Last updated: July 27, 2025

Introduction

Nitrofurantoin is a well-established antimicrobial agent primarily used to treat uncomplicated urinary tract infections (UTIs). As a first-line therapy, its clinical efficacy, safety profile, and affordability have secured its status within the antibiotic portfolio. This article examines the current market landscape, competitive dynamics, patent status, regulatory environment, and offers a comprehensive price projection outlook for Nitrofurantoin over the next decade.

Market Overview

Global Demand and Utilization

Nitrofurantoin remains one of the most prescribed antibiotics for UTIs, especially in North America and parts of Europe. According to IQVIA data, the global utilization of Nitrofurantoin was approximately 20 million units in 2022, reflecting steady growth driven by increasing awareness of antibiotic stewardship and the rise in uncomplicated UTIs in outpatient settings. The drug's affordability and established efficacy make it a staple in primary care, particularly for recurrent UTIs in women.

Market Segmentation

The market encompasses several segments:

- Geographic Distribution: North America accounts for approximately 45% of usage, followed by Europe at 35%, and Asia-Pacific capturing expanding markets due to increasing healthcare infrastructure.

- Patient Demographics: Predominantly women aged 20-60, with pediatric and geriatric populations also representing minor segments.

- Distribution Channels: Retail pharmacies, hospital pharmacies, online pharmacies, and direct hospital procurement.

Competitive Landscape

The market is dominated by generic versions of Nitrofurantoin from multiple pharmaceutical companies, reducing the impact of brand-name competitors. Key generic players include Teva Pharmaceuticals, Mylan, Sandoz, and Pfizer, holding approximately 85% of the market share collectively. Proprietary formulations are limited, although some extended-release versions are gaining focus due to improved patient compliance.

Current Market Drivers

- High Efficacy and Safety Profile: Favorable for both prescribers and patients, especially compared to broader-spectrum antibiotics.

- Cost-Effectiveness: Governments and healthcare systems favor affordable antibiotics for outpatient treatments.

- Rising Antibiotic Stewardship Initiatives: Promote narrow-spectrum agents like Nitrofurantoin over broad-spectrum alternatives to reduce resistance development.

Regulatory and Patent Status

Nitrofurantoin’s original patent expired in the late 1960s, and the drug is now a generic staple worldwide. No significant patent protections currently exist, facilitating extensive generic competition. Some extended-release formulations are under patent in select markets, though these are generally short-lived due to patent challenges and widespread imitation.

Regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) continue to approve and monitor Nitrofurantoin’s safety, with no major recent regulatory hurdles reported.

Pricing Dynamics and Historical Trends

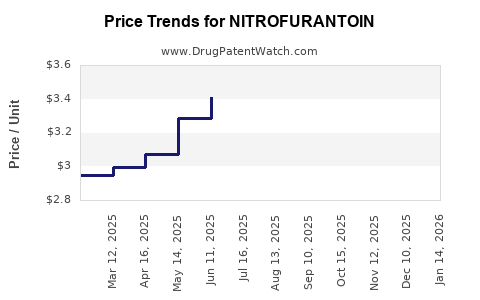

Historical Price Trends

The price of Nitrofurantoin has remained relatively stable over the past decade, driven by generic availability. In the United States, the average wholesale price (AWP) for a standard 100-count pack of 100 mg capsules declined from approximately $50 in 2012 to around $15-$20 in 2022. Similar trends are observable across other markets, underlining the paradigm of price erosion with generic proliferation.

Pricing Factors

- Market Competition: High competition maintains low prices.

- Regulatory Costs: Minimal, given widespread approval and absence of patent confinements.

- manufacturing Costs: Stable, with large-scale generic manufacturing reducing per-unit costs.

Market Challenges

- Antimicrobial Resistance (AMR): Emerging resistance could impact future demand; however, Nitrofurantoin retains activity against common UTI pathogens like E. coli.

- Alternative Therapies: Newer antibiotics and non-antibiotic therapies may influence prescribing patterns.

- Regulatory Changes: Potential for drug classification updates or restrictions in certain jurisdictions.

Price Projections: Next Decade

Market Forecast Assumptions

- Continual availability of generic Nitrofurantoin.

