Share This Page

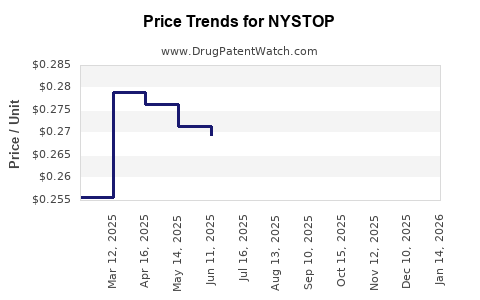

Drug Price Trends for NYSTOP

✉ Email this page to a colleague

Average Pharmacy Cost for NYSTOP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NYSTOP 100,000 UNIT/GM POWDER | 00574-2008-02 | 0.27906 | GM | 2025-12-17 |

| NYSTOP 100,000 UNIT/GM POWDER | 00574-2008-15 | 0.47299 | GM | 2025-12-17 |

| NYSTOP 100,000 UNIT/GM POWDER | 00574-2008-30 | 0.32407 | GM | 2025-12-17 |

| NYSTOP 100,000 UNIT/GM POWDER | 00574-2008-02 | 0.28089 | GM | 2025-11-19 |

| NYSTOP 100,000 UNIT/GM POWDER | 00574-2008-30 | 0.32955 | GM | 2025-11-19 |

| NYSTOP 100,000 UNIT/GM POWDER | 00574-2008-15 | 0.46289 | GM | 2025-11-19 |

| NYSTOP 100,000 UNIT/GM POWDER | 00574-2008-30 | 0.34987 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NYSTOP

Introduction

Nystop (Nystatin) is an antifungal medication primarily used to treat candidiasis in various forms, including oral, cutaneous, and systemic infections. As a well-established drug in antifungal therapy, NYSTOP holds a critical position within the pharmaceutical landscape for fungal infections. This analysis examines the current market dynamics, competitive landscape, regulatory environment, and price projection forecasts impacting NYSTOP over the coming years.

Market Overview

Global and Regional Market Dynamics

The antifungal drugs market, valued at approximately USD 16 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of about 3-4% through 2030 [1]. Nystatin remains integral, especially in developing countries and specialized niche segments, owing to its efficacy and favorable safety profile in superficial infections.

Key Drivers:

- Rising prevalence of superficial fungal infections globally, primarily driven by immunosuppressed populations (e.g., HIV/AIDS, cancer patients).

- Increasing awareness and diagnostic capabilities.

- Expanding application of Nystatin in topical formulations and oral suspensions.

- Generic drug proliferation, reducing therapeutic costs.

Market Limitations:

- Competition from broader-spectrum antifungals such as azoles (fluconazole, voriconazole) and echinocandins.

- Limited systemic indications constraining revenue streams.

- Patent expirations facilitating generic entry, impacting originator sales.

Competitive Landscape

Market Players

The primary manufacturers of Nystatin include pharmaceutical giants such as:

- Pfizer

- Sandoz (Novartis)

- Mylan (now part of Viatris)

- GSK

Most of these companies offer generic formulations due to patent expiry. Regional markets also feature local manufacturers providing lower-cost Nystatin products.

Market Share Distribution

Generics dominate the Nystatin market, accounting for over 85% of sales worldwide [2]. Leading players focus on price competition and expanding formulations to maintain market share.

Regulatory Considerations

Approval processes for generic Nystatin products are streamlined globally, given its status as a well-established, off-patent drug. Compliance with pharmacopeial standards (USP, EP, JP) is mandatory for market authorization.

Market Demand and Segmentation

Application Segments:

- Oral candidiasis (thrush): ~60% of Nystatin use

- Cutaneous candidiasis: ~25%

- Vaginal candidiasis: ~10%

- Systemic or invasive fungal infections: minimal, mainly in compounded or niche applications

Demographic Trends:

- Pediatric and geriatric populations are significant consumers, especially in settings with high candidiasis prevalence.

- Hospital and outpatient clinics are primary distribution points.

