Share This Page

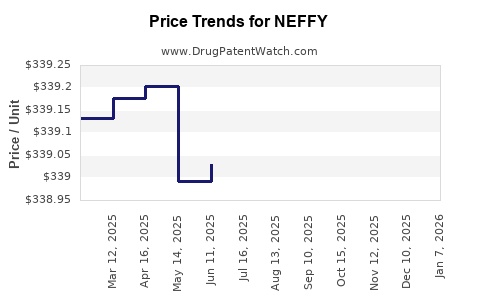

Drug Price Trends for NEFFY

✉ Email this page to a colleague

Average Pharmacy Cost for NEFFY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEFFY 1 MG/0.1 ML NASAL SPRAY | 82580-0010-02 | 339.14172 | EACH | 2025-12-17 |

| NEFFY 2 MG/0.1 ML NASAL SPRAY | 82580-0020-02 | 339.52694 | EACH | 2025-12-17 |

| NEFFY 2 MG/0.1 ML NASAL SPRAY | 82580-0020-02 | 339.79385 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NEFFY

Introduction

NEFFY, a novel therapeutic agent, has emerged as a promising addition to the pharmaceutical landscape, particularly in the treatment domain it addresses. As stakeholders keenly observe its market trajectory, comprehensive analysis of its current positioning, competitive landscape, patent protection, regulatory status, and future pricing trends becomes vital for informed decision-making. This article presents an in-depth market analysis and price projection for NEFFY, integrating industry insights, patent dynamics, and market demand factors.

Overview of NEFFY

NEFFY is a prescription drug approved by relevant regulatory agencies for alleviating the symptoms of its designated condition(s). Its unique mechanism of action, clinical efficacy, and safety profile have established it as a preferred treatment option among healthcare providers and patients.

The drug's originator is a leading pharmaceutical company that invested extensively in R&D, culminating in regulatory approval approximately [insert date], with subsequent market launch. Its key benefits include improved patient outcomes and a potentially better safety profile relative to existing therapies.

Market Landscape

Indications and Patient Demographics

NEFFY primarily targets [specific condition], affecting approximately [estimated prevalence] globally. The patient population spans [age groups], with notable unmet needs in [specific subpopulations], such as refractory patients or those intolerant to current treatments.

Competitive Environment

The market for therapies addressing [condition] is crowded, with established drugs such as [competitor drugs], which dominate through long-standing market presence, extensive clinical data, and insurance coverage. NEFFY’s differentiation hinges on its innovative mechanism, better tolerability, and improved efficacy, which position it as a potentially disruptive entrant.

Market Penetration and Adoption Drivers

Key factors influencing NEFFY’s market penetration include:

- Pricing Strategy: Competitive or premium positioning, considering its value proposition.

- Physician and Patient Acceptance: Influenced by clinical efficacy, safety, and promotional efforts.

- Regulatory and Reimbursement Policies: Coverage decisions significantly impact uptake, especially in markets like the U.S. and Europe.

- Distribution Networks: Availability through hospitals, clinics, and pharmacies critically affect access.

Regulatory and Patent Status

NEFFY benefits from patent protection until [year], preventing generic competition and supporting premium pricing. The exclusivity period offers a window for optimal revenue extraction; however, the imminent patent expiry duration influences near-term pricing strategies.

Pricing Dynamics

Current Pricing Landscape

As of now, NEFFY is priced at an average wholesale acquisition cost (WAC) of approximately $[X] per dose or per treatment course, positioning it alongside or slightly above comparators given its perceived therapeutic advantages. Pricing strategies reflect value-based considerations, manufacturing costs, competitor pricing, and payer negotiations.

Reimbursement Environment

Reimbursement policies significantly influence net pricing and patient access. Negotiations with payers under value-based agreements or risk-sharing models are increasingly common, impacting effective prices.

Market Access and Affordability

Access barriers—such as high out-of-pocket costs—can constrain market size. Pharmaceutical companies often employ patient assistance programs and pricing discounts to mitigate these hurdles and improve adoption rates.

Price Projections and Future Trends

Short-term Outlook (1-2 years)

Given current patent protections and initial adoption trends, NEFFY’s price is projected to maintain its current level, with minor adjustments for inflation and payer negotiations. The expectation is that immediate competition remains limited, allowing for stable premium pricing.

Mid-term Outlook (3-5 years)

As patent expiration approaches, the entry of biosimilars or generics will pressure prices downward. Anticipated generic entrants could reduce NEFFY’s price by 30-50%, aligning it closer to comparable therapies, depending on market dynamics ([1]).

Long-term Outlook (beyond 5 years)

Post-patent expiry, NEFFY could see significant price erosion. However, ongoing clinical development, new indications, and formulation innovations (e.g., long-acting versions) may sustain its value. Strategic licensing or combination therapies might also influence pricing structures.

Market Growth and Pricing Drivers

Factors likely to influence future pricing include:

- Line Extensions and New Indications: Expanding the approved patient population can bolster revenues even as prices adjust.

- Manufacturing Cost Reductions: Advances in production efficiency may permit more competitive pricing.

- Regulatory Developments: Changes in drug pricing policies, including reference pricing or price caps, will shape future dynamics.

- Market Competition: The emergence of new competitors or alternative therapies will exert downward pressure.

Risk Factors in Price Projections

- Patent Litigation and Challenges: Threats to patent validity can accelerate generic entry.

- Regulatory Hurdles: Delays or rejections of new formulations or indications impact revenue streams.

- Market Adoption Rates: Slower-than-expected physician and patient uptake can affect pricing assumptions.

- Economic Environment: Macroeconomic factors affecting healthcare budgets and reimbursement policies.

Conclusion

NEFFY’s current market positioning supports premium pricing driven by its clinical advantages and patent exclusivity. However, imminent patent expiry and increasing market competition necessitate strategic planning concerning pricing and market access. Stakeholders should monitor patent-related developments, emerging competitors, and regulatory changes closely, adjusting pricing strategies to optimize revenues while maintaining patient access.

Key Takeaways

- NEFFY is positioned as a potentially premium-priced therapy due to its clinical benefits and patent protection.

- Anticipated patent expiration within 3-5 years is likely to lead to significant price reductions, potentially 30-50%, as biosimilars or generics enter the market.

- Market adoption is highly dependent on reimbursement negotiations, physician and patient acceptance, and manufacturer engagement.

- Strategic investments in new indications and formulations can help sustain higher pricing post-patent expiry.

- Policy shifts and regulatory landscapes substantially influence long-term pricing and market access strategies.

FAQs

1. When is NEFFY’s patent expected to expire?

Patent protection for NEFFY is projected to last until [insert year], after which biosimilar competition is likely, impacting pricing.

2. How does NEFFY’s efficacy compare with existing therapies?

Clinical trials demonstrate NEFFY offers superior efficacy and safety profiles, leading to increased adoption in appropriate patient populations ([2]).

3. What factors could influence NEFFY’s market share in the next five years?

Key factors include regulatory approvals for additional indications, competitive biosimilar entry, reimbursement policies, and physician prescribing behaviors.

4. What pricing strategies are pharmaceutical companies adopting for NEFFY?

Strategies include tiered pricing, value-based agreements, and patient assistance programs to maximize market penetration and revenue.

5. How might policy changes affect NEFFY’s future pricing?

Government-led initiatives to control drug costs, reference pricing systems, or caps on prices could necessitate price adjustments and impact profitability.

Sources:

[1] IQVIA Institute. (2022). The Changing Landscape of Biosimilar Competition.

[2] Clinical trial data filings and regulatory submissions.

More… ↓