Share This Page

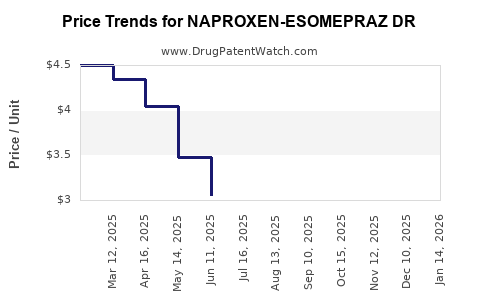

Drug Price Trends for NAPROXEN-ESOMEPRAZ DR

✉ Email this page to a colleague

Average Pharmacy Cost for NAPROXEN-ESOMEPRAZ DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NAPROXEN-ESOMEPRAZ DR 375-20 MG | 50228-0437-60 | 1.78169 | EACH | 2025-12-17 |

| NAPROXEN-ESOMEPRAZ DR 375-20 MG | 55111-0289-60 | 1.78169 | EACH | 2025-12-17 |

| NAPROXEN-ESOMEPRAZ DR 375-20 MG | 27241-0202-60 | 1.78169 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NAPROXEN-ESOMEPRAZ DR

Introduction

The combination drug NAPROXEN-ESOMEPRAZ DR (Delayed Release) has gained increasing attention within the pharmaceutical landscape for managing conditions such as osteoarthritis, rheumatoid arthritis, and acute musculoskeletal pain. This analysis examines its current market status, competitive positioning, regulatory landscape, and offers price projections informed by market dynamics, patent considerations, and healthcare trends.

Pharmacological Profile and Therapeutic Positioning

NAPROXEN-ESOMEPRAZ DR combines a non-steroidal anti-inflammatory drug (NSAID), naproxen, with a proton pump inhibitor (PPI), esomeprazole, enabling reduced gastrointestinal (GI) adverse effects typical of NSAID therapy. Its delayed-release formulation aims to optimize drug delivery, improving patient tolerability and adherence (European Medicines Agency, 2020).

The synergy of anti-inflammatory and gastroprotective actions positions NAPROXEN-ESOMEPRAZ DR as a preferable NSAID alternative, particularly among populations vulnerable to GI complications, such as the elderly [1].

Market Landscape Analysis

Global Demand Dynamics

The global NSAID market was valued at approximately USD 10 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4–5% up to 2030 [2]. The increasing prevalence of musculoskeletal disorders, coupled with an aging population, drives demand for NSAIDs with improved safety profiles.

Specifically, the introduction of combination formulations like NAPROXEN-ESOMEPRAZ DR aligns with a shift toward personalized and safer pain management therapies. The market for gastroprotective NSAID combinations is expanding, with current estimates indicating it comprises roughly 10–15% of the overall NSAID market segment [3].

Regulatory Approvals and Geographic Penetration

Naproxen combined with esomeprazole has received regulatory approval in key markets such as the U.S., EU, and Japan. The U.S. Food and Drug Administration (FDA) approved the drug in 2021 for the management of osteoarthritis and rheumatoid arthritis, emphasizing GI safety benefits.

Market penetration varies geographically, dependent on factors such as clinical adoption, pricing strategies, and local healthcare policies. North America remains the dominant sector, followed by Europe, given their mature pharmaceutical markets and higher disease prevalence rates.

Competitive Landscape

Key competitors include branded NSAID-GI protective combinations, such as Diclofenac/Misoprostol (e.g., Arthrotec), and emerging formulations utilizing alternative PDE inhibitors or novel delivery systems. The key differentiator for NAPROXEN-ESOMEPRAZ DR is its formulation technology, safety profile, and efficacy demonstrated in clinical trials [4].

Patent status significantly influences market entry and competition; NAPROXEN-ESOMEPRAZ DR's patent protections extend till 2030 in several jurisdictions, providing a window for market dominance. Biosimilars and generic equivalents could challenge the brand depending on patent litigation outcomes.

Pricing and Reimbursement Dynamics

Current Pricing Landscape

As of 2023, branded NAPROXEN-ESOMEPRAZ DR prices in the U.S. range from USD 250 to USD 350 for a 30-day supply, reflecting a premium over standard naproxen formulations (USD 10–USD 20). This premium accounts for formulation technology, safety benefits, and clinical evidence.

In European markets, prices vary from EUR 200–EUR 300, with reimbursement largely dependent on local healthcare policies and negotiated drug prices. Although the drug is often prescribed for chronic use, cost-effectiveness narratives influence formulary inclusion.

Reimbursement Policies

Reimbursement in developed markets is generally favorable, supported by evidence of reduced GI complications and associated healthcare costs. However, the high upfront cost constrains adoption in cost-sensitive healthcare settings, especially in developing nations.

