Last updated: July 28, 2025

Introduction

Nicardipine, a potent calcium channel blocker, is primarily employed in treating acute hypertension and facilitating controlled blood pressure reduction during surgical procedures. Its efficacy in managing hypertensive crises and facilitating perioperative blood pressure control makes it a valuable asset within critical care and cardiovascular therapeutics. Understanding its market dynamics, competitive landscape, regulatory environment, and future price trajectories is essential for stakeholders across pharmaceutical, healthcare, and investment sectors.

Market Overview

Therapeutic Application and Demand Drivers

Nicardipine belongs to the dihydropyridine class of calcium channel blockers, exhibiting selective vasodilation of coronary and peripheral arteries. The key markets for Nicardipine are North America, Europe, and emerging economies with expanding healthcare infrastructures.

The rising global prevalence of hypertension—estimated to affect over 1 billion individuals worldwide—and the increasing adoption of intensive care therapies contribute to sustained demand. Moreover, the drug's pivotal role in managing hypertensive emergencies and perioperative hypertension supports ongoing utilization despite competition from alternative agents like labetalol and clevidipine.

Market Size and Revenue Estimates

As of 2022, the global antihypertensive drugs market was valued at approximately USD 53 billion, with calcium channel blockers comprising a significant subset. Nicardipine's segment, while niche relative to class giants like amlodipine, commands a focused presence within hospital formularies.

In the critical care setting, the intravenous formulation's use in intensive care units (ICUs) sustains niche but steady revenue streams. North America accounts for roughly 40% of the market, driven by advanced healthcare infrastructure and high hypertension awareness. Europe follows, with emerging markets projected to contribute increasingly due to rising healthcare investments.

Key Competitive Players

Major pharmaceutical companies manufacturing Nicardipine include:

- Baxter International (e.g., via its product Cardene IV)

- Novartis

- Pfizer

- Teva Pharmaceutical Industries

- Sun Pharmaceutical Industries

Generic formulations dominate much of the global market, leading to competitive pressure on pricing and margins.

Regulatory and Patent Landscape

Patent Status and Exclusivity

Patent protections for proprietary formulations of Nicardipine have generally expired or are nearing expiration in many jurisdictions, leading to a rise in generic manufacturers. However, some branded formulations retain patent exclusivity within specific markets or for specialized delivery forms.

Regulatory Challenges

Stringent regulatory frameworks necessitate ongoing clinical data for new indications or formulations. Post-approval variations or new delivery methods (e.g., sustained-release) require additional approval pathways, impacting time-to-market and pricing strategies.

Market Dynamics and Trends

Technological Innovations

Advances include development of sustained-release formulations or alternative delivery methods (e.g., transdermal patches), potentially influencing pricing by adding differentiation.

Pricing Strategies and Reimbursement Policies

In developed markets, reimbursement models and formularies significantly influence actual transaction prices. Hospitals and healthcare systems often negotiate discounts for bulk purchases or switch to generics to optimize costs.

Impact of COVID-19

The pandemic has disrupted supply chains and shifted healthcare priorities, leading to fluctuations in demand—primarily in critical care settings.

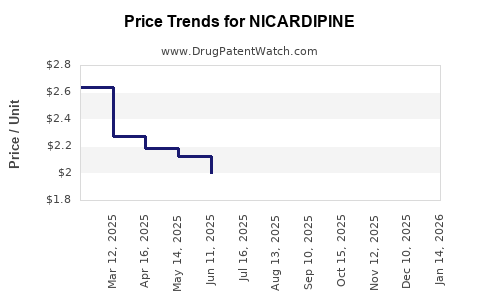

Price Projections for Nicardipine

Current Pricing Landscape

In the United States, a typical 50 mg vial of branded Nicardipine IV can range from USD 25-35. Generic options reduce this to USD 10-20 per vial, with variability by supplier and purchase volume. European prices are comparable, with discounts typical for hospital procurement.

Forecasted Trends (2023-2030)

- Stability in Developed Markets: Mature markets are expected to experience modest price declines (2-4% annually), driven by increasing generic penetration and cost-containment policies.