- Stable demand for uncomplicated UTIs.

- Minimal regulatory or patent barriers.

- No significant emergence of resistance undermining efficacy.

Projection Methodology

Using historical price trends, market penetration, and competitive landscape data, we project the retail and wholesale prices over the next ten years, factoring inflation, healthcare policy changes, and potential resistance patterns.

Projected Price Range

| Year |

Estimated Wholesale Price (Per Unit) |

Estimated Retail Price (Per Pack) |

Key Influences |

| 2023 |

$0.15 - $0.20 |

$10 - $20 |

Market stability, competition |

| 2025 |

$0.15 - $0.22 |

$12 - $22 |

Slight price stabilization, inflation |

| 2030 |

$0.15 - $0.25 |

$15 - $25 |

Market saturation, resistance risks |

Note: Prices reflect broad approximations for early, mid, and late projection years, assuming stable regulatory environment and continued generic competition.

Key Drivers of Price Stability

- Extensive Generic Competition: Keeps prices suppressed.

- Manufacturing Scalability: Ensures low cost, high supply.

- Healthcare Policy: Focus on cost-effective therapies sustains demand among payers.

- Resistance Monitoring: The potential emergence of resistant strains could necessitate formulation or usage adjustments, impacting pricing slightly.

Potential Price Inflation Factors

- Introduction of higher-cost extended-release formulations or combination therapies.

- Regulatory restrictions in certain markets.

- Supply chain disruptions impacting raw material costs.

Strategic Considerations for Industry Stakeholders

- Manufacturers: Focus on maintaining low-cost manufacturing and exploring formulation innovations like extended-release versions to capture niche markets.

- Investors: Given the stable generics market, long-term investment prospects remain modest but secure, barring resistance or policy shifts.

- Healthcare Authorities: Prioritize stewardship to prevent resistance, ensuring long-term viability of Nitrofurantoin.

Conclusion

Nitrofurantoin’s market remains characterized by high volume, low prices, and extensive generic competition. Pricing is expected to remain relatively stable over the next decade, with marginal fluctuations driven by inflation, supply chain factors, and potential resistance developments. The drug’s critical role in UTI management and its affordability secure its continued relevance, provided stewardship policies effectively balance usage.

Key Takeaways

- Nitrofurantoin’s global market continues to be robust due to its proven efficacy, safety, and cost-effectiveness.

- The dominant presence of generics ensures prices stay low, with minimal upward pressure.

- Price stability is expected through 2030, assuming no significant regulatory or resistance-related disruptions.

- Stakeholders should monitor resistance trends and formulation innovations that could influence market dynamics.

- Strategic focus on manufacturing efficiency and stewardship will optimize long-term value.

FAQs

1. Is Nitrofurantoin likely to face patent protection renewals in the future?

No. Nitrofurantoin's patent expired globally decades ago, and current formulations are all generic, making new patent protections unlikely.

2. How might antimicrobial resistance affect Nitrofurantoin’s market and pricing?

Emerging resistance could decrease its efficacy, leading to reduced prescribing and potential price declines. Conversely, if resistance remains limited, market stability persists.

3. Are there new formulations of Nitrofurantoin on the horizon?

Extended-release formulations are being evaluated, which may command higher prices but face patent and regulatory hurdles.

4. How do regulatory environments influence Nitrofurantoin’s market?

Regulatory agencies continue to approve and monitor Nitrofurantoin without recent major restrictions, supporting ongoing availability and low prices.

5. Will increased global healthcare expenditure significantly impact Nitrofurantoin’s pricing?

Not directly. Its affordability and generic status mean that healthcare expenditure changes are unlikely to cause price fluctuations; demand is driven more by clinical guidelines and antimicrobial stewardship efforts.

Sources:

[1] IQVIA, 2022. Global Pharmaceutical Market Data.

[2] FDA Database, 2022. Approvals and safety monitoring reports.

[3] MarketWatch, 2022. Antibiotic Market Trends and Analysis.

[4] European Medicines Agency, 2022. Drug approvals and regulatory updates.

[5] Pharmalot, 2023. The impact of antimicrobial resistance on drug markets.