Share This Page

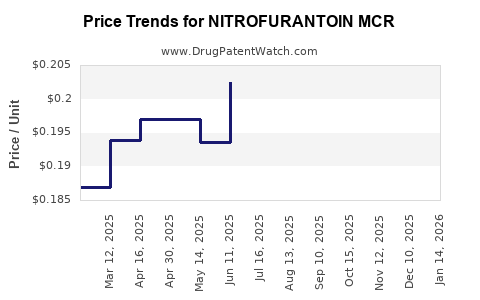

Drug Price Trends for NITROFURANTOIN MCR

✉ Email this page to a colleague

Average Pharmacy Cost for NITROFURANTOIN MCR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NITROFURANTOIN MCR 50 MG CAP | 72603-0183-01 | 0.15897 | EACH | 2025-12-17 |

| NITROFURANTOIN MCR 100 MG CAP | 00115-1645-01 | 0.23390 | EACH | 2025-12-17 |

| NITROFURANTOIN MCR 100 MG CAP | 43386-0642-01 | 0.23390 | EACH | 2025-12-17 |

| NITROFURANTOIN MCR 100 MG CAP | 50268-0624-15 | 0.23390 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nitrofurnantoin MCR

Introduction

Nitrofurantoin MCR (Multiple Chemical Residue) is a broad-spectrum antibiotic used primarily to treat urinary tract infections (UTIs). As a well-established pharmaceutical, its market dynamics are influenced by factors such as patent status, generic competition, regulatory landscape, and global healthcare trends. This analysis assesses current market conditions and projects future pricing trajectories for Nitrofurantoin MCR to inform stakeholders including manufacturers, healthcare providers, and investors.

Market Overview

Therapeutic Use and Market Demand

Nitrofurantoin has been a mainstay in antibiotic therapy for UTIs for decades. Its efficacy against common uropathogens like Escherichia coli, combined with a favorable safety profile, sustains consistent demand. The global incidence of UTIs, estimated to affect 150 million people annually according to the WHO, supports a sizable market for Nitrofurantoin products. The drug’s utilization is particularly prevalent in primary care settings across North America, Europe, and parts of Asia.

Regulatory Status and Patent Landscape

Nitrofurantoin's patent protections have generally expired, with generic formulations dominating markets in many regions. However, specific formulations such as Nitrofurantoin MCR, which involves chemically modified release mechanisms or combination regimens, may possess varying patent statuses. Manufacturers often seek exclusivity through formulation innovations, patents, or regulatory exclusivities, affecting market competitiveness. Regulatory bodies such as the FDA, EMA, and respective regional authorities approve Nitrofurantoin combinations and formulations, influencing market access and pricing.

Competitive Environment

The market is highly competitive, characterized by numerous generic manufacturers. The presence of multiple players tends to drive prices downward, particularly after patent expiration. Innovator brands may maintain premium pricing if they offer differentiated formulations or improved pharmacokinetics. The rise of resistance patterns influences prescribe behavior, occasionally prompting shifts to alternative antibiotics, which can impact demand for Nitrofurantoin MCR.

Market Size and Regional Insights

North America

North America represents the largest segment, driven by high UTI prevalence, established healthcare infrastructure, and aggressive adoption of generic drugs. The U.S. Pharmaceuticals market reports annual sales of Nitrofurantoin exceeding $200 million, with generic drugs accounting for over 90% of prescriptions.

Europe

Europe exhibits strong demand, with treatment guidelines favoring Nitrofurantoin for uncomplicated UTIs, especially following resistance concerns with other antibiotics. Pricing varies across countries, reflecting differing health policies and reimbursement schemes.

Asia-Pacific

APAC presents a rapidly growing market due to increasing UTI incidence, expanding healthcare access, and rising awareness of antibiotic therapy. The region's market growth is also bolstered by a proliferation of local generic manufacturers offering cost-competitive Nitrofurantoin formulations.

Price Trends and Projections

Current Pricing Landscape

In mature markets, the average wholesale price (AWP) for Nitrofurantoin ranges from $0.10 to $0.50 per tablet — comparable among generics, with brand-name formulations priced higher. The MCR formulations tend to command premiums of 10-20% over standard formulations due to specialized release mechanisms.

Factors Impacting Price Stability

- Generic Competition: The entry of multiple manufacturers sustains downward pressure.