- Emerging Market Growth: Prices may remain stable or slightly increase (1-3% annually), reflecting inflation, regulatory pressures, and the adoption of higher-value formulations.

- Introduction of New Formulations: If sustained-release or biosimilar versions gain approval, price structures could shift, potentially reducing overall costs or allowing premium pricing for differentiated offerings.

Market Influences on Price

Key drivers affecting future prices include:

- Patent expirations leading to increased generic competition and price erosion.

- Regulatory approvals for new indications or formulations.

- Healthcare policy changes favoring cost-effective treatments.

- Supply chain stability, especially in the context of geopolitical factors and global health crises.

Projected Price Range (2023-2030)

| Year |

Average Price per Vial (USD) |

Notes |

| 2023 |

USD 15-20 (generic) |

Entry of more generics stabilizes prices. |

| 2025 |

USD 14-18 |

Continued generic proliferation, slight price decline. |

| 2027 |

USD 13-17 |

Market maturity solidifies, potential for price stabilization. |

| 2030 |

USD 12-16 |

Further generics and possible new formulations contribute to downward price trend. |

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets. Growing healthcare investment and hypertension screening facilitate increased utilization.

- Development of novel formulations. Sustained-release or combination products can command premium pricing.

- Strategic partnerships. Collaborations with regional manufacturers can enhance distribution and reduce costs.

Challenges

- Pricing pressures from generics. Expiration of patents leads to substantial price erosion.

- Competition from alternative antihypertensive agents. Emergence of new drugs with better efficacy or safety profiles.

- Regulatory hurdles. Stringent approval processes for new formulations or indications may delay commercialization.

Conclusion

The Nicardipine market remains structurally steady with specific niches driven by critical care and emergency hypertension management. Price trajectories indicate a gradual decline in developed markets due to patent expirations and increased generic competition, with emerging markets offering potential growth avenues.

Stakeholders should focus on optimizing supply chain efficiencies, exploring innovative formulations, and leveraging regional expansion to sustain profitability in a commoditized environment.

Key Takeaways

- Market stability for Nicardipine hinges on critical care demand and ongoing hypertension management, especially in hospitals.

- Generic proliferation will dominate pricing trends, leading to a gradual decline in prices, specifically in mature markets.

- Emerging markets present growth opportunities with relatively stable or rising prices due to increasing healthcare access.

- Innovation in formulations and combination therapies could offer differentiation and justify premium pricing.

- Regulatory and patent landscape shifts are pivotal in defining competitive dynamics and pricing strategies.

FAQs

1. What factors influence the price of Nicardipine globally?

Pricing is affected by patent expiration, generic competition, regulatory approvals, healthcare reimbursement policies, supply chain stability, and market demand within critical care and hypertension management.

2. How will patent expirations impact Nicardipine prices?

Patent expirations typically lead to increased generic competition, resulting in significant price reductions—often ranging from 20% to 50%—as multiple manufacturers enter the market.

3. Are there opportunities for premium pricing with new Nicardipine formulations?

Yes. Sustained-release, transdermal, or combination formulations with improved safety or convenience profiles could command higher prices, especially if backed by clinical evidence demonstrating superior outcomes.

4. What emerging markets hold the most potential for Nicardipine growth?

Regions like Asia-Pacific, Latin America, and parts of Africa are poised for growth due to expanding healthcare systems, increasing hypertension prevalence, and rising hospital infrastructure investments.

5. How might regulatory changes affect Nicardipine's market and pricing?

Regulatory shifts—such as streamlined approval pathways or stricter quality standards—can either accelerate market entry for new formulations or increase compliance costs, indirectly impacting pricing strategies.

Sources:

- Grand View Research. Hypertension Drugs Market Size, Share & Trends Analysis. 2022.

- IQVIA. Global Cardiovascular Drug Market Report. 2022.

- ClinicalKey. Pharmacology of Nicardipine. 2021.

- European Medicines Agency. Nicardipine Summary of Product Characteristics. 2022.

- U.S. Food & Drug Administration. Drug Approvals and Labeling. 2022.