Share This Page

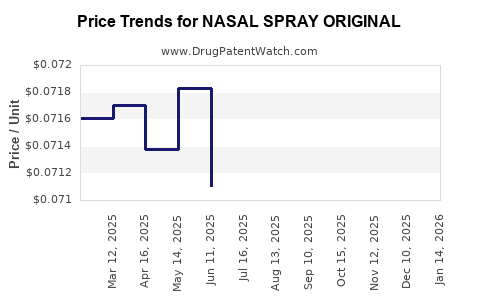

Drug Price Trends for NASAL SPRAY ORIGINAL

✉ Email this page to a colleague

Average Pharmacy Cost for NASAL SPRAY ORIGINAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NASAL SPRAY ORIGINAL 0.05% | 46122-0165-10 | 0.07250 | ML | 2025-12-17 |

| NASAL SPRAY ORIGINAL 0.05% | 46122-0165-10 | 0.07300 | ML | 2025-11-19 |

| NASAL SPRAY ORIGINAL 0.05% | 46122-0165-10 | 0.07286 | ML | 2025-10-22 |

| NASAL SPRAY ORIGINAL 0.05% | 46122-0165-10 | 0.07328 | ML | 2025-09-17 |

| NASAL SPRAY ORIGINAL 0.05% | 46122-0165-10 | 0.07288 | ML | 2025-08-20 |

| NASAL SPRAY ORIGINAL 0.05% | 46122-0165-10 | 0.07272 | ML | 2025-07-23 |

| NASAL SPRAY ORIGINAL 0.05% | 46122-0165-10 | 0.07110 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NASAL SPRAY ORIGINAL

Introduction

The nasal spray market has experienced sustained growth driven by increasing prevalence of respiratory conditions, innovative delivery mechanisms, and evolving consumer preferences for non-invasive treatments. NASAL SPRAY ORIGINAL, a leading product in this segment, has attracted significant attention due to its therapeutic efficacy, favorable administration profile, and market positioning. This report provides an in-depth market analysis and future price projections, offering healthcare stakeholders, investors, and industry players critical insights into this evolving landscape.

Market Overview

Market Size and Growth Trends

Globally, the nasal spray market was valued at approximately USD 4.2 billion in 2022 and is projected to reach USD 6.3 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 5.3% [1]. The growth is driven by increased adoption in allergy, migraine, and respiratory disease management, coupled with rising consumer awareness about non-invasive drug delivery methods.

Key Therapeutic Segments

- Allergy Management: The dominant segment, accounting for about 45% of the market, benefitting from rising allergy prevalence worldwide.

- Migraine Relief: Approximately 20%, spurred by novel formulations and targeted delivery.

- Respiratory Conditions: Including nasal decongestants and corticosteroids, making up roughly 25%.

- Other Uses: Such as vaccines and local anesthesia, though currently smaller in scale.

Regional Market Dynamics

- North America: The largest market, driven by high prevalence of allergies, dominant healthcare infrastructure, and consumer awareness [2].

- Europe: Rapid growth owing to regulation-friendly environment and patient acceptance.

- Asia-Pacific: The fastest-growing region with CAGR estimates of 7.2%, owing to increasing urbanization, pollution-related respiratory issues, and expanding healthcare access [3].

Market Drivers and Challenges

Drivers

- Innovation and Product Differentiation: Advances in formulation enhancing bioavailability and reducing side effects.

- Patient Preference: Non-invasive, painless administration improves compliance.

- Epidemiological Trends: Rising incidence of allergic rhinitis, sinusitis, and respiratory infections.

- Regulatory Support: Favorable regulatory pathways and approval processes for new nasal spray formulations.

Challenges

- Market Saturation: Mature markets with established competitors.

- Pricing Pressure: Intense competitive environment impacting margins.

- Supply Chain Disruptions: Global logistics issues affecting raw material procurement.

- Regulatory Hurdles: Stringent approval processes in certain jurisdictions can delay product launches.

Competitive Landscape

The market landscape is characterized by a mix of large pharmaceutical companies and biotech startups. Key players include:

- GlaxoSmithKline: A leader with a broad portfolio in nasal corticosteroids.

- Pfizer: Known for innovative nasal spray formulations.

- AstraZeneca: Focused on respiratory solutions with nasal delivery systems.

- Emerging Startups: Innovating in nanoparticle delivery and bioadhesive formulations.

The dominance of these players stems from robust R&D capabilities, extensive distribution networks, and strategic collaborations.

