Share This Page

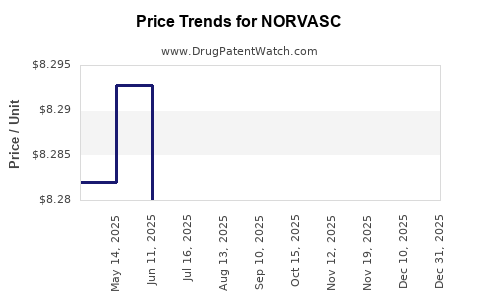

Drug Price Trends for NORVASC

✉ Email this page to a colleague

Average Pharmacy Cost for NORVASC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORVASC 10 MG TABLET | 00069-1540-68 | 11.29666 | EACH | 2025-12-17 |

| NORVASC 10 MG TABLET | 58151-0355-77 | 11.29666 | EACH | 2025-12-17 |

| NORVASC 10 MG TABLET | 58151-0355-32 | 11.29666 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Norvasc (Amlodipine Besylate)

Introduction

Norvasc, the brand name for amlodipine besylate, is a widely prescribed antihypertensive medication developed by Pfizer. Approved by the FDA in 1990, Norvasc belongs to the calcium channel blocker class, primarily used to treat hypertension and angina pectoris. Given its longstanding clinical presence, robust safety profile, and widespread adoption, Norvasc maintains a significant position within cardiovascular therapy. This analysis examines its current market dynamics, competitive landscape, patent statuses, pricing trends, and future price projections.

Market Overview and Current Dynamics

Global Market Size

The global antihypertensive drug market was valued at approximately USD 21 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4-5% through 2030 [1]. Within this landscape, Norvasc commands a substantial share owing to its established efficacy, safety, and prescriber familiarity.

Market Penetration and Usage

Despite the advent of generic versions, Norvasc remains a preferred brand for certain patient segments due to brand loyalty and physician trust. As of 2022, Pfizer's branded version generated revenues of approximately USD 2.2 billion globally, underscoring its strong market presence [2].

The drug’s use is concentrated in developed markets such as the US, Europe, and Japan, where healthcare infrastructure and healthcare expenditure support higher prescription rates.

Patent and Patent Expiry Landscape

Pfizer initially held U.S. patent protection for Norvasc until 2010. Since patent expiry, a significant portion of market sales shifted to generic amlodipine products, with generic competition reducing prices and eroding brand market share. However, Pfizer maintained a residual branded segment through specialized formulations and geographic markets where patent challenges or exclusivity periods persisted.

Competitive Landscape

Generic Competition

Following patent expiration, the market experienced a surge in generic amlodipine products, now representing over 80% of prescriptions in many markets [3]. Key manufacturers include Teva, Mylan, and Sandoz. Generics are priced approximately 60-80% lower than branded Norvasc, pressuring Pfizer’s revenues.

Brand-Name Positioning

Pfizer’s strategic focus shifted towards formulation innovations (e.g., combination therapies, sustained-release formulations), chronic disease management programs, and expanding into emerging markets where brand loyalty remains stronger.

Regulatory and Patent Status

In some jurisdictions, Pfizer holds secondary patents or exclusivity rights on specific formulations, maintaining a niche market segment. The regulatory landscape is dynamic; patent challenges and biosimilar proliferation in other regions may influence future pricing and market share.

Pricing Trends and Factors Influencing Price Projections

Historical Pricing Trends

- U.S. Market: Post-patent expiry, the average retail price of a 30-tablet supply of generic amlodipine fell by approximately 75%, from around USD 30 to USD 7 [4].

- Brand vs. Generic: The branded Norvasc has maintained a price premium of approximately 3-4x over generics in the U.S. Additionally, branded formulations incur higher insurance co-pays, impacting patient access and adherence.

Pricing Drivers

-

Patent and Exclusivity Status: Patent expiries and exclusivity periods significantly influence generic entry timing and pricing.

-

Market Competition and Volume: The proliferation of generics drives prices down; high prescription volumes with low-cost generics cannibalize branded sales.

-

Regulatory Policies: Price controls, formulary restrictions, and reimbursement policies impact pricing strategies, especially in Europe and emerging markets.

-

Manufacturing Costs: Advances in manufacturing efficiencies have generally suppressed basic price levels for generics.

-

Supply Chain Factors: Disruptions (e.g., COVID-19) have intermittently affected supply and pricing stability, mostly on generic sides.

