Share This Page

Drug Price Trends for NORETHIN-EE

✉ Email this page to a colleague

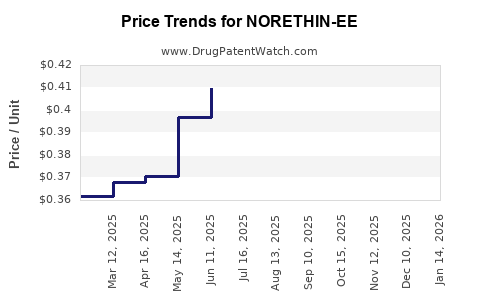

Average Pharmacy Cost for NORETHIN-EE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORETHIN-EE 1.5-0.03 MG(21) TB | 00378-7274-85 | 0.39151 | EACH | 2025-12-17 |

| NORETHIN-EE 1.5-0.03 MG(21) TB | 00378-7274-53 | 0.39151 | EACH | 2025-12-17 |

| NORETHIN-EE 1.5-0.03 MG(21) TB | 00378-7274-85 | 0.39233 | EACH | 2025-11-19 |

| NORETHIN-EE 1.5-0.03 MG(21) TB | 00378-7274-53 | 0.39233 | EACH | 2025-11-19 |

| NORETHIN-EE 1.5-0.03 MG(21) TB | 00378-7274-85 | 0.38347 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORETHIN-EE

Introduction

NORETHIN-EE, a combined oral contraceptive containing ethinyl estradiol and norethindrone, has established itself as a pivotal product within the global reproductive health market. As authorities and consumers increasingly prioritize contraceptive options with proven efficacy and safety profiles, understanding the market dynamics and forecasted pricing trajectories for NORETHIN-EE offers crucial insights for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Landscape

Global Pharmaceutical Market for Contraceptives

The global contraceptive market, valued at approximately $20.3 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 6% through 2030, driven by population growth, urbanization, and increasing awareness about family planning.[1] Oral contraceptives constitute a significant share, accounting for nearly 50% of the market globally**, due to their ease of use and established efficacy.

NORETHIN-EE’s Therapeutic Positioning

NORETHIN-EE is a generic formulation of estrogen-progestin combination contraceptives, competing primarily with branded products like Yasmin, Yaz, and other combination pills. Its appeal hinges on factors like cost-effectiveness, regulatory approval status, and physician preference.

Market Segments and Geographic Trends

-

North America & Europe: Mature markets, characterized by high contraceptive penetration, brand loyalty, and strict regulatory environments.

-

Asia-Pacific: Rapid growth owing to expanding healthcare infrastructure, favorable demographics, and evolving regulatory landscapes.

-

Emerging Markets: Significant growth potential lies here, despite challenges related to healthcare accessibility and regulatory hurdles.

Current Market Dynamics

Regulatory Environment & Patent Status

In the United States, NORETHIN-EE is approved as a generic product under the Abbreviated New Drug Application (ANDA) pathway, enhancing its accessibility. Patent expirations for branded equivalents often lead to increased market share for generics, further intensifying competition.[2]

Manufacturing & Supply Chain Considerations

Producers face pressure to streamline manufacturing to reduce costs in a highly competitive environment. Quality assurance and compliance with evolving regulatory standards (FDA, EMA) are crucial factors influencing supply reliability and, consequently, pricing strategies.

Competitive Landscape

The competitive framework is dominated by a few large generic manufacturers with extensive distribution networks. Market entry barriers are moderate, with regulatory approval being the key challenge. Price competition primarily focuses on cost leadership, quality, and patient safety features.

Price Trends and Projections

Historical Pricing Data

-

Average Wholesale Price (AWP): For generic oral contraceptives like NORETHIN-EE, the AWP has historically ranged between $15 and $25 per pack in North America.[3]

-

Market Trends: Over the past five years, there has been a consistent price decline of approximately 10-15% annually, driven by increased competition and patent expirations.

