Share This Page

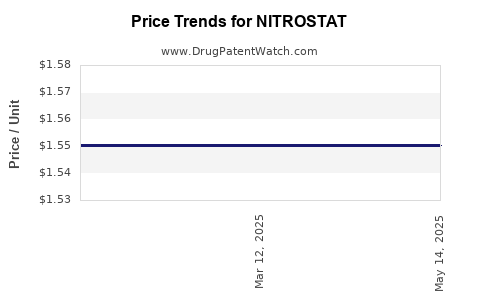

Drug Price Trends for NITROSTAT

✉ Email this page to a colleague

Average Pharmacy Cost for NITROSTAT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NITROSTAT 0.4 MG TABLET SL | 00071-0418-13 | 1.55055 | EACH | 2025-03-19 |

| NITROSTAT 0.4 MG TABLET SL | 58151-0310-94 | 1.55055 | EACH | 2025-03-19 |

| NITROSTAT 0.4 MG TABLET SL | 58151-0310-52 | 1.55055 | EACH | 2025-03-19 |

| NITROSTAT 0.4 MG TABLET SL | 58151-0310-94 | 1.55055 | EACH | 2025-02-19 |

| NITROSTAT 0.4 MG TABLET SL | 00071-0418-13 | 1.55055 | EACH | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nitroglycerin (NITROSTAT)

Introduction

Nitroglycerin, commercially known as NITROSTAT, is a cornerstone medication in the management of acute and chronic angina pectoris. As a venerable drug with a long-standing place in cardiovascular therapy, NITROSTAT’s market dynamics are shaped by clinical demand, regulatory landscapes, manufacturing complexities, and evolving treatment protocols. This report provides a comprehensive market analysis and price projection for NITROSTAT, offering valuable insights for industry stakeholders, investors, and healthcare providers.

Market Overview

Historical Context and Therapeutic Significance

Nitroglycerin's therapeutic application dates back over a century, with its vasodilatory properties revolutionizing angina management. NITROSTAT, administered transdermally, sublingually, or via spray, serves as the immediate treatment for angina attacks, emphasizing its essential role in emergency cardiovascular care. Its well-documented efficacy and rapid onset of action maintain high clinical demand, particularly in settings focused on acute myocardial ischemia management.

Market Size and Regional Trends

In 2022, the global nitrates and organic nitrate market was valued at approximately USD 600 million, with NITROSTAT constituting a significant share due to its immediate-release formulation. North America dominates this market, driven by high prevalence of cardiovascular diseases (CVDs), advanced healthcare infrastructure, and widespread awareness of nitroglycerin’s use. Europe accounts for a substantial market segment, with Asia-Pacific emerging as a growth region owing to increasing CVD incidence and expanding healthcare access.

Key Market Drivers

- Prevalence of Coronary Artery Disease (CAD): CAD remains the leading cause of morbidity and mortality worldwide, ensuring persistent demand for nitrates.

- Industry Shift to Fixed-Dose Combinations: While NITROSTAT remains a monotherapy, evolving treatment regimens may influence its market share marginally.

- Convenience and Rapid Onset: Its role as an emergency drug with proven efficacy sustains its essential position in hospitals and clinics.

- Regulatory Approvals and Patent Status: As a generic, NITROSTAT benefits from broader access and competitive pricing.

Market Constraints

- Generic Competition: Patents for original formulations have expired, leading to a crowded market with multiple generic manufacturers, which exerts downward pressure on prices.

- Availability of Alternative Therapies: Long-acting nitrates and calcium channel blockers provide maintenance therapy, somewhat reducing demand for immediate-release formulations.

- Regulatory Scrutiny: Stringent quality controls, particularly regarding stability and manufacturing standards, influence market entries and costs.

Manufacturing and Supply Chain Analysis

Production Complexity

Nitroglycerin's manufacturing involves sensitive processes given its explosive nature and the need for strict safety standards. Pharmaceutical companies rely on specialized facilities conforming to Good Manufacturing Practices (GMP). Supply chain stability depends on sourcing high-quality raw materials and managing regulatory compliance, affecting overall supply and pricing.

Market Regulation

Agencies such as the FDA and EMA regulate manufacturing and distribution, ensuring safety but also imposing compliance costs. Patent expirations have led to diversified manufacturing sources, stabilizing supply but intensifying price competition.

