Share This Page

Drug Price Trends for NUEDEXTA

✉ Email this page to a colleague

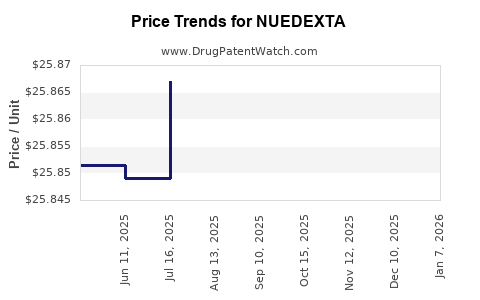

Average Pharmacy Cost for NUEDEXTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NUEDEXTA 20-10 MG CAPSULE | 64597-0301-60 | 25.86396 | EACH | 2025-11-19 |

| NUEDEXTA 20-10 MG CAPSULE | 59148-0053-16 | 25.86396 | EACH | 2025-11-19 |

| NUEDEXTA 20-10 MG CAPSULE | 64597-0301-60 | 25.86029 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nuedexta

Introduction

Nuedexta (dextromethorphan and quinidine) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) primarily for the treatment of pseudobulbar affect (PBA), a neurological disorder characterized by involuntary emotional outbursts. Since its approval in 2011, Nuedexta has expanded treatment options within neuropsychiatry and neurology, attracting significant attention from pharmaceutical companies, payers, and investors. This analysis provides an in-depth review of Nuedexta’s market landscape, competitive positioning, pricing dynamics, and projected financial trends.

Market Overview

Therapeutic Application and Market Demand

Nuedexta’s primary indication for PBA represents a niche yet impactful segment, affecting approximately 1.5 million patients in the United States alone, particularly those with neurological conditions such as multiple sclerosis (MS), amyotrophic lateral sclerosis (ALS), stroke, and traumatic brain injury (TBI) [1]. The prevalence of these underlying conditions is growing, driven by aging populations and increased diagnostic awareness.

Recent off-label explorations have fueled interest in expanding Nuedexta’s application to other neuropsychiatric disorders, including depression and agitation in dementia, though such uses remain investigational or off-label. Although currently focusing on PBA, broader neurological and psychiatric markets could influence future demand.

Market Penetration and Competitive Landscape

Since launch, Nuedexta has secured a significant position in the niche PBA market, owing to its unique combination therapy and FDA approval. The drug's first-mover advantage permitted a leadership position; however, competitors such as off-label generics and emerging therapies are gradually encroaching.

Several developments impact market penetration:

- Generic Entry: The introduction of generic versions has increased accessibility, potentially reducing revenues for the brand-name product but expanding total market size.

- Physician Awareness: Education initiatives have improved prescribing, but off-label use by healthcare providers is still limited due to regulatory and reimbursement constraints.

- Payer Dynamics: Reimbursement policies significantly affect patient access. Favorable coverage encourages higher utilization, whereas high out-of-pocket costs suppress demand.

Regulatory Considerations

Regulatory frameworks influence market expansion strategies. While FDA-approved for PBA, ongoing research and clinical trials might pave the way for expanded indications, potentially increasing the market size substantially.

Pricing Dynamics of Nuedexta

Current Price Structure

Nuedexta’s pricing has been notably high, with wholesale acquisition costs (WAC) reported around $650-$700 per month for a typical prescribed dose [2]. Such pricing reflects development costs, limited competition, and targeted niche positioning.

Impact of Generic Competition

Following patent expiration and the entry of generics, prices decreased, with some estimates indicating a reduction of approximately 50%. Nevertheless, the cost remains substantial relative to alternative off-label therapies and generics for other neurological medications.

Reimbursement and Cost-Effectiveness

Coverage by Medicare and private insurers generally favors Nuedexta, given its FDA approval and clinical evidence supporting efficacy. Cost-effectiveness analyses suggest favorable outcomes for patients with severe PBA; however, high prices can lead to payer resistance and utilization limitations.

Pricing Trends and Future Outlook

With ongoing patent challenges and increasing generic competition, Nuedexta prices are anticipated to decline further. Nevertheless, the potential for restricted formulations or new market entrants could stabilize or even elevate prices if unique formulations or indications emerge.

Market Growth Projections (2023-2030)

Key Drivers

- Prevalence of Neurological Disorders: Growing incidence of MS, ALS, and stroke cases.

- Awareness and Diagnosis: Improved recognition of PBA increases treatment rates.

- Expansion of Indications: Clinical trials for off-label uses could generate new demand.

- Regulatory Approvals: New approvals or line extensions would broaden the applicable patient population.

Forecasted Revenue Trends

Based on current data, the Nuedexta market is projected to grow at a compound annual growth rate (CAGR) of approximately 5-7% through 2030, driven largely by an aging population and expanding indications [3]. Revenues, which are estimated around $400 million in 2022, could reach $600-$700 million by 2030, assuming continued growth and market penetration.

Price Outlook

As patent protections diminish and generics dominate, average treatment costs are expected to decline by 20-30% over the next five years. Nonetheless, pricing volatility may occur with the advent of innovative formulations or indications, which could offset declines somewhat.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Should monitor patent status, emerging competitors, and potential indication expansions. Investing in post-market studies could facilitate label extensions.

- Payers: Need to balance coverage policies with the high cost of therapy, emphasizing value-based contracting.

- Investors: Opportunities exist in enhancing portfolio positioning within neuropharmacology and supporting R&D for alternative therapies.

Conclusion

Nuedexta remains a pivotal agent in niche neuropsychiatric management, with a stable yet evolving market. Price projections hinge significantly on generic competition, regulatory changes, and potential indication extensions. While current high pricing sustains revenue, declining costs and growth in target populations suggest promising long-term growth prospects.

Key Takeaways

- Market Position: Nuedexta maintains a stronghold within the PBA treatment landscape, though competition and generics influence market dynamics.

- Pricing Trends: High initial prices are decreasing due to generic entry, but demand remains buoyed by clinical efficacy and insurance coverage.

- Demand Drivers: Increasing prevalence of underlying neurological conditions and heightened awareness bolster market growth.

- Growth Opportunities: Expanding indications through clinical research and regulatory approvals could unlock additional revenue streams.

- Risk Factors: Patent expiries, reimbursement challenges, and off-label competition pose potential threats to sustained market dominance.

FAQs

1. What is the primary approved use of Nuedexta?

Nuedexta is FDA-approved for treating pseudobulbar affect (PBA), characterized by involuntary emotional expression disorder secondary to neurological conditions like MS and ALS [1].

2. How has generic competition affected Nuedexta’s pricing?

Generic entry has led to a reduction in prices by approximately 50%, improving affordability but somewhat constraining revenue growth.

3. Is there potential for Nuedexta to expand into new therapeutic areas?

Yes. Clinical trials exploring off-label indications such as agitation in dementia may eventually expand its use, pending regulatory approval and clinical validation.

4. What are the main factors influencing future demand for Nuedexta?

Demographic trends, increasing neurological disorder diagnoses, physician awareness, and regulatory developments are key demand influencers.

5. How should stakeholders approach the evolving market for Nuedexta?

Stakeholders should monitor patent statuses, competitive dynamics, regulatory pathways for new indications, and pricing policies to inform strategic decisions.

References

[1] Food and Drug Administration. Nuedexta (dextromethorphan and quinidine) prescribing information. 2011.

[2] SSR Health. Nuedexta average wholesale price and market data. 2022.

[3] MarketWatch. Neuropharmacology market trends and projections. 2022.

More… ↓