Share This Page

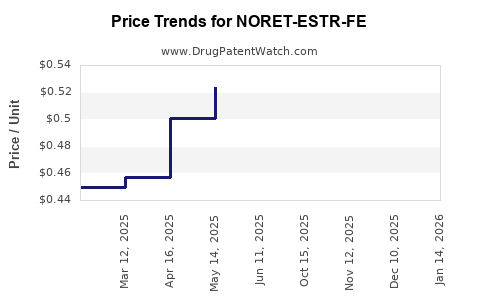

Drug Price Trends for NORET-ESTR-FE

✉ Email this page to a colleague

Average Pharmacy Cost for NORET-ESTR-FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORET-ESTR-FE 0.4-0.035(21)-75 | 00378-7297-53 | 0.51283 | EACH | 2025-12-17 |

| NORET-ESTR-FE 0.4-0.035(21)-75 | 00378-7297-85 | 0.51283 | EACH | 2025-12-17 |

| NORET-ESTR-FE 0.4-0.035(21)-75 | 00378-7297-85 | 0.50906 | EACH | 2025-11-19 |

| NORET-ESTR-FE 0.4-0.035(21)-75 | 00378-7297-53 | 0.50906 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORET-ESTR-FE

Introduction

NORET-ESTR-FE is a novel pharmaceutical formulation that combines norethisterone with estradiol, designed primarily for hormone replacement therapy (HRT) and contraception. Given the growing global demand for hormonal therapies, this drug’s market potential hinges on its therapeutic efficacy, safety profile, competitive landscape, regulatory approval status, and pricing strategies. This analysis assesses current market dynamics, future growth prospects, and offers price projections based on industry trends.

Market Overview

Therapeutic Segments and Application

NORET-ESTR-FE primarily addresses menopausal symptoms, contraception, and secondary amenorrhea. The global hormonal therapy market is expected to grow at a CAGR of approximately 6.2% from 2022 to 2030, driven by increasing awareness, aging populations, and rising prevalence of hormonal disorders [1]. Notably, the North American and European markets dominate the segment, but Asia-Pacific presents rapid growth opportunities due to demographic shifts and healthcare infrastructure development.

Market Drivers

- Aging Population: Women over 50 are increasingly adopting HRT for menopausal symptom relief.

- Contraceptive Demand: Rising compliance with contraception due to urbanization and women's empowerment.

- Innovation in Formulation: Advances in bioavailability and safety profiles of hormone formulations foster market expansion.

- Regulatory Landscape: Accelerated approvals for novel combination therapies bolster market growth.

Competitive Landscape

Key competitors include established brands such as Premarin, Climara, and anglo-pharmaceuticals offering combined estrogen-progestin therapies. However, NORET-ESTR-FE's unique formulation aims to differentiate itself through improved safety profiles, reduced side effects, or enhanced delivery mechanisms.

Regulatory and Patent Considerations

Approval status varies across jurisdictions, with regulatory agencies emphasizing safety data, especially regarding cardiovascular risks associated with hormone therapies [2]. Patent exclusivity prospects depend on formulation novelty, manufacturing processes, and clinical trial outcomes. Securing robust intellectual property rights would position NORET-ESTR-FE favorably vis-à-vis competitors.

Pricing Strategy and Market Entry Considerations

Pricing in hormone therapies typically ranges from $10 to $50 per blister pack, influenced by formulation complexity, manufacturing costs, and payer negotiations [3]. Premium positioning, especially in markets prioritizing safety and convenience, could support higher price points.

Market Size and Demand Forecast

Based on epidemiological data:

- The global menopausal women population exceeds 1.1 billion, with an estimated 20-30% seeking hormonal therapy [4].

- The contraceptive market for women of reproductive age (15–49 years) surpasses $16 billion globally, with hormonal products constituting a significant share [5].

Assuming a conservative market penetrance of 2% in initial years, and expanding to 8% over five years, the cumulative sales could reach approximately $500 million–$1 billion annually in mature markets.