Pricing Dynamics

Historical Pricing Trends

Historically, Nystatin's pricing has experienced downward pressure corresponding with increased generic competition. In mature markets (the US, Europe), prices for branded formulations have ranged from USD 10-30 per course of therapy, while generics often retail at USD 3-10 [3].

Pricing Factors Influencing Future Trends

- Manufacturing costs: Slight decrease with increased scale and competition.

- Regulatory costs: Stable, barring new formulations.

- Market penetration and volume: Higher buyer volume and economies of scale will reduce unit costs.

- Pricing pressures: Constrained by reimbursement policies and the availability of cheaper generics.

Price Projections (2023-2028)

Based on current trends, the following projections are posited:

-

Short-term (2023-2025):

Price stability or marginal decline (~1-3%) due to intense generic competition and price erosion. For example, oral Nystatin suspension predicted to average USD 2-5 per dose in key markets. -

Mid-term (2025-2028):

Prices may decline further (~2-5%) with market maturation, increased procurement efficiencies, and potential for biosimilar entry if formulations evolve [4]. -

High-volume applications:

Bulk or hospital procurement may see discounts up to 20-30% compared to retail prices. -

Emerging Markets:

Prices may remain relatively stable or slightly increase due to supply chain stability or import tariffs.

Impact of Regulatory and Market Factors

Potential shifts such as policies favoring local manufacturing, price caps, or inclusion in essential medicines lists could influence pricing structures. Conversely, the advent of novel antifungal agents may threaten demand for Nystatin, exerting downward pressure on pricing and market share.

Strategic Considerations for Stakeholders

Manufacturers:

- Focus on cost-effective manufacturing to sustain margins.

- Diversify formulations (e.g., lozenges, topical creams) to capture niche markets.

- Enhance supply chain efficiencies, particularly targeting emerging markets.

Investors/Distributors:

- Monitor pricing trends, especially in regions with aggressive price controls.

- Evaluate opportunities in markets with high infection prevalence and limited antifungal options.

Regulatory Agencies:

- Maintain standards to ensure safety and efficacy, enabling competitive pricing and market stability.

Key Takeaways

- The Nystatin market is mature with a predominant generic segment, resulting in stable or declining prices.

- Healthcare demand, especially for superficial fungal infections, sustains steady volume growth.

- Price projections indicate modest declines (~1-5%) over the coming five years, driven primarily by market saturation and intensified competition.

- Emerging markets present growth opportunities but may involve variable pricing due to regulatory and economic factors.

- Stakeholders should prioritize manufacturing efficiencies, formulation diversification, and strategic regional positioning to optimize profitability.

FAQs

1. How will patent expirations affect Nystatin’s market price?

Patent expirations facilitate generic entry, leading to increased competition and subsequent price reductions. Market prices are expected to decline gradually as generics dominate, strengthening affordability.

2. Are there any upcoming formulations or delivery mechanisms for Nystatin?

Current developments include novel delivery systems such as sustained-release lozenges and topical patches, which could influence future pricing and market share.

3. What regions offer the greatest growth potential for Nystatin?

Emerging markets in Asia, Africa, and Latin America represent growth opportunities due to rising infection prevalence and limited access to newer antifungals.

4. How do regulatory policies influence Nystatin pricing?

Price controls, reimbursement policies, and essential medicines listing can cap prices and influence supply dynamics, especially in public health sectors.

5. Will new antifungal agents threaten Nystatin’s relevance?

While newer agents like echinocandins have broader indications, Nystatin remains prevalent for superficial candidiasis. However, evolving resistance and efficacy profiles could alter its positioning in specific niches.

References

[1] Market Research Future. "Global Antifungal Drugs Market Analysis." 2022.

[2] IQVIA. "Pharmaceutical Market Data," 2022.

[3] GoodRx. "Nystatin Prices and Cost Comparison," 2023.

[4] EvaluatePharma. "Forecast of Antifungal Drug Market," 2022.

This comprehensive analysis enables stakeholders to gauge current market conditions and formulate strategic pricing and commercialization plans for NYSTOP over the coming years.

More… ↓