Last updated: July 27, 2025

Introduction

Octreotide is a synthetic analog of somatostatin, primarily used in managing neuroendocrine tumors, acromegaly, and related hormonal disorders. Since its introduction, octreotide's clinical applications and market dynamics have evolved, influenced by innovations in drug formulations, regulatory developments, and competitive landscape shifts. This analysis provides a comprehensive market overview and price projections for octreotide, offering professionals actionable insights.

Market Overview

Current Market Landscape

Octreotide's market is characterized by stable demand driven by its established efficacy in treating carcinoid tumors, acromegaly, and variceal hemorrhage. The global market was valued at approximately USD 650 million in 2022, with the key regions being North America, Europe, and Asia-Pacific.

Several formulations are available, chiefly:

- Sandostatin (Novartis): The original injectable formulation administered via subcutaneous or intramuscular route.

- Sandostatin LAR (Long-Acting Release): A depot formulation providing monthly dosing, enhancing patient compliance.

- Generic equivalents: Increasing presence following patent expirations.

Key Market Drivers

- Expanding indications: Recent approvals extend octreotide's use to include pediatric conditions and various neuroendocrine diseases.

- Growing prevalence of targeted conditions: Rising incidence of neuroendocrine tumors globally (estimated at 7 per 100,000 annually) boosts demand.

- Improved drug formulations: Long-acting formulations improve adherence and reduce healthcare costs.

- Market access and reimbursement: Favorable reimbursement policies, especially in developed regions, sustain market expansion.

Competitive Landscape

Major players include:

- Novartis: Market leader with Sandostatin and Sandostatin LAR.

- Teva Pharmaceutical Industries: Generic versions following patent expiry.

- Other Generic Manufacturers: Mylan, Sandoz, and others investing in biosimilar production.

Emerging biosimilars are poised to influence prices competitively, increasing access but pressuring profit margins for branded products.

Regulatory and Patent Dynamics

Patent expiry timelines vary but have generally concluded in the late 2010s, allowing biosimilar entry. Regulatory approvals for biosimilars have increased, facilitating market penetration.

Market Challenges and Opportunities

Challenges

- Pricing pressures: Biosimilars and generics reduce overall pricing levels.

- Manufacturing complexity: Biopharmaceuticals like octreotide require sophisticated facilities.

- Reimbursement hurdles: Variability across regions may impact volumes.

Opportunities

- Expanding indications: Investigating new therapeutic areas and pediatric populations.

- Innovative delivery systems: Development of convenience-focused formulations.

- Increasing awareness and screening: Enhanced diagnosis rates can elevate demand.

Price Analysis and Projections

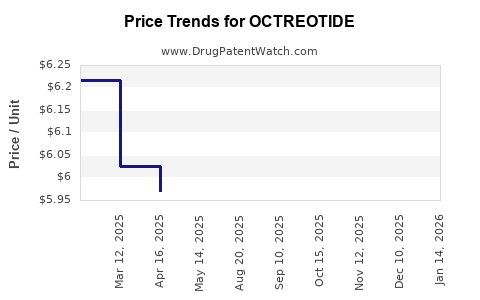

Historical Price Trends

Prices for branded octreotide formulations have declined by approximately 20–35% since patent expirations, partly due to biosimilar competition. For instance, in the U.S., the average wholesale price (AWP) for a 20 mg vial of Sandostatin LAR was around USD 1,000 in 2018, dropping to approximately USD 650 by 2022.

Current Pricing Dynamics

- Branded products: Retain premium due to brand recognition, clinical data, and physician preference.

- Biosimilars and generics: Offer price reductions of up to 50%, with current prices around USD 300–400 per 20 mg vial in the U.S. and Europe.

Future Price Projections (2023–2028)

Given market trends:

- Branded octreotide: Prices are expected to stabilize or slightly decrease (around 2–4% annually) owing to market saturation and cost pressures.

- Biosimilars: Likely to see considerable price reductions, reaching up to 70% below brand prices by 2028, with projected costs of USD 200–300 per 20 mg vial.

- Regional variation: Prices in emerging markets will remain lower relative to Western markets, driven by local healthcare policies.

Factors Influencing Price Trajectories

- Regulatory approvals: Faster approval and market entry of biosimilars will intensify price competition.

- Manufacturing innovation: Improved biosimilar manufacturing efficiencies may further reduce costs.

- Market demand: Stabilized or growing demand ensures sustained revenue, but extreme price competition could impact profitability.

- Pricing regulations: Government interventions and price caps may influence projections, particularly in Europe and emerging markets.

Strategic Implications for Stakeholders

- Pharmaceutical companies investing in biosimilars should expect significant price erosion but can capitalize on market expansion.

- Healthcare payers will exert pressure on pricing, favoring biosimilar adoption.

- Innovators focusing on novel formulations or delivery systems may maintain premium pricing through differentiation.

Conclusion

The octreotide market is transitioning toward greater biosimilar penetration, leading to sustained price competition. While branded formulations will maintain core market share due to established efficacy and reputation, biosimilars are poised to significantly lower generic prices, expanding accessibility. Overall, a slow, steady decline in branded octreotide prices is forecasted, aligned with biosimilar entry and competitive pressures, unless innovative therapies or new indications emerge.

Key Takeaways

- Market Value: Estimated at USD 650 million in 2022, with growth driven by increased indications and demand for long-acting formulations.

- Price Trends: Branded octreotide prices are declining at approximately 2–4% annually; biosimilars are driving prices down by up to 70% by 2028.

- Competitive Dynamics: Patent expirations have introduced biosimilars, increasing market competition and affordability.

- Regional Variability: Developing markets continue to see lower prices; regulatory and reimbursement policies significantly influence market access.

- Future Outlook: Innovation and biosimilar proliferation will shape pricing and market share, with an emphasis on cost containment and expanding clinical applications.

FAQs

1. How will biosimilars impact the octreotide market?

Biosimilars are expected to substantially reduce prices, increase market competition, and broaden access, especially in regions where cost is a primary barrier.

2. What factors could cause deviations from the projected price trends?

Regulatory changes, trade policies, manufacturing innovations, or new clinical indications could alter pricing dynamics and market growth trajectories.

3. Are there upcoming formulations or delivery methods that could affect octreotide prices?

Yes. Research into less invasive, patient-friendly delivery systems, including implantable devices or oral formulations, could influence future pricing and market share.

4. In which regions is octreotide market growth expected to be most robust?

Asia-Pacific and Latin America are anticipated to experience the highest growth rates due to increasing disease prevalence, expanding healthcare infrastructure, and growing awareness.

5. What opportunities exist for pharmaceutical companies regarding octreotide?

Companies can explore biosimilar development, new indications, combination therapies, and innovative delivery methods to sustain revenue in a cost-competitive landscape.