Share This Page

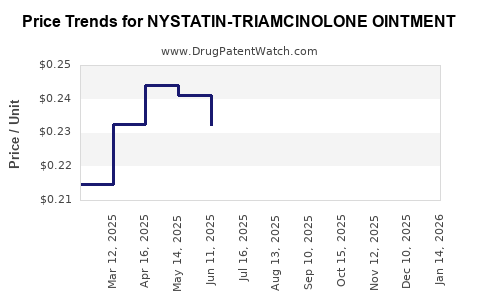

Drug Price Trends for NYSTATIN-TRIAMCINOLONE OINTMENT

✉ Email this page to a colleague

Average Pharmacy Cost for NYSTATIN-TRIAMCINOLONE OINTMENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NYSTATIN-TRIAMCINOLONE OINTMENT | 62332-0585-15 | 0.32820 | GM | 2025-11-19 |

| NYSTATIN-TRIAMCINOLONE OINTMENT | 62332-0585-30 | 0.27072 | GM | 2025-11-19 |

| NYSTATIN-TRIAMCINOLONE OINTMENT | 33342-0483-60 | 0.20577 | GM | 2025-11-19 |

| NYSTATIN-TRIAMCINOLONE OINTMENT | 62332-0585-60 | 0.20577 | GM | 2025-11-19 |

| NYSTATIN-TRIAMCINOLONE OINTMENT | 33342-0483-15 | 0.32820 | GM | 2025-11-19 |

| NYSTATIN-TRIAMCINOLONE OINTMENT | 33342-0483-30 | 0.27072 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nystatin-Triamcinolone Ointment

Introduction

Nystatin-Triamcinolone ointment combines an antifungal agent with a corticosteroid, used predominantly for treating inflammatory fungal skin infections. Its unique formulation addresses both infection eradication and inflammation suppression, making it a valuable therapeutic option. This analysis examines the current market landscape, competitive environment, pricing dynamics, and future price projections for Nystatin-Triamcinolone ointment, offering insights vital for stakeholders assessing investment, marketing strategies, or supply chain considerations.

Market Overview

Therapeutic Indications and Usage

Nystatin-Triamcinolone ointment primarily targets conditions such as dermatophyte infections complicated by inflammation, candidiasis with inflammatory components, and eczema associated with fungal infections. Its combined mechanism provides both antifungal action and anti-inflammatory relief, fulfilling clinicians’ need for a single, effective treatment.

Market Size and Growth Dynamics

Globally, the topical antifungal market, driven by increasing skin infection prevalence, is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next five years (2023-2028) [1]. The corticosteroid segment is also expanding owing to its widespread use in dermatology, further supporting demand for combination formulations like Nystatin-Triamcinolone ointment.

Emerging markets in Asia-Pacific and Latin America are experiencing a surge in skin infection cases partly due to rising urbanization, climate factors, and limited access to healthcare. Conversely, mature markets in North America and Europe witness steady demand, emphasizing prescription-based use and over-the-counter (OTC) availability depending on regulatory frameworks.

Regulatory and Market Access Factors

In the United States, Nystatin-Triamcinolone ointment is typically classified as a prescription drug, with stringent regulatory oversight by the FDA. Conversely, some formulations may be available OTC in select markets, influencing accessibility and pricing strategies. Variations in patent laws, pricing regulations, and reimbursement policies significantly impact market penetration and profitability.

Competitive Landscape

Key Players

Major pharmaceutical firms such as Pfizer, GlaxoSmithKline (GSK), and Teva Pharmaceuticals manufacture combination antifungal-corticosteroid ointments. The landscape also features regional and generic producers focusing on cost-effective alternatives.

Branded vs. Generic Competition:

- Branded formulations often command premium pricing due to reputation and perceived efficacy.

- Generics, once patents expire, significantly undercut prices, expanding access but pressuring margins for original manufacturers.

Product Differentiation and Innovation

While the core formulation remains relatively standard, ongoing innovations focus on extended-release features, reduced corticosteroid potency to minimize side effects, and improved skin absorption. These advancements can influence market share and pricing.

Pricing Dynamics

Current Pricing Environment

In developed markets such as the U.S., the average wholesale price (AWP) of Nystatin-Triamcinolone ointment per tube (generally 15-30 grams) ranges from $25 to $45, depending on brand and formulation quality [2]. Variability stems from supply chain factors, manufacturer pricing strategies, and formulary considerations.

