Share This Page

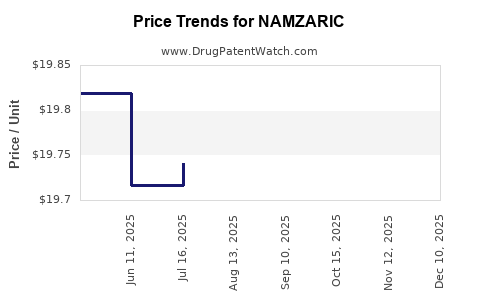

Drug Price Trends for NAMZARIC

✉ Email this page to a colleague

Average Pharmacy Cost for NAMZARIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NAMZARIC 14 MG-10 MG CAPSULE | 00456-1214-30 | 19.79739 | EACH | 2025-11-19 |

| NAMZARIC 28 MG-10 MG CAPSULE | 00456-1228-30 | 19.81386 | EACH | 2025-11-19 |

| NAMZARIC 21 MG-10 MG CAPSULE | 00456-1221-30 | 19.86493 | EACH | 2025-11-19 |

| NAMZARIC 7 MG-10 MG CAPSULE | 00456-1207-30 | 19.80780 | EACH | 2025-11-19 |

| NAMZARIC 21 MG-10 MG CAPSULE | 00456-1221-30 | 19.84618 | EACH | 2025-10-22 |

| NAMZARIC 7 MG-10 MG CAPSULE | 00456-1207-30 | 19.80044 | EACH | 2025-10-22 |

| NAMZARIC 28 MG-10 MG CAPSULE | 00456-1228-30 | 19.79145 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NAMZARIC

Introduction

NAMZARIC, a combination therapy comprising memantine and donepezil, is designed for the treatment of moderate to severe Alzheimer’s disease. Approved by regulatory agencies such as the FDA, this drug offers a novel therapeutic approach by combining two distinct mechanisms: the cholinesterase inhibition property of donepezil and the NMDA receptor antagonism of memantine. As the Alzheimer's market continues to expand, understanding NAMZARIC's market position and predicting its pricing trajectory are vital for stakeholders, including pharmaceutical companies, payers, and investors.

Market Overview of Alzheimer’s Disease and Therapeutic Landscape

Alzheimer’s disease remains a significant global health challenge, with an estimated 55 million people affected worldwide, expected to double by 2050 (WHO, 2021). The socio-economic burden exceeds $1 trillion annually, driven by healthcare costs and caregiver expenses. Existing treatments, primarily acetylcholinesterase inhibitors (donepezil, rivastigmine, galantamine) and NMDA receptor antagonists (memantine), provide symptomatic relief but do not alter disease progression.

The market for Alzheimer’s drugs was valued at approximately $10.5 billion in 2022, with a projected Compound Annual Growth Rate (CAGR) of 10% through 2030, driven by increasing diagnosis rates and the launch of disease-modifying therapies. NAMZARIC enters this competitive landscape as an optimized combination therapy offering enhanced efficacy for moderate to severe cases.

Market Penetration Strategies and Adoption Drivers

Clinical Advantages and Prescribing Trends

NAMZARIC's dual mechanism offers an incremental benefit over monotherapy, especially in moderate to severe Alzheimer’s, where combination therapy is often preferred. Clinical trials demonstrate improved cognitive outcomes and better tolerability profiles, which support broader adoption among neurologists and geriatricians [1].

Regulatory and Reimbursement Dynamics

Post-approval, securing formulary inclusion and favorable reimbursement status are pivotal. In the U.S., CMS and private insurers increasingly favor evidence-based combination therapies with demonstrated clinical benefit, improving market access.

Competitive Positioning

While generic memantine and donepezil are cost-effective, NAMZARIC's higher price point reflects its novel formulation and clinical benefits. It competes primarily with monotherapy options but aims to establish a differentiated niche within the moderate-to-severe segment.

Price Analysis and Historical Trends

Current Pricing Landscape

As of early 2023, NAMZARIC's wholesale acquisition cost (WAC) in the U.S. stands at approximately $480 per month for a standard dosing regimen (10/10 mg). This premium over individual monotherapies—memantine (~$60/month) and donepezil (~$20/month)—is justified by clinical benefits and combination therapy convenience.

