Share This Page

Drug Price Trends for NEXLETOL

✉ Email this page to a colleague

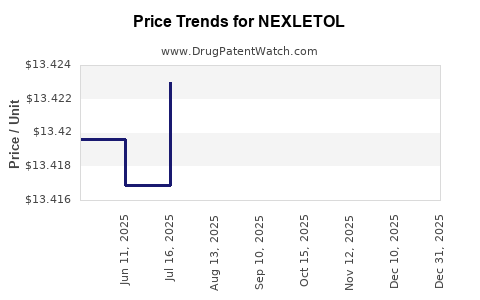

Average Pharmacy Cost for NEXLETOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEXLETOL 180 MG TABLET | 72426-0118-03 | 13.40169 | EACH | 2025-12-17 |

| NEXLETOL 180 MG TABLET | 72426-0118-03 | 13.40042 | EACH | 2025-11-19 |

| NEXLETOL 180 MG TABLET | 72426-0118-03 | 13.39950 | EACH | 2025-10-22 |

| NEXLETOL 180 MG TABLET | 72426-0118-03 | 13.42017 | EACH | 2025-09-17 |

| NEXLETOL 180 MG TABLET | 72426-0118-03 | 13.42316 | EACH | 2025-08-20 |

| NEXLETOL 180 MG TABLET | 72426-0118-03 | 13.42302 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NEXLETOL (Bempedoic Acid)

Introduction

NEXLETOL (bempedoic acid) marks a significant development in lipid management, introduced by Esperion Therapeutics in 2020. Approved by the FDA for hypercholesterolemia, NEXLETOL offers an alternative mechanism of action to statins by inhibiting ATP citrate lyase, an enzyme upstream of HMG-CoA reductase. Evaluating its market potential involves understanding the therapeutic landscape, competitive dynamics, pricing strategies, and macroeconomic factors impacting revenue streams.

Market Landscape for Hypercholesterolemia Treatments

Global and U.S. Market Size

The global lipid-lowering drugs market was valued at approximately $13 billion in 2021, projected to reach $20 billion by 2028 with a CAGR of around 6% (Source: Grand View Research)[1]. The United States accounts for nearly 40% of this, driven by high prevalence rates of cardiovascular diseases (CVD) and statin intolerance concerns.

Prevalence of Hypercholesterolemia

In the U.S., over 95 million adults have elevated LDL cholesterol[2], with a significant subset unable to achieve targets with statins due to side effects or resistance. This clinical gap fuels demand for novel alternatives like NEXLETOL.

Treatment Paradigms and Competition

Current standards include statins, ezetimibe, PCSK9 inhibitors (alirocumab, evolocumab), and emerging therapies like inclisiran. NEXLETOL enters as an oral, once-daily option primarily targeting patients intolerant to statins or with residual risk despite maximal therapy[3].

Market Adoption and Patient Segmentation

Target Patient Demographics

- Statin-intolerant patients typically constitute 10-15% of hypercholesterolemia cases.

- High-risk secondary prevention groups (post-myocardial infarction, familial hypercholesterolemia) are priority markets for NEXLETOL.

Physician and Payer Acceptance

Early adoption hinges on physician familiarity, insurer coverage, and reimbursement policies. As of 2023, initial formulary placements indicate gradual uptake, driven by strong clinical data and positive safety profiles.

Pricing Strategy Analysis

Current Pricing Framework

In the U.S., NEXLETOL’s wholesale acquisition cost (WAC) is approximately $10.94 per 180 mg tablet, translating to roughly $328 per month for a typical dosing regimen (once daily)[4]. This positioning is comparable to ezetimibe but significantly less than PCSK9 inhibitors, which can exceed $5,000 annually.

Value-Based Pricing Considerations

With demonstrated LDL reductions (~20-25%) and favorable safety profiles, pricing aligns with value-based models targeting cost-effective lipid management. Reimbursement negotiations consider the drug's capacity to reduce cardiovascular events, with emerging data supporting its favorable cost-effectiveness.