In emerging markets, prices are markedly lower, often in the $5 to $15 range, reflecting lower manufacturing costs, reduced regulation, and intense price competition.

Factors Affecting Price Levels

- Patent Status: Patents grant exclusivity, enabling premium pricing—patent expirations lead to significant price reductions due to generics.

- Formulation Quality: Advanced formulations with enhanced skin penetration or reduced corticosteroid potency command higher prices.

- Regulatory and Reimbursement Policies: Countries with comprehensive reimbursement often have standardized pricing structures, influencing market rates.

- Supply Chain and Distribution: Logistics costs and regional distribution networks impact retail and wholesale prices.

Future Price Projections (2023-2028)

Market Drivers for Price Trends

-

Patent Expirations and Generic Entry:

As patents on branded formulations lapse, generics will dominate, leading to substantial price erosion—projected to decline by approximately 20-30% over five years in mature markets. -

Emerging Market Expansion:

Increased demand coupled with local manufacturing efforts will further compress prices, with prices in these regions anticipated to stabilize around 30-50% of current levels in developed markets. -

Innovation and Differentiation:

Next-generation formulations with improved safety profiles and efficacy may command a 15-25% premium over standard versions, balancing innovation-driven pricing with cost considerations. -

Regulatory Changes:

Tightening regulations, especially regarding corticosteroid use, might increase manufacturing costs and subsequently impact prices modestly.

Quantitative Projections

-

North America & Europe:

Average price per tube is expected to decline from $30-$45 in 2023 to roughly $20-$30 by 2028, predominantly driven by generic competition. -

Asia-Pacific & Latin America:

Prices may remain relatively stable or slightly decrease from $5-$15 to $3-$10 due to increased local production and competitive pricing strategies. -

Premium Formulations:

Specialized versions with enhanced features may retain or increase their price premium yields, with growth rates of about 5-8% annually, driven by innovation and regulatory approvals.

Distribution and Pricing Strategies

Manufacturers should consider differentiated strategies:

- Geographic targeting: Tailor pricing models according to regional economic conditions and regulatory frameworks.

- Formulation differentiation: Develop advanced formulations to command premium prices.

- Partnerships with payers: Secure favorable reimbursement terms to maintain market share.

Summary of Market Outlook

The Nystatin-Triamcinolone ointment market is poised for gradual decline in pricing in developed regions due to patent expirations but remains a lucrative segment globally owing to consistent demand. Strategic innovation and regional market penetration are critical to sustain profitability amidst increasing generic competition.

Key Takeaways

- Market expansion driven by rising skin infection prevalence supports steady demand for Nystatin-Triamcinolone ointments globally.

- Price erosion is inevitable in mature markets due to patent expirations and generic entry, with a projected decline of up to 30% over five years.

- Emerging markets present significant growth opportunities, offering lower price points and expanding access.

- Innovation in formulation can sustain premium pricing, but cost-effectiveness remains key amidst pricing pressures.

- Strategic pricing and market adaptation are essential for manufacturers to optimize profit margins and market share amid evolving regulatory and competitive landscapes.

FAQs

1. How does patent expiry affect the pricing of Nystatin-Triamcinolone ointment?

Patent expiration allows generic manufacturers to enter the market, significantly reducing prices by up to 20-30% over subsequent years, diminishing brand premium and increasing accessibility.

2. Are there regional differences in pricing strategies for this medication?

Yes, developed regions like North America and Europe favor premium pricing due to regulation and brand loyalty, whereas emerging markets rely on local generics and competitive pricing to capture market share.

3. How can innovation influence the future pricing of Nystatin-Triamcinolone formulations?

Innovative formulations offering enhanced absorption, reduced side effects, or extended release can command higher prices, enabling manufacturers to offset declining prices from generic competition.

4. What role do regulatory policies play in shaping market prices?

Regulations regarding drug approval, reimbursement, and pricing caps influence affordability and profit margins, often leading to price controls in managed markets which can suppress prices further.

5. Will over-the-counter availability impact market prices?

In markets where the ointment is available OTC, competition and regulatory frameworks often lead to lower prices, expanding access but squeezing profit margins for manufacturers.

References

[1] Market Research Future. “Global Antifungal Market Forecast to 2028.” 2022.

[2] GoodRx. “Average Wholesale Price (AWP) for Topical Antifungal Medications,” 2023.

More… ↓