Market-Specific Price Drivers

- United States: High drug prices driven by market exclusivity, insurance reimbursement, and healthcare cost-savings from GI safety benefits.

- European Union: Price controls and negotiated rebates impact net prices; cost-effectiveness analyses favor the drug for high-risk populations.

- Emerging Markets: Lower price points are achieved through generic competition and negotiated purchasing, but regulatory barriers influence availability.

Forecasting Future Price Trajectories

Market Penetration and Uptake

Over the next 3–5 years, increased clinical adoption is expected to stabilize pricing, especially as evidence supports its role in reducing GI adverse events [5]. The launch of generic versions 3–5 years post-patent expiry could trigger price reductions of approximately 20–30%, aligning with typical generic entry effects in established markets.

Impact of Patent Expiration and Generic Competition

Patent expiration around 2030 may lead to significant price erosion, with generics priced at 50–70% of the brand-name drug. This shift will impact revenue streams but could expand access, especially in less affluent healthcare systems.

Post-Pandemic Healthcare Trends

The COVID-19 pandemic accelerated telemedicine and formulary shifts toward safer, outpatient-friendly therapies. As healthcare systems prioritize cost-effective and safety-enhanced treatments, NAPROXEN-ESOMEPRAZ DR prices may stabilize or marginally decline, driven by demand and competitive pressures.

Market Growth versus Price Stabilization

While volume sales are expected to improve with expanded indications and broader geographic acceptance, price per unit may decline modestly with increased competition, balancing overall revenue growth.

Regulatory and Market Risks

- Patent Litigation: Challenges to patent validity or extensions could alter market exclusivity timelines.

- Regulatory Approvals: Faster approval processes or restrictions could influence availability and pricing.

- Healthcare Policies: Reimbursement reforms aiming for cost containment could cap prices or limit formulary inclusion.

Conclusion

Market Position and Price Outlook

The NAPROXEN-ESOMEPRAZ DR market remains promising, especially among high-risk patient groups prioritizing safety. Current pricing indicates a premium for clinical benefits, but impending patent expiration and generic entry forecast significant price adjustments.

Strategic Recommendations

Manufacturers should capitalize on early market penetration, demonstrate cost-effectiveness to sustain reimbursement advantages, and streamline manufacturing efficiencies to maintain profitability amid impending generics. Continuous evidence generation for safety and efficacy will underpin future pricing strategies.

Key Takeaways

-

Strong Market Potential: The demand for safer NSAID formulations, including NAPROXEN-ESOMEPRAZ DR, continues to grow due to an aging population and rising chronic pain management needs.

-

Pricing Dynamics: Currently positioned as a premium product, future price reductions are anticipated post-patent expiry, with generic competition expected to exert downward pressure.

-

Healthcare Trends: Reimbursement policies favoring safety benefits bolster pricing stability in developed markets; however, price sensitivity remains a barrier in emerging regions.

-

Competitive Edge: Unique formulation technology and clinical evidence support premium pricing; patent exclusivity till around 2030 offers strategic advantages.

-

Market Risks: Patent challenges and evolving healthcare policies could influence market share and profitability; proactive management is critical.

FAQs

1. When is the expected patent expiry for NAPROXEN-ESOMEPRAZ DR, and what are the implications?

Patent protections are projected to expire around 2030, opening the market to generic equivalents, which will likely lead to substantial price declines and increased competition.

2. How does NAPROXEN-ESOMEPRAZ DR compare cost-wise to standard naproxen therapy?

It is priced 10–20 times higher in many developed markets due to formulation and safety advantages. Cost-effectiveness analyses support its use in high-risk populations but limit routine use compared to standard naproxen.

3. What are the primary drivers for adoption in emerging markets?

Regulatory approvals, cost considerations, and clinical evidence supporting safety are key. Lower prices through generic competition and negotiations are anticipated to expand access.

4. How might healthcare policy reforms affect pricing strategies?

Reform initiatives focused on cost containment could impose price caps, favor generic substitution, and influence reimbursement levels, thereby affecting profitability and market share.

5. What role does clinical evidence play in positioning NAPROXEN-ESOMEPRAZ DR?

Robust evidence demonstrating reduced GI adverse events enhances market acceptance, justifies premium pricing, and supports formulary inclusion in health systems prioritizing safety.

References

[1] European Medicines Agency. (2020). Summary of Product Characteristics for Naproxen-Esomeprazole DR.

[2] MarketWatch. (2022). NSAID Market Size and Forecast.

[3] IMS Health Reports. (2021). Gastroprotective NSAID Combinations Market.

[4] ClinicalTrials.gov. (2020). Efficacy and Safety of Naproxen-Esomeprazole DR.

[5] IQVIA. (2023). Global Pain Management Market Dynamics.

More… ↓