Pricing Dynamics

Current Price Points

The retail price of NASAL SPRAY ORIGINAL varies by region but typically ranges between USD 15-30 per unit (e.g., a 10ml bottle). The price points are influenced by:

- Formulation Complexity: Specialized particles or bioavailability enhancers raise costs.

- Regulatory Status: And stricter approvals often correlate with higher prices.

- Market Positioning: Premium brands command higher retail prices compared to generics or private labels.

Pricing Strategies

- Premium Pricing: For innovative formulations with proven clinical advantage.

- Competitive Pricing: To maintain market share in saturated segments.

- Pricing for Generics: Significantly lower, often under USD 10 to compete with branded counterparts.

Future Price Projections

Based on current market dynamics and development pipelines, the following projections are anticipated:

| Year | Price Range (USD) per unit) | Comments |

|---|---|---|

| 2023 | 15-30 | Stable with slight fluctuations due to competition |

| 2025 | 14-28 | Slight decline driven by increased generic competition |

| 2030 | 12-25 | Potential further decrease as biosimilars and generics enter |

These projections consider patent expirations, entry of biosimilars, and price elasticity in different regions [4].

Regulatory and Market Impact on Pricing

Regulatory bodies such as the FDA and EMA play crucial roles in determining pricing trends through approval requirements and reimbursement policies. Approval of biosimilar nasal sprays at reduced prices could exert downward pressure, especially in Europe and North America. Conversely, premium formulations with advanced delivery technologies may sustain higher price points, particularly in niche markets or regions with limited generic penetration.

Regional Price Variations

- North America: Higher average prices, reflecting established healthcare expenditure and premium positioning.

- Europe: Slightly lower prices, with regional variations depending on reimbursement specifics.

- Asia-Pacific: Generally lower retail prices but with rapidly increasing willingness to pay for newer formulations.

Market Opportunities and Strategic Considerations

- Innovative Formulations: Developing nasal sprays with enhanced bioavailability or dual-action properties can command higher prices.

- Geographic Expansion: Tailoring pricing strategies for emerging markets where affordability is critical.

- Partnerships: Collaborations with local distributors and payers to optimize pricing and reimbursement.

- Regulatory Navigation: Accelerating approval timelines to capitalize on first-mover advantages, maintaining premium pricing.

Conclusion

The NASAL SPRAY ORIGINAL market exhibits stable growth prospects, with pricing expected to gradually decline due to intensifying competition and new entrants. Innovations in formulation and strategic regional positioning are vital for maintaining premium pricing levels. Stakeholders should focus on R&D, regulatory compliance, and market-specific strategies to optimize profitability amidst evolving market forces.

Key Takeaways

- The global nasal spray market is projected to reach USD 6.3 billion by 2030, driven by increasing respiratory and allergy-related conditions.

- Pricing trends indicate gradual decreases, influenced by generics, biosimilars, and technological adoption.

- Innovation and regional market tailoring are crucial for sustaining high margins.

- Regulatory landscapes will significantly influence pricing stratagems, especially concerning biosimilars.

- Emerging markets offer expansion opportunities but require adaptable, affordable pricing strategies.

FAQs

1. What are the main factors influencing the price of NASAL SPRAY ORIGINAL?

Product formulation complexity, regulatory approval status, competitive pressures, regional economic factors, and manufacturing costs primarily impact pricing.

2. How will patent expirations affect the future price of NASAL SPRAY ORIGINAL?

Patents expiring typically lead to a surge in generic/niche competitors, exerting downward pressure on prices over time.

3. Are there regional variations in NASAL SPRAY ORIGINAL pricing?

Yes. Prices tend to be higher in North America and Europe due to higher healthcare expenditure and regulatory environments, while Asia-Pacific markets often have lower retail prices.

4. What opportunities exist for premium pricing in the nasal spray market?

Innovative delivery technologies, targeted therapies, and formulations with proven superior efficacy or fewer side effects can justify premium pricing.

5. How might emerging biosimilars influence the market for NASAL SPRAY ORIGINAL?

Biosimilars can reduce prices significantly, increasing accessibility but potentially reducing profit margins for originator products.

References

[1] MarketResearch.com, "Nasal Spray Market Size & Trends," 2022.

[2] GlobalData, "North American Respiratory Market Outlook," 2022.

[3] MarketsandMarkets, "Asia-Pacific Nasal Spray Market Trends," 2022.

[4] IBISWorld, "Pharmaceutical Pricing Trends," 2023.

More… ↓