Projected Price Movements (2023-2030)

-

Short-term (2023–2025): Prices are expected to stabilize or slightly decline owing to intensified generic competition. Wholesale prices are projected to range between $10 and $18 per pack, with retail prices adjusting accordingly.

-

Mid to Long-term (2026–2030): Further reductions, potentially reaching $8 to $12 per pack in highly competitive markets, are anticipated as more manufacturers enter the space and economies of scale improve manufacturing efficiency.

-

Influencing Factors:

-

Regulatory approvals in emerging markets: Will possibly reduce prices as market entry barriers diminish.

-

Supply chain disruptions: Could temporarily elevate prices but are unlikely to alter long-term downward trends.

-

Insurance and reimbursement policies: Play vital roles in retail pricing, especially in North America.

-

Key Market Drivers and Barriers

Drivers

- Increasing acceptance of generic contraceptives driven by rising healthcare costs and insurance coverage.

- Population demographics, especially in developing countries, sustaining high demand.

- Advances in product formulations that improve patient adherence and safety.

Barriers

- Regulatory challenges in certain regions which may delay market entry or limit price competition.

- Patient preferences shifting toward long-acting reversible contraceptives (LARCs), which may impact demand.

- Pricing regulations in different jurisdictions, especially price caps in European countries and emerging markets.

Competitive Pricing Strategies

Pharmaceutical companies adopting aggressive pricing strategies, including bundling, discounts, and patient assistance programs, can influence retail prices. Additionally, differentiation through enhanced safety profiles or packaging convenience might command premium pricing in niche markets.

Implications for Stakeholders

- Manufacturers should focus on optimizing production costs and expanding into emerging markets to capitalize on volume gains.

- Policy makers can influence market prices through regulatory policies and subsidies, affecting overall accessibility.

- Investors should consider patent expiration timelines and regional regulatory developments when assessing future profitability.

Conclusion

The market for NORETHIN-EE is characterized by a mature landscape with steady downward pricing trends driven by generic competition. Short-term stability is anticipated, with prices per pack declining from recent levels of approximately $15–$25, reaching potentially below $10 in the next five years in highly competitive regions. Strategic positioning, regulatory navigation, and market expansion into emerging markets will be pivotal in optimizing profitability and maintaining market relevance.

Key Takeaways

- The global contraceptive market continues to grow at a healthy pace, with generics like NORETHIN-EE capturing increasing market share.

- Prices are expected to decline steadily, influenced by intensified competition, patent expirations, and regional regulatory factors.

- Cost optimization and market diversification are critical to sustain margins amid declining prices.

- Expansion into emerging markets offers significant growth potential, offsetting mature market saturation.

- Regulatory policies and healthcare reimbursement mechanisms significantly influence retail and wholesale pricing.

FAQs

1. What factors most influence the pricing of NORETHIN-EE globally?

Regulatory approval timelines, patent expirations, manufacturing costs, competition levels, and healthcare reimbursement policies are primary factors impacting prices.

2. How does NORETHIN-EE compare price-wise to branded contraceptives?

Generics like NORETHIN-EE are typically priced 30-50% lower than branded equivalents, mainly due to lower development costs and market competition.

3. What is the expected impact of emerging markets on NORETHIN-EE's pricing?

Emerging markets present opportunities for volume growth with prices potentially lower due to regulatory and economic factors, but increased competition may lead to further price reductions.

4. How might regulatory changes affect NORETHIN-EE pricing?

Stricter regulations could increase costs or delay entry, causing temporary price stabilization or increases, whereas regulatory harmonization can facilitate competitive pricing.

5. What strategic actions should manufacturers consider to maximize profitability?

Investing in manufacturing efficiencies, expanding into underserved markets, enhancing product safety profiles, and leveraging patient assistance programs can optimize margins.

References

[1] Market Research Future. (2022). Global Contraceptive Market Analysis.

[2] FDA. (2021). ANDA Approvals and Patent Data.

[3] IQVIA. (2022). Pharmaceutical Pricing Trends Report.

More… ↓