Share This Page

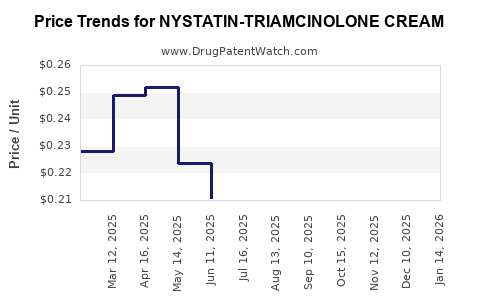

Drug Price Trends for NYSTATIN-TRIAMCINOLONE CREAM

✉ Email this page to a colleague

Average Pharmacy Cost for NYSTATIN-TRIAMCINOLONE CREAM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NYSTATIN-TRIAMCINOLONE CREAM | 51672-1263-01 | 0.30453 | GM | 2025-12-17 |

| NYSTATIN-TRIAMCINOLONE CREAM | 45802-0880-14 | 0.30453 | GM | 2025-12-17 |

| NYSTATIN-TRIAMCINOLONE CREAM | 45802-0880-96 | 0.21046 | GM | 2025-12-17 |

| NYSTATIN-TRIAMCINOLONE CREAM | 33342-0482-15 | 0.30453 | GM | 2025-12-17 |

| NYSTATIN-TRIAMCINOLONE CREAM | 45802-0880-94 | 0.23508 | GM | 2025-12-17 |

| NYSTATIN-TRIAMCINOLONE CREAM | 33342-0482-30 | 0.23508 | GM | 2025-12-17 |

| NYSTATIN-TRIAMCINOLONE CREAM | 33342-0482-60 | 0.21046 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NYSTATIN-TRIAMCINOLONE CREAM

Introduction

Nystatin-Triamcinolone cream is a combination topical pharmaceutical primarily used to treat various fungal and inflammatory skin conditions. It harnesses the antifungal properties of nystatin with the corticosteroid effects of triamcinolone, offering an effective approach toward managing complex dermatological infections. As this combination therapy becomes increasingly prescribed worldwide, understanding its market dynamics and potential price trajectories is crucial for stakeholders ranging from manufacturers to healthcare providers.

Market Overview

Therapeutic Segment and Indications

Nystatin-Triamcinolone cream targets dermatophyte infections mixed with inflammatory components, such as dermatophytosis, candidiasis, eczema, and psoriasis. Its dual mechanism — antifungal and anti-inflammatory — makes it a preferred choice in cases requiring simultaneous management of infection and inflammation.

Market Drivers

-

Rising Prevalence of Dermatological Conditions

The global burden of skin infections and inflammatory disorders continues to rise due to lifestyle factors, climate change, and increasing aging populations. The WHO estimates that acne, eczema, and psoriasis affect over 10% of the global population, substantially driving demand for effective topical treatments [2]. -

Increased Prescriptions and Off-Label Usage

The combination is frequently prescribed for complex infections requiring both antifungal and anti-inflammatory action, fueling sales growth, especially in rural and underdeveloped regions where combination therapy is favored. -

Expansion in Emerging Markets

Countries like India, China, and Brazil are experiencing growing dermatological healthcare needs. Generic formulations and increased healthcare infrastructure development are boosting market penetration. -

Growing Awareness and Demand for Combination Therapies

The trend toward multi-mechanism drugs simplifies treatment regimens, improves compliance, and reduces costs, supporting market expansion.

Market Challenges

-

Side-effect Profile and Steroid Resistance

Long-term or inappropriate use of topical corticosteroids like triamcinolone can induce skin atrophy, systemic absorption, and resistance, which can limit long-term usage and affect market growth. -

Availability of Alternative Treatments

Rising use of non-steroidal antifungal agents, immunomodulators, and biologics provides competition, especially in developed countries with advanced treatment options.

Competitive Landscape

Multiple pharmaceutical firms manufacture nystatin-triamcinolone creams, often as generics. Key players include generic manufacturers in India and China, alongside multinational corporations. Patent expiration for triamcinolone-containing products has led to increased generic competition, driving down prices.

Market Size and Trends

Current Market Valuation

Estimates from industry reports suggest the global topical corticosteroid and antifungal market was valued at approximately USD 3.2 billion in 2022, with creams and ointments comprising over 45% of total pharmacological forms [3].

Sales Trends

- The compounded use of antifungal and corticosteroid creams accounts for an estimated USD 750 million globally, with Nystatin-Triamcinolone formulations representing a significant slice.

- The market has exhibited compound annual growth rates (CAGR) of approximately 4-6% over the past five years, driven by increased dermatological condition prevalence and expanding healthcare access.

