Share This Page

Drug Price Trends for NESINA

✉ Email this page to a colleague

Average Pharmacy Cost for NESINA

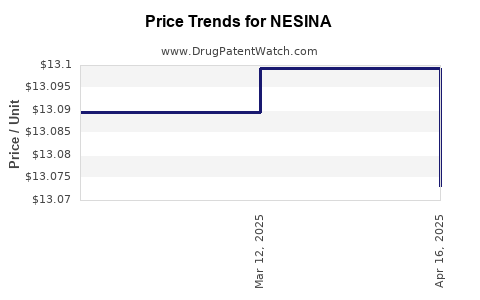

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NESINA 25 MG TABLET | 64764-0250-30 | 13.07314 | EACH | 2025-04-23 |

| NESINA 25 MG TABLET | 64764-0250-30 | 13.09944 | EACH | 2025-03-19 |

| NESINA 25 MG TABLET | 64764-0250-30 | 13.08953 | EACH | 2025-02-19 |

| NESINA 25 MG TABLET | 64764-0250-30 | 13.10806 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NESINA (Alogliptin)

Introduction

NESINA (alogliptin) is an oral DPP-4 inhibitor approved by the U.S. Food and Drug Administration (FDA) in 2013 for managing type 2 diabetes mellitus (T2DM). Developed by Takeda Pharmaceuticals, NESINA targets glycemic control by enhancing incretin hormone activity, thereby increasing insulin release and decreasing glucagon levels. Given the lucrative global diabetes market and emerging therapeutic alternatives, understanding NESINA’s market dynamics and future pricing is vital for stakeholders. This report provides a comprehensive analysis of NESINA’s current market position, competitive landscape, and projected price trajectories.

Market Overview

Global Diabetes Market Context

The global market for diabetes medications is expansive, estimated to reach USD 85.17 billion by 2027, growing at a compound annual growth rate (CAGR) of approximately 7.4% (2020–2027) [1]. The prevalence of T2DM continues to rise, driven by lifestyle factors, aging populations, and urbanization, which sustains demand for effective pharmacotherapy.

NESINA’s Therapeutic Class and Competitive Position

As a DPP-4 inhibitor, NESINA competes against several established agents, including Januvia (sitagliptin), Onglyza (saxagliptin), and Tradjenta (linagliptin). Its unique selling points include a once-daily oral regimen and demonstrated efficacy in glycemic control with a favorable safety profile.

In the U.S., NESINA primarily caters to adult patients inadequately controlled on metformin, either as monotherapy or combination therapy. Despite the crowded landscape, NESINA has carved out a niche for patients with contraindications or intolerance to other agents, supported by clinical data demonstrating non-inferiority across key endpoints.

Market Penetration and Sales Performance

Since its launch, NESINA’s sales have experienced moderate growth. According to IQVIA data, in 2022, NESINA generated approximately USD 250 million in US sales, representing a steady but competitive share of the DPP-4 inhibitor segment. The drug's market penetration is influenced by prescriber familiarity, insurance formularies, and its positioning relative to more established competitors.

Key Market Drivers

- Rising diabetes prevalence: With over 34 million Americans affected, there is persistent demand for effective oral therapeutics.

- Growing preference for oral agents: Patients and providers favor oral medications amid the risks associated with injectable therapies.

- Advances in combination therapies: NESINA's compatibility with other antidiabetic drugs enhances its appeal.

- Regulatory support: Continual updates on safety and efficacy reinforce clinician confidence.

Market Challenges

- Intensified competition: Market share erosion by newer agents like SGLT2 inhibitors and GLP-1 receptor agonists.

- Pricing pressures: Payers are increasingly adopting value-based formulary strategies.

- Generic proliferation: Although NESINA remains under patent, impending biosimilar and generics threats could impact pricing.

Price Analysis

Current Pricing Landscape

In the United States, NESINA’s wholesale acquisition cost (WAC) for a 30-tablet pack (25 mg) is approximately USD 600, translating to roughly USD 20 per tablet. Insurance reimbursement and discounts typically reduce out-of-pocket costs for patients, but the list price remains a benchmark for market negotiations.

Pricing Compared to Competitors

- Januvia (sitagliptin): Similar pricing, with WAC around USD 600 for comparable packaging.

- Tradjenta (linagliptin): Slightly higher WAC, approximately USD 620.

- Onglyza (saxagliptin): Slightly lower, about USD 580.