- Regulatory Changes: Approval of biosimilar or alternative antibiotics may diminish Nitrofurantoin's market share.

- Supply Chain Dynamics: Raw material costs, manufacturing capacity, and geopolitical factors influence pricing.

- Healthcare Policies: Reimbursement models and formulary preferences critically impact list prices and patient out-of-pocket expenses.

Future Price Projection (2023-2030)

Given current trends, the market for Nitrofurantoin MCR is expected to experience:

-

Gradual Price Decline (2023-2026): As patent expiries and generic competition intensifies, prices are projected to decrease by approximately 5-8% annually, stabilizing at an average of $0.10-$0.30 per tablet in developed markets.

-

Stabilization and Possible Premiums Post-2026: If innovative MCR formulations demonstrate clinical advantages—such as improved pharmacokinetics, reduced resistance potential, or enhanced patient compliance—manufacturers could sustain higher pricing tiers. Premium pricing may reach 15-25% over older formulations, especially in regions with regulatory barriers to generics.

-

Impact of Resistance Patterns: Rising antimicrobial resistance may influence prescribing behaviors, potentially shifting demand toward newer, possibly more expensive, formulations or combination therapies, thus affecting price dynamics.

-

Regional Variations: Emerging markets may sustain lower prices ($0.05-$0.15 per tablet), influenced by local manufacturing, regulatory environments, and healthcare budgets.

Market Drivers and Barriers

Drivers

- High UTI Incidence: Consistently high demand sustains market volume.

- Established Efficacy and Safety Profile: Continued reliance on Nitrofurantoin favors stable or growing demand.

- Regulatory Approvals for New Formulations: Potential development of MCR variants with enhanced features supports market longevity.

Barriers

- Antimicrobial Resistance (AMR): Increasing resistance diminishes clinical utility, possibly reducing market size.

- Emergence of New Antibiotics: Novel drugs with better efficacy or safety could supplant Nitrofurantoin in some indications.

- Pricing Pressures: Heightened cost containment initiatives and reimbursement constraints hinder price increases.

Strategic Recommendations

Stakeholders should monitor resistance trends, regulatory changes, and formulation innovations that could influence market positioning. Investment in differentiating Nitrofurantoin MCR formulations—such as sustained-release or combination therapies—may allow premium pricing persistence. Additionally, expanding access through partnerships in emerging markets can sustain revenues amid global price declines.

Key Takeaways

- Nitrofurantoin MCR's core market remains robust due to widespread UTI treatment needs, but it faces mounting generic competition and resistance concerns.

- Price declines of approximately 5-8% annually are anticipated in mature markets through 2026, with stabilization thereafter if formulations are innovated.

- Formulation innovations that offer clinical advantages could sustain higher pricing tiers and market share.

- The global market will diversify, with developing regions offering lower prices, influenced by local manufacturing and economic factors.

- Strategic focus on resistance management, formulation development, and regional expansion will be critical for maximizing profitability.

FAQs

-

What factors most significantly influence Nitrofurantoin MCR pricing?

Factors include patent status, generic competition, formulation innovations, regional regulatory policies, and antimicrobial resistance patterns. -

How does antimicrobial resistance impact the Nitrofurantoin market?

Rising resistance can reduce clinical efficacy, decrease demand, and shift prescribing towards alternatives, thus influencing overall market size and pricing. -

Are there upcoming formulation innovations that could affect Nitrofurantoin MCR prices?

Yes, sustained-release formulations or combination therapies with improved pharmacokinetics could command higher prices and extend market viability. -

What regional differences should stakeholders be aware of?

Developed markets tend to have stable, higher prices with robust demand, while emerging markets may feature lower prices with growth potential driven by expanding healthcare access. -

What are the key risks facing Nitrofurantoin MCR market projections?

Key risks include the emergence of superior antibiotics, new resistance patterns, regulatory shifts, and global supply chain disruptions.

References

[1] World Health Organization. (2022). Urinary Tract Infections Fact Sheet.

[2] IQVIA. (2022). Pharmaceutical Market Data.

[3] FDA. (2021). Antibiotic Approval and Licensing Data.

[4] European Medicines Agency. (2022). Marketed Antibiotics Data.

[5] GlobalData. (2023). Antibiotics Market Forecasts.

More… ↓