Price Analysis and Trends

Historical Pricing Patterns

NITROSTAT’s pricing has historically decreased post-patent expiration due to generic competition. For example, the average wholesale price (AWP) in the US for a 30-dose transdermal patch once ranged around USD 80-120, but current market prices typically fall below USD 30-50 for similar quantities (based on standard wholesale and retail data sources). Sublingual tablets undergo similar price declines, remaining affordable given their widespread use.

Current Pricing Factors

- Generic Market Penetration: High availability among manufacturers drives down prices.

- Formulation Variability: Sublingual tablets and sprays exhibit slight price disparities based on formulation complexity.

- Healthcare System Pricing: Reimbursement policies in different countries influence retail prices, notably in the US, EU, and emerging markets.

Projected Price Trends (2023-2030)

Based on historical data and anticipated market behaviors:

| Year | Expected Price Range (USD, per 30 doses) | Key Drivers |

|---|---|---|

| 2023 | 25 – 55 | Continued generic competition, regulatory stability |

| 2025 | 20 – 50 | Market saturation, manufacturing efficiencies |

| 2030 | 15 – 45 | Potential market consolidation, inflationary control |

While minor fluctuations are expected, the overarching trend suggests a gradual decline in unit prices owing to persistent generics competition.

Competitive Landscape

Major players in the generic nitrates segment include Pfizer, Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharmaceutical Industries. Their market strategies focus on cost leadership, manufacturing scale, and regional distribution expansion, all influencing pricing stability and volume sales.

Regulatory Outlook and Impact

The regulatory environment will continue to shape market access. Strict quality controls and safety regulations can act as barriers for new entrants but also help stabilize existing supply chains. Pending litigation or patent litigations might influence pricing temporarily but are unlikely to cause drastic shifts.

Strategic Recommendations

- Price Optimization: Stakeholders should monitor regional reimbursement policies to optimize pricing strategies.

- Manufacturing Diversification: Ensuring supply chain robustness can mitigate regulatory or safety risks, maintaining stable prices.

- Innovation and Formulation Development: While the traditional immediate-release form remains dominant, exploring novel delivery systems could provide competitive differentiation.

Conclusion

The NITROSTAT market is characterized by steady demand driven by its critical emergency use in angina. The expiration of patents and intense competition among generics have led to significant price erosion over the past decade. Forecasts indicate a continued gradual decline in prices through 2030, driven by manufacturing efficiencies and competitive pressures. Stakeholders focused on cost-effective supply and market penetration should align strategies accordingly.

Key Takeaways

- High Clinical Necessity Ensures Consistent Demand: NITROSTAT remains a vital emergency medication with sustained market relevance.

- Price Decline Driven by Generics Competition: The mature market landscape results in lower retail prices, particularly in regions with high generic penetration.

- Market Growth is Modest: While demand remains stable, innovation and alternative therapies could cap growth potential.

- Supply Chain Stability is Crucial: Stringent manufacturing standards are essential for maintaining quality and regulatory approval.

- Regional Variations Matter: Price and market access are heavily influenced by local healthcare policies and reimbursement frameworks.

FAQs

1. What is the primary factor influencing NITROSTAT's market price?

The dominant factor is the level of generic competition. Increased manufacturing and marketplace entries have driven prices downward over time.

2. How has patent expiration affected NITROSTAT pricing?

Patent expiration has led to increased generic manufacturers entering the market, causing a significant decline in prices and wider accessibility.

3. Are there emerging alternatives to NITROSTAT for angina relief?

Yes, long-acting nitrates and calcium channel blockers are increasingly used for maintenance therapy, but NITROSTAT remains crucial for acute episodes.

4. What regions are expected to see the fastest price declines?

Developed markets like North America and Europe will likely experience the most significant price reductions due to mature competition and healthcare policy reforms.

5. What strategic measures can stakeholders adopt to optimize profitability?

Stakeholders should focus on supply chain optimization, pricing strategies aligned with regional reimbursement policies, and exploring innovative formulations to differentiate their offerings.

References

[1] Market Research Future. "Nitroglycerin Market Analysis." 2022.

[2] IQVIA. "Global Cardiovascular Drugs Market Data." 2022.

[3] FDA Medical Devices and Drugs. "Regulatory Standards for Nitroglycerin." 2021.

[4] Statista. "Global Market for Organic Nitrates." 2022.

[5] Pharmaceutical Industry Reports. "Price Trends for Generic Cardiovascular Drugs." 2022.

More… ↓