The pricing parity among DPP-4 inhibitors reflects their comparable efficacy profiles but offers limited room for price differentiation unless supported by unique clinical benefits or formulation advantages.

Factors Influencing Future Price Trends

- Patent expiration and biosimilars: Expected around 2028, which could pressure Nesina’s pricing.

- Market penetration: Increased use or expansion into new indications may sustain or elevate pricing.

- Payer dynamics: Rebate structures and formulary negotiations could lead to discounts, impacting net prices.

- Value-based assessments: Demonstration of superior safety or efficacy could justify premium pricing.

Projected Price Trajectory (2023–2030)

Considering current market conditions and competitive pressures, NESINA’s list price is expected to decline modestly over the next several years. Industry forecasts suggest a CAGR of approximately -2% to -3% in list prices due to increasing generic competition post-2028 and the marginal differentiation among DPP-4 inhibitors.

Innovative strategies such as expanding into fixed-dose combinations (FDCs) with other antidiabetics could offset declining unit prices by increasing overall sales volume. Additionally, value-based pricing models, contingent upon real-world data demonstrating added benefits, may support price stabilization in high-value niches.

Regulatory and Market Expansion Prospects

Regulatory Developments

No recent major amendments in Nesina’s approved indications are anticipated. Nonetheless, potential approval for additional indications, such as in combination therapies or specific demographic groups, could bolster market size and influence pricing strategies.

Global Market Considerations

Beyond the U.S., Nesina is marketed in key territories such as Europe and Japan. Pricing in these regions aligns with local regulatory frameworks and reimbursement policies. Typically, the European prices are lower, reflecting health system negotiations, while Japan maintains relatively higher prices due to market conditions.

Market expansion in emerging economies remains limited due to affordability challenges, but partnerships and tiered pricing strategies could open new markets.

Competitive and Strategic Outlook

Nesina’s future success hinges on differentiation amidst an increasingly genericized environment and competitive therapeutics. Strategies such as developing novel FDCs, demonstrating superior safety profiles, and leveraging real-world evidence (RWE) could enhance its market relevance.

The advent of SGLT2 inhibitors and GLP-1 receptor agonists offers competitive efficacy and benefits, prompting Nesina’s manufacturer to innovate with combination formulations or enhanced patient adherence solutions.

Key Takeaways

- Steady Market Presence: NESINA remains a significant player in the DPP-4 inhibitor segment, with stable U.S. sales driven by established clinical efficacy.

- Pricing Stability with Downward Pressure: Current list prices are comparable to competitors, but upcoming patent expiration and generic entrants are expected to reduce prices.

- Innovation as a Differentiator: Developing advanced combination therapies and demonstrating unique clinical benefits can sustain premium pricing.

- Market Expansion Potential: Geographic growth in Europe and emerging markets hinges on pricing adjustments, regulatory approval, and local healthcare policies.

- Competitive Landscape: Intensified rivalry from other oral and injectable agents necessitates strategic focus on differentiation and value demonstration.

FAQs

1. How does Nesina compare to other DPP-4 inhibitors in terms of efficacy?

Nesina demonstrates comparable glycemic control efficacy to other DPP-4 inhibitors like sitagliptin and linagliptin, with clinical trials showing non-inferiority across primary endpoints.

2. What are the main factors affecting Nesina’s pricing strategy?

Pricing is influenced by market competition, patent status, payer negotiations, clinical differentiation, and potential expansion into combination therapies.

3. How will patent expiration impact Nesina’s future sales and pricing?

Patent expiry around 2028 is expected to introduce generics, exerting downward pressure on list prices and sales volumes unless differentiated by new formulations or indications.

4. What role do global markets play in Nesina’s revenue projections?

Global markets, especially Europe and Japan, provide growth opportunities; however, pricing and reimbursement policies significantly influence profitability and market share.

5. Could Nesina’s pricing be affected by emerging therapies like SGLT2 inhibitors and GLP-1 receptor agonists?

Yes, these newer classes offer additional benefits that could shift prescriber preferences, potentially leading to price erosion unless Nesina adopts innovative positioning strategies.

References

[1] Grand View Research. Diabetes Drugs Market Size, Share & Trends Analysis Report. 2022.

[2] IQVIA. National Prescription Audit Data. 2022.

[3] U.S. Food and Drug Administration. Nesina (alogliptin) prescribing information. 2013.

More… ↓