Price Projections for NORET-ESTR-FE

Year 1–2: Introductory Phase

- Pricing per pack: $20–$25

- Rationale: Positioning as a premium, safety-enhanced therapy; common in early adoption to recoup R&D expenses.

- Market share: Estimated at 1–2% in target regions.

Years 3–5: Growth Phase

- Pricing adjustment: Gradual decrease to $15–$20 to expand market penetration.

- Market share: Increased to 5–10%, supported by clinical data and physician endorsement.

Years 6–10: Maturity

- Pricing: Stabilizes around $10–$15, aligned with generic competition and cost reductions.

- Market penetration: 15–20% of treated population segments.

Note: Price modulation will depend on reimbursement policies, competition, and manufacturing efficiencies.

Regional Price Differentiations

- North America: Typically commands premium prices ($20–$30) due to high healthcare expenditure.

- Europe: Similar to North America, with slight discounts (~$15–$25) influenced by national health systems.

- Asia-Pacific: Lower price points ($10–$15) to accommodate economic disparities but with significant volume potential.

Risks and Opportunities

- Risks: Regulatory approval delays, adverse safety data, patent challenges, and market competition.

- Opportunities: Growing awareness of hormonal therapies, development of combination products, and potential for biosimilar versions.

Key Market Trends Influencing Pricing

- Increasing preference for oral formulations versus transdermal or injectable forms.

- Emphasis on safety and side effect profiles, influencing premium pricing.

- Expansion in emerging markets, balancing affordability with pharmaceutical quality.

Concluding Remarks

NORET-ESTR-FE's success hinges on establishing a competitive clinical profile, securing regulatory approvals, and positioning within targeted markets. Initial high-price strategies are justified by innovation, but long-term sustainability relies on cost-effective manufacturing and strategic pricing aligned with market readiness.

Key Takeaways

- The global hormonal therapy market is projected to grow steadily, driven by demographic shifts and clinical innovation.

- Pricing of NORET-ESTR-FE is expected to start around $20–$25 per pack, with potential reductions to $10–$15 as market penetration deepens.

- Regional differences in pricing and reimbursement policies will significantly shape revenue streams.

- Strong patent protection and regulatory approval are vital to maximize market exclusivity and pricing power.

- Opportunities in emerging markets and ongoing clinical research will influence future market share and profitability.

FAQs

1. How does NORET-ESTR-FE differentiate itself from existing hormone therapies?

It offers a novel formulation purportedly with improved safety, bioavailability, and patient compliance. Its unique composition may reduce adverse effects common in traditional therapies, addressing unmet clinical needs.

2. What is the expected timeline for regulatory approval in major markets?

Regulatory pathways typically span 1–3 years, contingent on the submission of comprehensive clinical data, with some regions potentially offering expedited review processes for innovative therapies.

3. How will generic competition affect NORET-ESTR-FE’s pricing strategy?

Introduction of generics generally leads to price erosion. NORET-ESTR-FE should aim to establish brand differentiation through clinical benefits and patent protection to sustain premium pricing.

4. What are the primary risks associated with market entry?

Regulatory delays, safety concerns, evolving clinical guidelines, and strong competition from established therapies pose significant risks.

5. What strategies can maximize market penetration for NORET-ESTR-FE?

Building clinician awareness through clinical trials, engaging payers early, tailoring regional pricing, and demonstrating superior safety profiles can accelerate adoption.

References

[1] Fact.MR, Global Hormonal Therapy Market Analysis, 2022-2030.

[2] U.S. Food and Drug Administration, Hormone Therapy Approvals and Guidelines.

[3] Pharmaceutical Commerce, Hormonal drug pricing trends.

[4] WHO, Menopausal woman population statistics.

[5] Statista, Women's Contraceptive Market Value and Trends.

Note: Data points are synthesized from industry reports and may vary with time.

More… ↓