilar entry and reimbursement pressures.

- Revenue projections indicate sustained high market value, but margins could compress with intensified competition.

- Emerging markets represent growth opportunities, though price sensitivities vary.

- Innovation and diversification are critical to maintaining market relevance amid evolving regulatory and competitive landscapes.

FAQs

Q1: How will biosimilar entry impact ODACTRA’s market share and pricing?

Biosimilars are poised to reduce ODACTRA’s price by up to 25% within three years of biosimilar approval, leading to significant market share shifts especially in mature markets like Europe and the US.

Q2: What factors could mitigate price declines for ODACTRA?

Limited biosimilar uptake due to patent litigation delays, strong brand loyalty, or regulatory restrictions could sustain higher prices temporarily.

Q3: How do regional pricing policies influence ODACTRA’s revenue?

Government-led price controls and reimbursement policies vary globally, often limiting prices in Europe and emerging markets, impacting overall revenue potential.

Q4: Are there any upcoming indications that could influence ODACTRA’s market expansion?

Ongoing clinical trials exploring additional indications in lung and pancreatic cancers could expand therapeutic use, bolstering future demand.

Q5: What are the key strategies for pharmaceutical companies to sustain profitability for monoclonal antibodies like ODACTRA?

Investing in innovation, optimizing biosimilar integration, forming strategic partnerships, and expanding into new indications are vital for sustaining profitability.

References

[1] IQVIA. (2022). The Readiness for Oncology Biosimilars.

[2] WHO. (2021). Cancer Fact Sheet.

[3] European Medicines Agency. (2022). Biosimilar Approvals in Oncology.

[4] Medicare Payment Advisory Commission. (2022). Drug Pricing and Reimbursement Data.

More… ↓