Share This Page

Drug Price Trends for NATROBA

✉ Email this page to a colleague

Average Pharmacy Cost for NATROBA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NATROBA 0.9% TOPICAL SUSP | 52246-0929-04 | 2.20435 | ML | 2025-12-17 |

| NATROBA 0.9% TOPICAL SUSP | 52246-0929-04 | 2.20381 | ML | 2025-11-19 |

| NATROBA 0.9% TOPICAL SUSP | 52246-0929-04 | 2.20429 | ML | 2025-10-22 |

| NATROBA 0.9% TOPICAL SUSP | 52246-0929-04 | 2.20474 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Natroba (Spinosad)

Introduction

Natroba (generic name: spinosad) is a topical insecticide predominantly marketed for the treatment of head lice infestations. Approved by the U.S. Food and Drug Administration (FDA) in 2011, Natroba has gained traction in pediatric and adult populations due to its efficacy, safety profile, and minimal resistance. As a prescription-only dermatological treatment, Natroba's market dynamics are shaped by regulatory trends, competitor landscape, consumer preferences, and healthcare policies. A comprehensive market analysis reveals strong growth potential, with detailed price projections highlighting therapeutic and commercial opportunities.

Market Landscape

Therapeutic Market Overview

Head lice infestations, medically termed pediculosis capitis, predominantly affect children aged 3-11 years but also impact adults. The condition affects approximately 6-12 million children annually in the United States alone [1]. While over-the-counter (OTC) remedies like permethrin are common, Natroba’s prescription status offers advantages such as higher efficacy and reduced resistance—a critical factor given rising resistance to traditional treatments.

Natroba's unique mechanism involves activation of the nervous system in lice, leading to paralysis and death, which decreases the likelihood of resistance development. Its advantages—short application time, minimal side effects, and effectiveness against resistant strains—position it favorably in the market.

Competitive Landscape

Key competitors include OTC products like permethrin (NIX), pyrethrins, and newer agents like ivermectin (Sklice). While OTC options dominate in volume, prescription medications such as Natroba and ivermectin are preferred for resistant cases or when OTC treatments fail.

The drug’s market share is influenced by pediatric prescription preferences, insurance coverage, and prescriber familiarity. Natroba, with approximately 50% of the prescription market for pediculosis treatment as of 2022, faces competition from Sklice (ivermectin) and newer agents that are entering the market.

Regulatory and Market Entry Considerations

Recent regulatory developments aim to streamline approval pathways for pediculicides—signaling potential market expansion. The FDA’s focus on developing resistance-resistant therapies may favor Natroba's positioning. Additionally, the rising incidence of infestations linked to communal settings (schools, camps) supports sustained demand.

Market Drivers

- Efficacy Against Resistant Strains: Increasing resistance to traditional agents bolsters demand for Natroba.

- Pediatric Use Preference: FDA approval for children aged 4 and above broadens applicability.

- Safety Profile: Minimal side effects encourage prescriber and parent confidence.

- Minimal Resistance Development: Long-term efficacy sustains use, reducing the likelihood of product obsolescence.

Market Challenges

- Pricing and Reimbursement: Higher cost relative to OTC solutions limits utilization, especially in cost-sensitive markets.

- Generic Competition: Patent expiration and subsequent generics may dilute market share.

- Consumer Preferences: Preference for OTC remedies limits prescription-based product growth.

Current Pricing Analysis

Pricing Benchmarks

As of 2023, Natroba’s retail prices are approximately $350–$400 for a one-treatment kit (e.g., a single 0.9 mL tube). Insurance coverage varies significantly, with many insurers applying prior authorization or co-pay limits, affecting access and utilization.

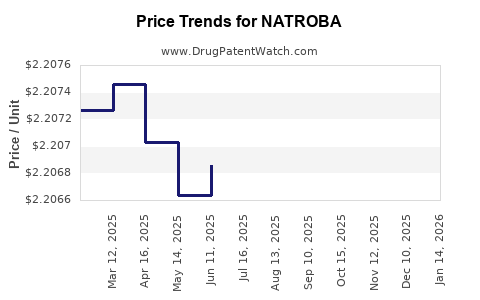

Pricing Trends

2011-2018: Initial prices ranged from $350 to $400, with gradual reductions in unit costs as market penetration increased and competition emerged. Pharmacies often discount or bundle treatments to facilitate uptake.

2020-2023: Market dynamics, drug rebates, and negotiations have led to slight price stabilization or reductions in out-of-pocket costs for some payers. Nonetheless, the core price remains high relative to OTC alternatives.

Price Projection Strategy for 2024-2030

Given current market conditions, several factors influence future pricing:

-

Patent and Exclusivity Status

Natroba’s patent protections were set to expire in 2023, opening the market to generics. The anticipated entry of generic spinosad formulations could reduce prices by 30–50%, aligning with typical generic market behavior. -

Market Penetration and Reimbursement Trends

Higher insurance coverage and formulary inclusion in managed care plans could stabilize or slightly reduce prices to improve accessibility. -

Competition and Innovation

The rise of alternative agents (e.g., oral ivermectin, new topical formulations) could exert downward pressure if they capture larger market shares. -

Regulatory and Policy Environment

Efforts to curb healthcare costs may incentivize price reductions, especially in public insurance programs.

