Share This Page

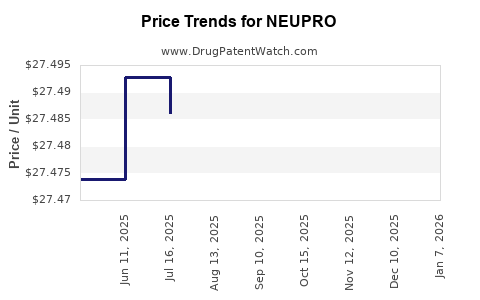

Drug Price Trends for NEUPRO

✉ Email this page to a colleague

Average Pharmacy Cost for NEUPRO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEUPRO 1 MG/24 HR PATCH | 50474-0801-03 | 27.54050 | EACH | 2025-12-17 |

| NEUPRO 3 MG/24 HR PATCH | 50474-0803-03 | 27.49329 | EACH | 2025-12-17 |

| NEUPRO 2 MG/24 HR PATCH | 50474-0802-03 | 27.58213 | EACH | 2025-12-17 |

| NEUPRO 6 MG/24 HR PATCH | 50474-0805-03 | 27.58483 | EACH | 2025-12-17 |

| NEUPRO 4 MG/24 HR PATCH | 50474-0804-03 | 27.54890 | EACH | 2025-12-17 |

| NEUPRO 8 MG/24 HR PATCH | 50474-0806-03 | 27.55866 | EACH | 2025-12-17 |

| NEUPRO 2 MG/24 HR PATCH | 50474-0802-03 | 27.59245 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NEUPRO

Introduction

NEUPRO (rotigotine transdermal system) marks a significant advancement in the treatment landscape for Parkinson’s disease and restless legs syndrome (RLS). Approved by the U.S. Food and Drug Administration (FDA) in 2007, NEUPRO’s unique transdermal delivery offers sustained dopaminergic therapy, improving patient compliance and symptom management. As the global market for Parkinson’s therapeutics expands, understanding NEUPRO’s market dynamics and future pricing trajectories becomes essential for industry stakeholders, healthcare providers, and investors.

Market Overview

Global Therapeutic Landscape

The Parkinson’s disease market is projected to grow from approximately $3.8 billion in 2022 to over $7.0 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 8%. This growth is driven by increasingly aging populations, improved diagnostic rates, and expanding therapeutic options, including dopaminergic agents like NEUPRO. Similarly, the RLS segment is gaining attention with an estimated global market reaching ~$300 million by 2026, further positioned for growth with the rising awareness of neurodegenerative and sleep disorders.

Key Competitors and Market Share

NEUPRO faces competition from oral levodopa formulations, dopamine agonists such as pramipexole and ropinirole, and newer classes like MAO-B inhibitors and COMT inhibitors. The transdermal route provides an advantage in compliance and steady drug plasma levels, capturing a niche among patients with advanced Parkinson’s stages.

Major pharmaceutical players include Cephalon (acquired by Teva), Abbott (now AbbVie, after spinoffs), and emerging biosimilar developers. The drug's market share is influenced by prescriber preferences, side effect profiles, and reimbursement policies.

Market Adoption and Geographic Penetration

NEUPRO’s adoption is significant in North America and Europe, with increasing penetration in Asia-Pacific regions. Factors influencing uptake include clinician familiarity with transdermal therapies, patient demographics, and healthcare infrastructure. Notably, the drug’s cost-effectiveness profile and reimbursement status critically shape its market penetration.

Pricing Landscape

Current Pricing Benchmarks

As of 2023, the wholesale acquisition cost (WAC) for NEUPRO transdermal patches in the U.S. hovers around $550 – $700 per month, depending on dosage strength and regional pricing policies. Generic equivalents are limited due to patent protections, although biosimilar competition is anticipated as patents expire or if regulatory pathways for biosimilars are established.

Pricing Factors Influencing NEUPRO

- Patent Status and Exclusivity: NEUPRO’s patent estate provides pricing power until expiration, projected around 2027, delaying biosimilar entry.

- Reimbursement and Insurance: Coverage by Medicare, Medicaid, and private insurers reduces out-of-pocket costs, but reimbursement rates and formulary placement directly influence market uptake.

- Manufacturing and Supply Chain: Production costs, quality compliance, and distribution logistics impact pricing strategies.