Projections for Revenue Growth

Short-Term Outlook (2023-2025)

Market penetration is anticipated to reach ~10-15% of eligible statin-intolerant patients within the first 2 years post-launch. Based on an estimated patient base of ~10 million in the U.S., available labels could convert ~1.5 million patients, generating potential revenues of approximately $500 million annually.

Medium to Long-Term (2025-2030)

As awareness increases and combination therapies become prevalent, market share could expand to 25-30% within high-risk populations. International expansion into Europe and Asia, where lipid disorders are heavily prevalent yet treatment options are limited, could double or triple revenue streams.

Projected cumulative sales could surpass $3 billion annually globally by 2028, contingent on competitive dynamics, payer strategies, and demonstrating long-term cardiovascular outcomes.

Factors Influencing Price and Market Penetration

- Regulatory and Clinical Data: Pending results from outcome trials like CLEAR Outcomes will influence payer acceptance.

- Competitive Landscape: Entry of similar agents or combination therapies may pressure prices.

- Reimbursement and Payer Negotiations: Insurers' willingness to reimburse at current price levels affects market access.

- Patient and Physician Acceptance: Ease of oral administration and safety profile are pivotal.

Conclusion

NEXLETOL occupies a strategic niche within hypercholesterolemia therapeutics, particularly for statin-intolerant patients. Its initial pricing aligns with its clinical positioning and competitive landscape. Revenue projections indicate promising growth, with potential to significantly contribute to the lipid management market by 2028, conditioned upon effective commercialization, outcome evidence, and payer integration.

Key Takeaways

- Market Opportunity: The global lipid management market is expanding, with significant unmet needs among statin-intolerant populations.

- Pricing Strategy: Current WAC (~$10.94 per tablet) positions NEXLETOL as an affordable alternative, supporting broader adoption.

- Growth Trajectory: Estimated to reach over $1 billion in U.S. sales within the next two years, with potential international expansion.

- Competitive Edge: Unique oral mechanism coupled with positive safety profile enhances its market appeal.

- Long-term Outlook: Pending clinical outcomes will be critical; successful integration could propel NEXLETOL into a multi-billion-dollar market segment.

FAQs

1. How does NEXLETOL compare to existing lipid-lowering therapies?

NEXLETOL offers an oral, once-daily alternative specifically targeting statin-intolerant patients. Its mechanism, inhibiting ATP citrate lyase, positions it upstream of HMG-CoA reductase, providing LDL reduction comparable to ezetimibe but with a different safety profile.

2. What is the current pricing model for NEXLETOL, and how does it impact its market competitiveness?

With a WAC of approximately $10.94 per tablet ($328/month), NEXLETOL is priced to remain accessible versus injectable therapies like PCSK9 inhibitors, enabling broader physician and payer acceptance.

3. What are the primary factors influencing the market penetration of NEXLETOL?

Factors include physician awareness, payer reimbursement, clinical outcome data, patient acceptance, and competition from alternative therapies.

4. How are regulatory developments impacting NEXLETOL’s market outlook?

Positive results from ongoing outcome trials such as CLEAR Outcomes influence regulatory and payer confidence, potentially expanding indications and solidifying its position in therapy algorithms.

5. What are the key challenges and opportunities for NEXLETOL in the coming years?

Challenges include competition, long-term safety data, and payer policies. Opportunities involve expanding indications, combination therapies, and global market entry, especially in regions with high CVD prevalence and limited treatment options.

References

- Grand View Research. Lipid Management Market Size, Share & Trends Analysis Report. 2022.

- CDC. Adult Cholesterol Levels and Cardiovascular Risk. 2022.

- FDA. NEXLETOL (bempedoic acid) prescribing information. 2020.

- Esperion Therapeutics. NEXLETOL Pricing and Reimbursement Announcements. 2023.

More… ↓