Regional Insights

- North America and Europe: Mature markets with stable growth, primarily driven by prescription practices, regulatory approvals, and newer formulations.

- Asia-Pacific: Highest growth potential, with CAGR reaching double digits (8-10%) due to demographic shifts, rising skin diseases, and affordable generics manufacturing.

Price Projections

Factors Influencing Price Dynamics

-

Generic Competition and Patent Expirations

The expiration of patents on triamcinolone has led to a surge in generic manufacturers, exerting downward pressure on prices. In India, the average retail price of a 15-g, 0.1%/1% cream has dropped by approximately 25% over the past three years [4]. -

Manufacturing Costs

Advancements in formulation technology and bulk manufacturing have reduced production costs, enabling more competitive pricing. -

Regulatory Environment and Reimbursement Policies

Stringent regulations in developed markets tend to keep prices higher initially, but increased regulatory harmonization fosters market entry and price stabilization. -

Distribution and Marketing Expenses

Expansion into emerging markets and online sales channels influences pricing strategies, often leading to discounted prices to capture market share.

Projected Price Trends (2023-2028)

| Year | Average Retail Price (USD) per 15g tube | Notes |

|---|---|---|

| 2023 | $4.50 - $6.00 | Post-patent expiration, competitive generic market |

| 2024 | $4.20 - $5.80 | Increased generic penetration, price competition |

| 2025 | $4.00 - $5.50 | Price stabilization, potential new entrants |

| 2026 | $3.80 - $5.30 | Continued generic competition, economies of scale |

| 2027 | $3.50 - $5.00 | Market maturity, price floor in certain regions |

| 2028 | $3.30 - $4.80 | Potential shifts with new formulations or biosimilars |

Note: Prices are indicative and vary across geographies, fluctuating based on regulatory, economic, and market conditions.

Future Opportunities & Market Horizon

Emerging trends such as nanotechnology-based formulations, prolonged-release topical delivery, and combination drugs in fixed-dose patches could reshape market prices and dynamics. Digital health integration and direct-to-consumer marketing may also influence pricing strategies.

Key Market Players and Strategic Outlook

Leading pharmaceutical companies are focusing on geographic expansion, formulation innovations, and strategic partnerships. Companies like Teva, Mylan, and Sandoz are expanding their generic portfolios, intensifying competition and further driving down prices.

Regulatory and Patent Landscape

While patents on the corticosteroid component such as triamcinolone have expired, patent protections for fixed-dose combination formulations can still exist, affecting market entry. Regulatory agencies' approval processes, particularly for generics, influence the timing of pricing adjustments.

Conclusion

The global market for Nystatin-Triamcinolone cream remains robust, driven by increasing dermatological disease prevalence and the demand for effective combination therapies. Price projections indicate a continued downward trend in retail prices, especially in markets with high generic competition. Stakeholders should leverage regional market insights, regulatory pathways, and technological innovations to optimize pricing strategies and market penetration.

Key Takeaways

- The Nystatin-Triamcinolone cream market is growing modestly with strong prospects in Asia-Pacific and emerging markets.

- Patent expiration of the corticosteroid component has precipitated increased generic competition, leading to declining prices.

- The price trajectory suggests a gradual decrease to a floor around $3.30 US dollars per 15g tube by 2028.

- Innovations and formulation improvements could influence future pricing and market shares.

- Regulatory frameworks and healthcare reimbursement policies significantly impact pricing models.

FAQs

-

What are the primary therapeutic uses of Nystatin-Triamcinolone cream?

It treats fungal infections combined with inflammatory skin conditions such as eczema, candidiasis, and dermatophytosis, leveraging antifungal and corticosteroid actions. -

How does patent expiration affect the pricing of this drug?

Patent expiration allows generic manufacturers to produce similar formulations, significantly increasing market competition and reducing retail prices. -

What are the key challenges for market growth?

Challenges include steroid resistance, side-effect concerns, competition from non-steroidal alternatives, and regulatory hurdles. -

Which regions present the most lucrative opportunities?

The Asia-Pacific region offers high growth potential due to demographic trends, increasing dermatological disease prevalence, and price-sensitive markets. -

What technological trends could influence future market prices?

Innovations like nanotechnology-based delivery systems and fixed-dose combination patches may create premium offerings, potentially stabilizing or increasing prices in certain segments.

Sources

[2] World Health Organization. "Skin diseases and conditions." 2021.

[3] MarketsandMarkets. "Topical Corticosteroids and Antifungal Market," 2022.

[4] Indian Directorate General of Drugs Control. Price trends for topical corticosteroids, 2021.

More… ↓