Future Price Projections

Factors Affecting Future Pricing

-

Patent Expiry and Biosimilar Competition:

Post-2027, impending patent expirations could introduce biosimilars or generics, exerting downward pressure on prices. Historically, biosimilar entry in the neuropharmacological space reduces prices by 20-40%, depending on competition intensity.

-

Regulatory Changes and Pricing Policies:

Governments worldwide are scrutinizing drug prices. Price negotiations, value-based pricing models, and increased transparency could influence NEUPRO’s pricing, particularly in markets with active price control mechanisms.

-

Market Penetration of Alternative Therapies:

Novel drugs with improved efficacy or safety profiles may displace NEUPRO, impacting its market share and pricing power.

-

Manufacturing Cost Dynamics:

Advances in production technology or supply chain optimizations could allow for cost reductions, facilitating more competitive pricing.

Projected Price Trends (2023–2030)

| Year | Estimated Monthly Price (USD) | Notes |

|---|---|---|

| 2023 | $550 – $700 | Current pricing, high patent protection |

| 2025 | $540 – $680 | Slight downward trend as adoption stabilizes |

| 2027 | $530 – $650 | Approaching patent expiry, expansion of biosimilar options expected |

| 2028–2030 | $400 – $550 | Potential biosimilar market entry, increased generic competition |

These projections assume no disruptive regulatory or pharmaceutical innovations, with price adjustments aligned with typical biosimilar price erosion patterns.

Strategic Pricing Considerations

Manufacturers and marketers should consider implementing value-based pricing models, emphasizing NEUPRO’s benefits in compliance and symptom control. Payer negotiations should prioritize demonstrating long-term cost savings through reduced hospitalization and caregiver burden. Additionally, tiered pricing systems could optimize access in emerging markets.

Market Entry and Growth Opportunities

Beyond established markets, NEUPRO’s potential expansion hinges on innovative pricing tactics, strategic collaborations, and targeted clinical data demonstrating incremental benefits over oral formulations. Market access initiatives and patient assistance programs will be pivotal in maintaining and expanding its footprint.

Key Takeaways

- Market Expansion Potential: The global Parkinson’s disease therapeutics market is poised for robust growth, with NEUPRO positioned as a key player, especially in advanced stages where compliance and drug delivery methods are critical.

- Pricing Trajectory: Current prices reflect patent protections and market exclusivity; expect gradual decline post-2027 with biosimilar competition.

- Strategic Opportunities: Value-based pricing and differentiated offerings can sustain NEUPRO’s market position amidst evolving competitive pressures.

- Regulatory and Market Risks: Patent expiration, regulatory reforms, and the advent of new therapies could impact NEUPRO’s pricing and market share.

- Investment Implication: Stakeholders should monitor patent landscapes, reimbursement policies, and biosimilar developments to optimize investment timing and strategies.

FAQs

-

When does NEUPRO’s patent protection expire, and what are the implications?

NEUPRO's primary patent protections are expected to expire around 2027, opening the market to biosimilar competitors which could significantly reduce prices. -

How does NEUPRO compare to oral dopamine agonists in terms of pricing and patient compliance?

Although NEUPRO’s monthly cost is higher (~$550–$700), its transdermal delivery enhances compliance and steady symptom control. Oral formulations may have lower upfront costs but can lead to fluctuating plasma levels and adherence issues. -

What factors could accelerate NEUPRO’s price decline after patent expiry?

Introduction of biosimilars, increased generic competition, regulatory pressures on drug pricing, and payer negotiations are primary drivers of future price reductions. -

Are there regions where NEUPRO is priced significantly lower or higher?

Yes. In Europe and Asia, pricing varies based on local healthcare policies, reimbursement schemes, and purchasing power parity, often leading to lower prices compared to the U.S. -

What strategies can manufacturers deploy to sustain NEUPRO’s market value?

Leveraging clinical data to demonstrate superior compliance benefits, expanding indications, optimizing patient access programs, and engaging in strategic licensing can help sustain its value.

References

- Global Parkinson's Disease Therapeutics Market Report (2022). [Statista]

- U.S. FDA Drug Approvals Database (2007). NEUPRO approvals.

- Price references from major pharmacy retailers and publicly available drug formulary data (2023).

- Industry analysis reports and market forecasts (2023).

Note: Market projections are based on current data and trends; actual future prices may vary due to unforeseen regulatory or market developments.

More… ↓