Share This Page

Drug Price Trends for NORITATE

✉ Email this page to a colleague

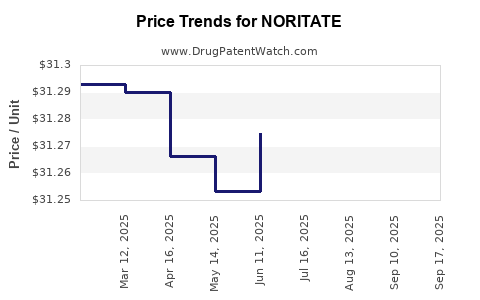

Average Pharmacy Cost for NORITATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORITATE 1% CREAM | 00187-5202-60 | 31.26962 | GM | 2025-09-17 |

| NORITATE 1% CREAM | 00187-5202-60 | 34.38096 | GM | 2025-09-15 |

| NORITATE 1% CREAM | 00187-5202-60 | 31.28386 | GM | 2025-08-20 |

| NORITATE 1% CREAM | 00187-5202-60 | 31.26264 | GM | 2025-07-23 |

| NORITATE 1% CREAM | 00187-5202-60 | 31.27472 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORITATE (Methylprednisolone Sodium Succinate)

Introduction

NORITATE, the brand name for methylprednisolone sodium succinate, is a high-potency corticosteroid used primarily in the management of severe inflammatory and allergic conditions. Its pharmacological efficacy, established clinical utility, and existing market presence make it a subject of continuous interest amidst evolving healthcare landscapes. This analysis examines the current market dynamics, competitive positioning, regulatory environment, and prospective pricing trajectories for NORITATE to assist stakeholders in strategic decision-making.

Pharmacological Profile and Clinical Applications

Methylprednisolone sodium succinate, under the brand NORITATE, is administered intravenously to rapidly control acute inflammation, autoimmune responses, and allergic reactions. Its fast onset, potent anti-inflammatory effects, and extensive approval history underpin its longstanding role in hospital formularies and emergency medicine.

The compound’s key applications include:

- Acute allergic reactions

- Autoimmune diseases

- Neurological conditions such as multiple sclerosis relapses

- Critical care settings for systemic inflammation management

This breadth sustains consistent demand, especially in hospital and emergency contexts.

Market Landscape Overview

Global Market Size and Segmentation

The corticosteroid drug market, valued at approximately USD 4.6 billion in 2022, is projected to grow at a CAGR of 3.2% through 2030, driven by expanding indications and an aging population with increased chronic inflammatory disorders[^1].

Within this, the injectable corticosteroid segment, including methylprednisolone formulations like NORITATE, accounts for nearly 40% of the total corticosteroid sales, reflecting high intravenous use in acute settings. North America remains the dominant region, capturing approximately 45-50% of the global market share due to well-established healthcare infrastructure and high prescribing rates[^2].

Competitive Portfolio

NORITATE faces competition from multiple formulations of methylprednisolone, such as Solu-Medrol (by Pfizer), as well as other corticosteroids like dexamethasone and hydrocortisone. The competitive landscape is consolidated, with key players controlling significant market shares through established manufacturing and distribution channels.

Key Drivers and Barriers

Drivers:

- Increasing prevalence of autoimmune and inflammatory diseases

- Growing utilization in critical care and emergency medicine

- Introduction of biosimilars and generics reducing costs, expanding access

Barriers:

- Stringent regulations impacting formulation approvals

- Concerns over corticosteroid side effects limit off-label use

- Market saturation in mature regions

Regulatory Environment and Patent Landscape

Regulatory Status

NORITATE is approved by the U.S. Food and Drug Administration (FDA) and similar agencies worldwide, with a long-standing approval that enhances market credibility. No current patent exclusivities directly protect NORITATE in the U.S., as its primary patents have expired, permitting generic manufacturing.

Patent and Exclusivity Outlook

The expiration of primary patents has precipitated a surge in generic methylprednisolone sodium succinate formulations, exerting downward pressure on prices. However, some proprietary manufacturing processes or new formulations could potentially provide limited exclusivities.