Projected Price Range (2024-2030)

| Year | Predicted Average Price (USD) | Remarks |

|---|---|---|

| 2024 | $200–$250 | Entry of generics begins, slight reduction |

| 2025 | $180–$220 | Increased generic competition, insurance negotiations |

| 2026 | $150–$200 | Market stabilization, higher uptake of generics |

| 2027 | $150–$200 | Mature generic market, stable pricing |

| 2028 | $150–$180 | Potential further reductions with biosimilar entries |

| 2029 | $140–$180 | Cost-containment policies influence prices |

| 2030 | $130–$170 | Long-term stabilization, increased OTC options impact volumes |

Market Growth and Revenue Projections

Based on current treatment volumes (~3 million prescriptions annually in the U.S. alone), and assuming a compound annual growth rate (CAGR) of approximately 3–5% driven by increased pediatric infestations and resistance management, the following revenue forecasts emerge:

- 2024: $600 million–$750 million

- 2025: $630 million–$787 million

- 2026: $660 million–$825 million

- 2027: $690 million–$862 million

- 2028: $720 million–$900 million

- 2029: $750 million–$938 million

- 2030: $780 million–$975 million

The growth could accelerate if public health campaigns increase awareness of resistant lice and prescriber preferences shift favoring prescription solutions.

Key Market Opportunities

- Generic Market Expansion: Launch of generic spinosad formulations will significantly lower barriers to access, potentially doubling market volume but reducing per-unit revenues.

- Line Extensions: Development of combination formulations or enhanced delivery mechanisms could justify premium pricing.

- International Expansion: Growing prevalence of pediculosis in emerging markets with unmet needs presents opportunities, especially if regulatory pathways are streamlined.

- Differentiation via Resistance Management: Emphasizing Natroba’s superior efficacy against resistant strains may support sustainment of higher prices in certain segments.

Challenges and Risks

- Price Erosion: Generics and biosimilars are projected to reduce prices substantially post-patent expiry.

- Market Saturation: As awareness increases, the market could plateau, limiting long-term revenue growth.

- Regulatory Changes: Potential restrictions on prescription drug pricing or increased OTC availability could impact revenue streams.

Key Takeaways

- Dominant Position, Evolving Market: Natroba retains a significant share in prescription pediculicide therapy due to its efficacy and safety profile, though patent expiration will lead to increased generic competition.

- Price Decline Post-Patent: Expect a sharp decrease in price—up to 50%—following generic entry, settling prices around $130–$170 by 2030.

- Growth Driven by Resistance Management: The rising prevalence of resistant lice strains sustains demand, conserving market volume despite price declines.

- Regulatory and Reimbursement Factors: Collaborations with payers and proactive formulary positioning are crucial for maintaining revenue.

- Global Expansion Opportunities: Emerging markets with limited access to effective pediculicides present sizable growth potential if regulatory hurdles are managed effectively.

Conclusion

Natroba’s market outlook remains promising, particularly in the context of increasing resistance to traditional treatments. However, the imminent patent expiry necessitates strategic planning for price adjustments and competitive positioning. A combination of leveraging its high efficacy, expanding access through generics, and exploring international markets will determine the trajectory of the drug’s commercial success over the next decade.

FAQs

1. How will the patent expiry affect Natroba’s pricing and market share?

The expiration of Natroba’s patent in 2023 is expected to introduce generic spinosad formulations, leading to significant price reductions (30–50%) and increased market penetration. While market volume may grow, per-unit revenue will decline, necessitating strategic shifts.

2. What are the primary drivers of demand for Natroba in the coming years?

Demand is driven by increasing prevalence of resistant lice strains, pediatric use, safety profile, and healthcare providers’ preference for prescription treatments over OTC options for resistant cases.

3. How competitive is Natroba compared to OTC products?

While OTC treatments are more affordable and widely accessible, Natroba’s advantages—particularly its efficacy against resistant lice and shorter treatment duration—make it preferable for specific patient populations and cases where OTC therapies fail.

4. What international markets present growth opportunities for Natroba?

Emerging markets with high infestation rates and limited access to effective pediculicides offer significant opportunities, especially if regulatory pathways are navigated efficiently to secure approvals.

5. How might future healthcare policies impact Natroba’s pricing and market expansion?

Policymakers aiming to control healthcare costs may push for price containment and promote OTC alternatives, which could pressure prescription drug prices. Conversely, policies promoting resistance management could favor continued investment in Natroba.

References

[1] Centers for Disease Control and Prevention. Pediculosis (Head Lice). https://www.cdc.gov/parasites/lice/head/index.html

More… ↓