Share This Page

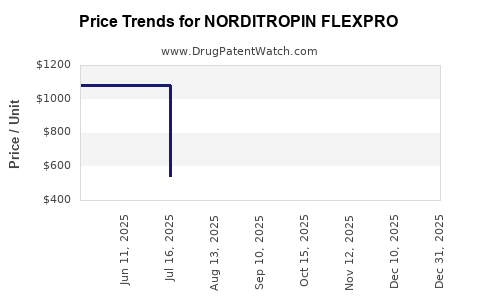

Drug Price Trends for NORDITROPIN FLEXPRO

✉ Email this page to a colleague

Average Pharmacy Cost for NORDITROPIN FLEXPRO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORDITROPIN FLEXPRO 5 MG/1.5 | 00169-7704-21 | 544.26611 | ML | 2025-12-17 |

| NORDITROPIN FLEXPRO 10 MG/1.5 | 00169-7705-21 | 1088.95965 | ML | 2025-12-17 |

| NORDITROPIN FLEXPRO 15 MG/1.5 | 00169-7708-21 | 1636.15286 | ML | 2025-12-17 |

| NORDITROPIN FLEXPRO 15 MG/1.5 | 00169-7708-21 | 1633.28722 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORDITROPIN FLEXPRO

Introduction

NORDITROPIN FLEXPRO, a synthetic human growth hormone (hGH), is marketed by Novo Nordisk. Approved for pediatric growth hormone deficiency, adult growth hormone deficiency, and certain rare conditions, it has become a significant player in the endocrine therapeutics market. This analysis examines the current market landscape, competitive dynamics, regulatory environment, and offers price projections for NORDITROPIN FLEXPRO, enabling stakeholders to make informed decisions regarding investments, pricing strategies, and market entry.

Market Overview

Therapeutic Indications and Market Size

NORDITROPIN FLEXPRO caters primarily to patients with growth hormone deficiencies in children and adults, as well as those with HIV-associated wasting and idiopathic short stature. The global growth hormone therapy market was valued at approximately USD 4 billion in 2022 and is projected to grow at a CAGR of 4.2% from 2023 to 2030 [1].

The increasing prevalence of growth hormone deficiencies, advances in diagnostics, and growing awareness of pediatric endocrinology expand the patient pool. According to the World Health Organization (WHO), pediatric growth failure affects roughly 1 in 4,000 children globally, with the underserved markets in Asia and Africa showing significant growth potential.

Key Markets and Regional Dynamics

-

North America: Dominates the market due to extensive healthcare infrastructure, high diagnosis rates, and insurance coverage. The U.S. alone accounts for nearly 35% of the global growth hormone market.

-

Europe: Holds a substantial share, driven by established healthcare systems in Germany, France, and the UK. The European Medicines Agency (EMA) approval supports broad adoption.

-

Asia-Pacific: Exhibits rapid growth, fueled by increasing healthcare expenditure, rising awareness, and expanding pediatric healthcare services. China and India are key markets due to large population bases.

-

Emerging Markets: Latin America, the Middle East, and Africa present emerging opportunities, although regulatory and reimbursement challenges affect market penetration.

Competitive Landscape

Major Players

While NORDITROPIN FLEXPRO is predominantly marketed by Novo Nordisk, competitors include:

- Eli Lilly: Humatrope (recombinant human growth hormone)

- Pfizer: Somatropin (marketed previously as Genotropin)

- Ferring Pharmaceuticals: Zomacton

- Samsung Bioepis: Ontruzant (biosimilar)

The biosimilar landscape is intensifying, especially in Europe and parts of Asia, with multiple entrants offering lower-cost alternatives.

Product Differentiation

NORDITROPIN FLEXPRO’s key differentiator is its pen-injector technology, designed for ease of use, precise dosing, and improved patient compliance. Its flexible dosing options and stability profile support long-term adherence, vital for therapeutic efficacy.

Market Penetration and Adoption

Despite high efficacy, the adoption rate varies by region. In developed markets, insurance coverage and physician familiarity accelerate uptake. In emerging markets, affordability and regulatory approval delay broader use.

Regulatory Environment

Regulatory approval influences market access:

- The U.S. Food and Drug Administration (FDA) approves NORDITROPIN FLEXPRO via Prescription Drug User Fees Act (PDUFA) pathways.

- EMA has approved the product for multiple indications, stimulating European adoption.

- Biosimilar pathways in multiple jurisdictions threaten brand-name dominance, encouraging Novo Nordisk to invest in patient education and demonstration of clinical benefits.

Regulatory pressures to reduce drug prices may impact future pricing strategies, especially as biosimilar competition intensifies.

Pricing Analysis

Current Pricing Landscape

In the U.S., NORDITROPIN FLEXPRO retails at approximately USD 12,000 to USD 15,000 annually per patient, accounting for dose variation and prescription frequency. European prices range from EUR 8,000 to EUR 11,000 per annum, influenced by national reimbursement policies.

