Last updated: July 27, 2025

Introduction

Naloxone, a life-saving opioid antagonist, has witnessed a dramatic surge in demand due to the global opioid crisis. Its ability to rapidly reverse opioid overdose incidents has positioned it as an essential medication in both clinical and community settings. This report provides an in-depth market analysis and forecasts future pricing trends for Naloxone, considering factors such as market drivers, regulatory landscape, manufacturing dynamics, and competitive forces.

Market Overview

The global Naloxone market has expanded significantly over the past decade, driven predominantly by the rising prevalence of opioid-related overdoses. According to the CDC, opioid overdose deaths in the U.S. hit over 100,000 annually during 2020-2021, underscoring the urgent need for accessible Naloxone formulations (CDC, 2022). The market encompasses various forms including injectable, auto-injectors, nasal sprays, and recent innovations such as pre-filled intranasal devices.

Market Size and Growth:

The global Naloxone market was valued at approximately USD 600 million in 2022, with a compound annual growth rate (CAGR) projected at about 12% from 2023 to 2030. This growth trajectory is fueled by increased awareness, expanded government initiatives, and broader adoption in community settings.

Key Market Drivers

-

Increasing Opioid Overdose Rates:

The opioid epidemic predominantly affects North America, especially the U.S., where policy reforms are emphasizing overdose prevention programs.

-

Regulatory Support and Policy Initiatives:

Governments worldwide are easing restrictions on Naloxone distribution. For instance, the U.S. FDA’s approval of intranasal formulations and policies that authorize over-the-counter (OTC) sale bolster accessibility.

-

Widening Awareness and Education:

Public health campaigns and harm reduction programs effectively normalize Naloxone use among high-risk populations and first responders.

-

Manufacturer Innovations:

Introduction of user-friendly delivery devices enhances market penetration and adoption in non-clinical settings.

Competitive Landscape

Major players include Teva Pharmaceuticals, Eli Lilly and Company, Mylan (now part of Viatris), Hikma Pharmaceuticals, and Emergent BioSolutions. Patent expirations and generic entrants are increasing price competition, although proprietary formulations such as nasal sprays retain premium pricing due to convenience and innovation.

Regulatory and Reimbursement Dynamics

Regulatory agencies like the FDA have recently approved OTC Naloxone products, potentially broadening market access and influencing pricing. However, reimbursements vary across regions, impacting affordability. Expansion of government-funded distribution programs further incentivizes manufacturers to lower prices and expand supply.

Manufacturing and Supply Chain Considerations

The production of Naloxone involves specialized chemical synthesis and formulation processes. Recent advances in manufacturing, including biosimilar development, are likely to reduce costs over time. Supply chain constraints, aggravated by global disruptions, have temporarily affected availability but are expected to stabilize by 2024.

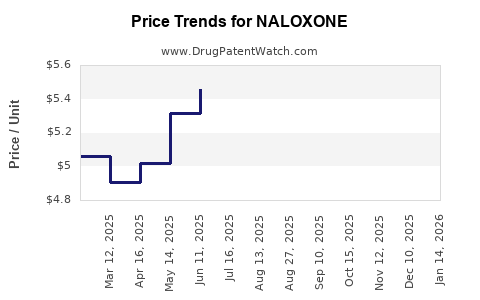

Price Trends and Future Projections

Historical Price Landscape

Historically, the price of Naloxone has been variable:

- Epinephrine-like nasal spray (e.g., Narcan®): Approximate retail price of USD 150–200 per device in 2018, with significant reductions in recent years following generic competition.

- Injectable Formulation: Lower per-dose cost but requires medical administration.

Factors Influencing Future Pricing

- Generic Market Expansion: Increased patent expirations starting from 2023 are expected to introduce generics that will exert downward pricing pressure.

- Innovative Delivery Systems: Newer formulations, such as auto-injectors and simplified nasal devices, command higher premiums but may see pricing reductions as competition intensifies.

- Government Procurement and Subsidies: Public sector bulk purchasing and subsidies can suppress retail prices for end-users.

Price Projection (2023–2030)

-

Base Case:

- Retail Nasal Spray: Prices are projected to decline by approximately 20–30% over the next five years, reaching around USD 100–140 per device by 2028.

- Injectable Formulars: Remain relatively stable but may decrease marginally, driven by generic competition, to approximately USD 5–10 per dose.

-

Optimistic Scenario:

- Widespread OTC availability and government subsidies could further accelerate price reductions, possibly lowering retail prices by up to 40% by 2030.

-

Pessimistic Scenario:

- Supply chain disruptions or regulatory hurdles could sustain elevated prices or limit availability in certain regions.

Implications for Stakeholders

-

Manufacturers:

Competition from generics will necessitate cost-efficient manufacturing and innovative delivery systems to maintain market share.

-

Healthcare Providers:

Anticipated lower prices will improve distribution and uptake, especially in underserved communities.

-

Policymakers:

Continued federal and regional support in procurement and distribution will be pivotal in ensuring affordability and widespread access.

-

Patients and Public Health:

Reduced prices will enhance accessibility, ultimately improving overdose survival rates.

Conclusion

The Naloxone market exhibits robust growth prospects fueled by rising overdose incidences, regulatory shifts, and technological innovations. While price reductions are anticipated as generic formulations enter the market and regulatory barriers lessen, certain premium formulations will sustain higher price points temporarily. Overall, stakeholders can expect increased affordability and supply, reinforcing Naloxone’s role as a cornerstone of opioid overdose intervention strategies.

Key Takeaways

- The global Naloxone market is projected to grow at approximately 12% CAGR from 2023 to 2030, driven by opioid crisis mitigation efforts.

- Price reductions of 20–30% for nasal spray formulations are anticipated over the next five years due to the expansion of generics and competitive pricing.

- Regulatory trends favor broader OTC distribution, which will likely lower prices and enhance accessibility.

- Supply chain stability and manufacturing efficiency will be critical in maintaining competitive prices.

- Stakeholders should prepare for increased market competition, innovation in delivery methods, and evolving pricing dynamics.

FAQs

1. How will upcoming patent expirations impact Naloxone pricing?

Patent expirations starting around 2023 will enable generic manufacturers to enter the market, intensifying price competition and contributing to significant price reductions during the subsequent years.

2. Are OTC Naloxone products cost-effective?

Yes, OTC availability typically reduces costs for consumers and health programs, improving access and potentially decreasing overdose fatalities.

3. Which forms of Naloxone are most likely to dominate future markets?

Nasal spray formulations are expected to dominate due to ease of administration, with auto-injectors gaining ground in emergency settings.

4. How have regulatory policies influenced the Naloxone market?

Regulatory approvals for OTC products and supportive policies have expanded access, leading to increased demand and lower prices through market competition.

5. What role will public funding play in Naloxone affordability?

Government procurement programs, subsidies, and harm reduction initiatives will continue to play a pivotal role in ensuring affordable Naloxone for vulnerable populations.

References:

[1] CDC. (2022). Opioid Overdose Deaths. Centers for Disease Control and Prevention.

[2] MarketWatch. (2023). Naloxone Market Size and Forecast.

[3] U.S. FDA. (2022). Approvals and Regulatory Updates on Naloxone.

[4] IMS Health Data. (2022). Pharmaceutical Pricing Trends.