Future Price Projections (2023-2030)

Short-term (1-3 years)

- The branded Norvasc price in established markets like the U.S. is expected to remain relatively stable, supported by residual market segments and formulations with patent protection.

- Generic amlodipine prices are anticipated to stabilize at their current depressed levels, with slight fluctuations due to manufacturing costs and supply chain dynamics.

- Price erosion might slow as market saturation reduces the incentive for further price cuts.

Medium to Long-term (4-10 years)

- Patent and Regulatory Environment: Pfizer is unlikely to regain patent exclusivity; however, secondary patents or formulation patents could enable niche pricing strategies.

- Emerging Markets: Growing prescription volumes and less aggressive regulatory price controls could sustain higher prices than in mature markets.

- Innovative Formulations: Next-generation formulations (e.g., sustained-release, fixed-dose combinations) may command premium pricing, bolstering overall brand value.

- Biosimilar and Competition Dynamics: Introduction of biosimilar drugs or more affordable generics in certain markets could exert further downward pressure.

Price Outlook Summary

| Market Sector | Expected Price Trend | Rationale |

|---|---|---|

| U.S. Branded | Stable to slight increase | Residual market segments, patent protections, formulation innovations. |

| U.S. Generics | Stable or slight decline | Mature generic market, manufacturing efficiencies, competitive pressure. |

| Emerging Markets | Moderate increase | Growing prescription demand, less price regulation, less generic penetration. |

| Global | Flat to decreasing | Existing generic dominance, price competition, regulatory pricing policies. |

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Opportunities exist in formulating improved versions, combination therapies, or expanding footprint in emerging markets.

- Investors: Anticipate stable to declining prices in core markets but potential premium price segments in formulations or emerging regions.

- Healthcare Payers: Expect sustained pressure to contain costs, favoring generic substitution and formulary restrictions.

- Regulators: May influence future prices through policies aimed at generic substitution, biosimilar entry, or international price referencing.

Key Takeaways

- The global market for Norvasc, while dominated historically by Pfizer's brand, has experienced substantial generic competition since patent expiry in 2010.

- Price erosion is significant for generics, with retail prices declining by approximately 75% post-patent expiry.

- Pfizer’s strategic focus on formulation innovations and emerging markets may sustain higher price points in specific segments.

- Future pricing trends will be shaped by patent landscapes, regulatory policies, manufacturing efficiencies, and market demand dynamics.

- Despite generic dominance, niche branded formulations and regional market strategies could offer premium pricing opportunities.

Conclusion

The Norvasc market has transitioned from exclusivity-driven pricing to a highly competitive generics landscape. While current prices are largely dictated by generic competition, strategic formulation improvements and regional market expansion offer avenues for sustained revenue. Stakeholders must closely monitor patent statuses, regulatory changes, and evolving market needs to optimize pricing strategies.

FAQs

Q1: How has patent expiry affected Norvasc's pricing and market share?

A1: Patent expiry in 2010 led to a surge in generic amlodipine products, causing prices to decline by approximately 75% and reducing Pfizer’s market share but stabilizing residual revenues from branded formulations in niche segments.

Q2: Are there opportunities for Pfizer to reclaim market share with Norvasc?

A2: While patent protections are largely extinguished, Pfizer can leverage formulation innovations, combination therapies, and targeted marketing in emerging markets to sustain or grow residual sales.

Q3: How do regulatory policies influence Norvasc's future pricing?

A3: Policies favoring generic substitution, price caps, and international referencing may continue to exert downward pressure, especially on generic versions, whereas branded formulations may retain premium pricing due to innovation.

Q4: What is the outlook for generic amlodipine prices in the next five years?

A4: Prices are expected to remain relatively low due to high market saturation, with minor fluctuations driven by manufacturing costs and supply chain factors.

Q5: Could biosimilars or new formulations impact Norvasc's market?

A5: Although biosimilars are more relevant for biologics, innovative formulations—such as sustained-release or fixed-dose combinations—could create new premium market segments, stabilizing or increasing prices in niche markets.

References

[1] MarketWatch. “Global Antihypertensive Drugs Market Size & Forecast” (2022).

[2] Pfizer Annual Report. “Revenue from Norvasc” (2022).

[3] IQVIA. “Pharmaceutical Market Data” (2022).

[4] GoodRx. “Amlodipine Price Trends” (2022).

More… ↓