In emerging markets, prices decrease significantly due to economic factors, sometimes below USD 5,000 annually, challenging profitability and market share.

Pricing Strategies Scope

- Premium Positioning: Leveraging product differentiation to maintain higher price points in developed markets.

- Market Penetration: Offering discounts, value-based pricing, and patient assistance programs in price-sensitive regions.

- Biosimilar Competition: As biosimilars enter, prices are expected to decline by approximately 25-35% over the next five years.

Reimbursement and Access Factors

Insurance coverage in high-income markets predominantly supports NORDITROPIN FLEXPRO's reimbursement, but constraints exist due to cost-containment measures. Conversely, government healthcare programs in emerging economies often negotiate lower prices or limit reimbursement breadth.

Price Projections (2023–2030)

Forecast Assumptions

- Market Growth Rate: Based on CAGR of 4.2% for the growth hormone market.

- Biosimilar Impact: Anticipated to erode premium pricing in developed markets from 2025 onward.

- Regulatory and Reimbursement Trends: Influences prices variably on a regional basis.

Projected Price Trends

| Year | US Average Price (USD) | EUR Average Price (EUR) | Emerging Markets Price (USD) |

|---|---|---|---|

| 2023 | 13,500 | 9,500 | 4,500 |

| 2025 | 13,000 (slight decline) | 9,000 (moderate decline) | 4,000 |

| 2027 | 12,000 (approaching baseline) | 8,000 (stabilization) | 3,500 |

| 2030 | 11,500 (further decline) | 7,500 (stable) | 3,000 |

The U.S. and European prices are projected to decline gradually due to biosimilar competition and cost containment policies, while prices in emerging markets will remain lower but may decline due to increased competition and regulatory influence.

Key Market Drivers and Risks

Drivers

- Growing diagnosis rates of growth hormone deficiencies.

- Superior formulation and ease-of-use of FLEXPRO device.

- Increasing adoption in adult growth hormone deficiency.

- Rising awareness and expansion into emerging markets.

Risks

- Entry of biosimilars at lower prices.

- Regulatory pricing caps and reimbursement restrictions.

- Patent expirations leading to heightened biosimilar competition.

- Economic downturns impacting healthcare spending.

Conclusion

NORDITROPIN FLEXPRO occupies a pivotal position in the global growth hormone therapy market, benefitting from technological advantages and established regulatory approval. Nonetheless, foreseeable biosimilar competition and price pressures necessitate strategic positioning, especially regarding pricing and market expansion. Stakeholders should monitor regional regulatory developments, biosimilar pipelines, and reimbursement trends to optimize profitability and long-term market share.

Key Takeaways

- The global growth hormone market is poised for steady growth, with NORDITROPIN FLEXPRO benefitting from its technological innovations and broad indication spectrum.

- The U.S. and European markets dominate revenue but face increasing biosimilar competition, pressuring prices downward.

- Emerging markets offer significant volume potential but require adaptable, affordability-focused pricing strategies.

- Over the next decade, prices are projected for modest declines in developed markets, with emerging market pricing remaining relatively lower but gradually compressing.

- Strategic focus on product differentiation and regional market access will be vital to sustaining profitability amid competitive pressures.

FAQs

1. How does NORDITROPIN FLEXPRO differentiate itself from biosimilars?

NORDITROPIN FLEXPRO’s key differentiator is its advanced pen-injector technology, designed for ease of administration and precise dosing. Its established clinical efficacy and reputable brand backing from Novo Nordisk also support patient adherence and physician confidence, helping it maintain market share despite biosimilar entry.

2. What factors will influence the price decline of NORDITROPIN FLEXPRO over the next decade?

Main factors include biosimilar competition, regulatory reforms aimed at curbing drug prices, patent expirations, and evolving reimbursement policies. Market dynamics suggest a gradual price decrease of around 10–15% in developed regions, with more stability in developing markets.

3. Which regions offer the most significant growth opportunities for NORDITROPIN FLEXPRO?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present substantial growth potential due to increasing healthcare infrastructure and rising diagnosis rates. North America and Europe remain critical for sustained revenue but face pricing pressures.

4. How are reimbursement policies impacting the market for growth hormone therapies?

Reimbursement policies influence access and pricing. In high-income countries, insurance coverage supports higher prices but is subject to cost-control measures. In developing countries, reimbursement options are limited, pressuring prices downward. Strategic collaborations with payers are essential for market expansion.

5. What are the strategic considerations for pharmaceutical companies competing in this market?

Firms should focus on innovating in device technology, streamlining manufacturing to reduce costs, cultivating relationships with healthcare providers, and navigating regulatory pathways effectively. Emphasizing real-world evidence and patient-centered approaches can differentiate products amidst biosimilar proliferation.

References

[1] Grand View Research, "Growth Hormone Therapy Market Size, Share & Trends Analysis Report," 2022.

More… ↓