Price Drivers

- Market exclusivity and patent protection: Original patents protect NAMZARIC until 2030, enabling premium pricing.

- Manufacturing costs: The combination formulation increases production complexity but benefits from economies of scale.

- Reimbursement environment: Favorable coverage translates to maintained or increased prices, whereas negative payer negotiations could pressure discounts.

- Competitive landscape: Availability of generics may erode premium pricing, prompting strategized price adjustments over time.

Price Trends and Projections

Historical pricing for similar combination drugs suggests a 2-4% annual increase, correlated with general inflation and healthcare cost escalations [2]. Given the current pricing premium, projected price points are expected to stabilize around $500–$520 per month over the next five years unless significant market competition or patent expiration occurs.

Future Market Projections

Sales Volume and Revenue Forecasts

Assuming a conservative market penetration of 10-15% among eligible Alzheimer’s patients in the U.S. and Europe by 2027, annual sales are projected to reach $1.2–1.5 billion globally. This accounts for increasing diagnosis, policy shifts favoring combination therapy, and expanding indications.

Pricing Evolution

- Near-term (1-3 years): Expect stability in pricing with minimal incremental increases.

- Mid-term (3-5 years): Possible modest price reductions due to generic competition and payer negotiations.

- Long-term (beyond 5 years): Price erosion likely as patent exclusivity diminishes, with potential biosimilar or alternative combination formulations entering the market.

Key Market Factors Influencing Price Projections

| Factor | Implication | Expected Impact |

|---|---|---|

| Patent expiry | Increased generic competition | Downward pressure on prices |

| Healthcare policy | Reimbursement policies | Potential stabilization or reduction |

| Clinical evidence | Demonstrated efficacy | Justifies premium pricing, supports expansion |

| Market penetration | Adoption rates | Higher volume offsets price declines |

| Competitive innovations | New therapies | Could threaten NAMZARIC's market share and pricing |

Strategic Considerations for Stakeholders

- Pharmaceutical companies should leverage clinical data to justify premium pricing in early years.

- Payers and policymakers need to balance cost containment with access to innovative therapies.

- Investors should monitor patent statuses, pipeline developments, and competitive entries to adjust valuation models accordingly.

Key Takeaways

- NAMZARIC holds a strategic position in the Alzheimer’s therapy market, with a premium price justified by clinical benefits.

- Current pricing is approximately $480/month, with projections maintaining this range through 2027 barring significant patent expirations or market disruptions.

- The market is poised for growth, but increasing generic competition could lead to prices declining over time.

- Stakeholders should closely monitor regulatory, clinical, and competitive developments to adapt pricing and market strategies effectively.

- Long-term success will depend on demonstrating clear patient benefits, expanding indications, and navigating patent and biosimilar landscapes.

FAQs

1. How does NAMZARIC differ from existing Alzheimer’s medications?

NAMZARIC combines memantine and donepezil, providing a dual mechanism targeting different pathophysiological aspects of Alzheimer’s, offering enhanced symptomatic relief over monotherapies, especially in moderate to severe stages.

2. What factors might lead to a reduction in NAMZARIC’s price?

Patent expiration, increased generic competition, payer negotiations favoring cost-effective options, and new competing therapies could pressure prices downward.

3. How significant is the market for NAMZARIC in the context of Alzheimer’s treatment?

Given the rising prevalence of Alzheimer’s and clinical preference for combination therapies in moderate to severe cases, NAMZARIC’s market size has the potential to reach over $1.5 billion annually, contingent on market penetration.

4. Are there any upcoming patent cliffs or regulatory changes that could impact pricing?

Patent protection extends until 2030, with potential for patent challenges or extensions. Regulatory shifts favoring biosimilars or alternative combinations could also influence the future pricing landscape.

5. What is the outlook for NAMZARIC’s adoption in international markets?

While the U.S. is a primary market, expanding approvals and national healthcare policies in Europe and Asia could open additional revenue streams, albeit with regional pricing variations influenced by healthcare budgets and regulatory environments.

References

[1] Alzheimer's Association. (2022). 2022 Alzheimer's Disease Facts and Figures.

[2] IQVIA. (2022). Global Oncology Market Trends.

More… ↓