Pricing Trends and Projections

Current Pricing Dynamics

In the U.S., the average wholesale price (AWP) for a vial of methylprednisolone sodium succinate (various dosages) ranges approximately from USD 10-25. The availability of generics significantly influences price sensitivity, with hospital procurement often relying on negotiated contracts that favor lower rates.

Factors Influencing Future Prices

- Generic Competition: Increased number of generic manufacturers entering the market is anticipated to perpetuate a declining price trend over the next 3-5 years[^3].

- Regulatory and Reimbursement Policies: Policies favoring cost containment, such as prior authorization and formulary restrictions, could further reduce prices.

- Emergence of Biosimilars and Alternative Therapies: Though biosimilars are more common in biologics, any innovation that replaces corticosteroids in specific indications could weaken demand.

Projected Pricing Trajectory (2023-2028)

Based on historical trends and market fundamentals, prices of NORITATE and comparable methylprednisolone sodium succinate products are expected to decrease by an average of 5-8% annually until 2028. By 2028, the median wholesale price per vial could approximate USD 7-15, depending on dosage and packaging.

Market Share and Revenue Outlook

Despite declining unit prices, volume-based growth, driven by high clinical utilization, could stabilize or slightly increase overall revenues for manufacturers maintaining competitive costs. Large hospital formularies and government procurement tenders remain influential in securing market share, further pressuring margins.

Strategic Opportunities and Risks

Opportunities

- Expanding Indications: Investigating off-label uses and newer formulations could open additional revenue streams.

- Emerging Markets: Rapid healthcare infrastructure development in Asia-Pacific and Latin America offers expansion potential.

- Value-Added Formulations: Developing formulations with improved stability, ease of administration, or reduced side effects can command premium pricing.

Risks

- Price Erosion: Increased generics and strict cost control measures threaten profit margins.

- Regulatory Barriers: New safety requirements or label updates may delay market stability.

- Competitive Substitutes: Introduction of alternative therapies such as biologics for autoimmune indications could diminish corticosteroid demand.

Key Takeaways

- Stable Demand, Price Pressure: NORITATE’s core indications ensure consistent demand; however, market saturation and generic competition are exerting downward pressure on pricing.

- Market Maturation: The corticosteroid market is mature, with slow growth; innovative formulations and market development in emerging regions represent key opportunities.

- Pricing Outlook: Expect a continued decline in per-vial prices by approximately 5-8% annually through 2028, driven by generic proliferation and cost-containment policies.

- Regulatory Environment: Long-standing approval and absence of active patent protections facilitate generic entry but pose challenges to sustained premium pricing.

- Strategic Focus: Stakeholders should prioritize cost-effective manufacturing, diversification into new indications, and geographic expansion to mitigate pricing erosion.

FAQs

1. What is the primary driver behind the declining prices of NORITATE?

The main driver is the expiration of patents leading to increased generic competition, which enhances market availability and reduces prices.

2. How does the emergence of biosimilars affect corticosteroid markets like NORITATE?

While biosimilars are more relevant to biologic drugs, any innovative corticosteroid formulations claiming similar efficacy could introduce additional competitive pressures, potentially impacting pricing and market share.

3. Are there opportunities for premium pricing with NORITATE?

Yes, developing formulations with improved delivery, stability, or reduced side effects can command premium pricing, especially in niche or high-need indications.

4. How does regulatory policy influence future market prospects?

Regulatory agencies' evolving safety and efficacy requirements could impact approval timelines and launch costs, influencing pricing strategies and market access.

5. What markets are expected to drive future growth for methylprednisolone sodium succinate?

Emerging markets in Asia-Pacific and Latin America, driven by expanding healthcare infrastructure and increasing autoimmune disease prevalence, are poised to be growth drivers.

References

[^1]: Grand View Research, “Corticosteroids Market Size & Trends,” 2022.

[^2]: IQVIA, “Global Corticosteroids Market Data Report,” 2022.

[^3]: EvaluatePharma, “Generic Drug Market Outlook,” 2022.

More… ↓